Private banking

Valuation of the stock market against the economic situation

Due to the economic situation that we are confronting these days, it seems relevant to discuss issues of utmost importance to investors and that, for some reason, continue to cause confusion and puzzlement, even among professional investors and analysts.

How to invest in uncertain times

The first thing is to try to remain calm and not get carried away by your emotions in these volatile and complicated times, which will probably continue to condition the behaviour of the markets in the coming months.

How to control one's emotions and avoid making hasty decisions

Periods of panic and/or euphoria bring to mind the recurring question of how to control one's emotions and avoid making hasty decisions. There are no general recipes for this because everyone has their own personality shaped through their experience, knowledge, etc. For example, a person who likes extreme sports will have a different concept of risk than, say, someone who likes more traditional sports.

Socially responsible investing post COVID-19

One of the benefits often attributed to socially responsible investing is its strong defensive nature, something that we've been able to examine during the recent Covid-19 crisis. This article analyses that aspect and the reaction of investors when it comes to allocating their assets.

Keys to quality and active ageing

The world population is gradually ageing. This has created an important health challenge for everyone. Efforts must be made to ensure that all the years of life that have been achieved through healthcare advances are lived satisfactorily with quality of life at a physical, mental and emotional level.

Market outlook: June 2020

The developed economies are gradually reopening but the downward revision of economic growth in 2020 continues for now. There is an increasing likelihood of recovery and economic growth returning in the third quarter. The strength and speed of the announced economic measures (monetary and fiscal) could protect markets from the worst-case scenario. This is a cyclical recession, with a sharp drop in supply and demand, but it will be shorter and different in nature from the 2008/09 crisis. The European Union is negotiating a recovery fund with positive political repercussions in terms of cohesion and the European project.

BBVA celebrates one-year anniversary of its new brand identity

Twelve months ago, BBVA announced the worldwide unification of its brand and logo. A year later, the deployment of the new brand is well-entrenched across the Group’s footprint in both its physical and digital assets.

Is gold a good safe haven?

The first asset we think about when it comes to protecting our wealth, in a situation where the economy has entered a recession and the central banks are flooding the markets with liquidity, is usually gold.

2020 Outlook: A winning strategy

After 10 years of bull markets and one of the longest economic cycles in history, many investors refuse to think that the situation has changed; and that the most appropriate equity investment model has therefore also changed.

Medium-term value of US investment-grade corporate bonds

As a consequence of the global economic slowdown deriving from the COVID-19 outbreak, the main central banks have set their rates back to 0% or negative; and they are promising to leave them at this level in the coming years to support the sustainable recovery of economic growth.

Consumer confidence index shows the US consumer sentiment of the general economic situation

Consumer confidence, measured in the Conference Board Consumer Confidence (CCI), is defined as the degree of optimism about the state of the economy in general. This index shows the results of a survey of 5,000 households.

BBVA in Switzerland annual report: 2019

BBVA in Switzerland (thereafter BBVA SA or the Bank) closed a successful 2019, a year in which we grew and continued to transform ourselves in order to meet clients' needs and ensure we stay relevant to them in the future with a compiling value proposition for managing their wealth. As we look ahead, our client-centric business model, combined with strong investment advisory capabilities and disciplined cost management, will be key for achieving sustainable growth.

Market outlook: May 2020

The trend in the coronavirus contagion curve and the improvement in the Chinese economy acting as a leading indicator are positive signs. It increases the probability that we will be in the central scenario in which recovery and economic growth return in Q3. The strength and speed of the announced economic measures (monetary and fiscal) could protect markets from the worst-case scenario. It is a cyclical recession, with a sharp drop in supply and demand, but shorter and different in nature from the 2008/09 crisis. Headline inflation could fall in the coming months due to the drop in oil prices, to gradually rise again in 2021.

Introducing the online request service for account opening

Video identification and digital signatures are more necessary than ever in this new normal. In the wake of the social distancing measures introduced to halt the spread of the COVID-19 pandemic, BBVA Switzerland has become closer to customers and is using technology to digitise the process for opening accounts.

Differences between inflation and deflation

Due to the current crisis situation we are living, we are often seeing in the media the terms "inflation" and "deflation". Both terms can be confusing on occasions, so here we provide a brief and simple overview to give you a basic idea of the two concepts.

Opening an account in a bank abroad: frequently asked questions

Given the growing number of people who are interested in opening an account in Switzerland, we have decided to present answers to some of the most frequently asked questions we receive on this matter.

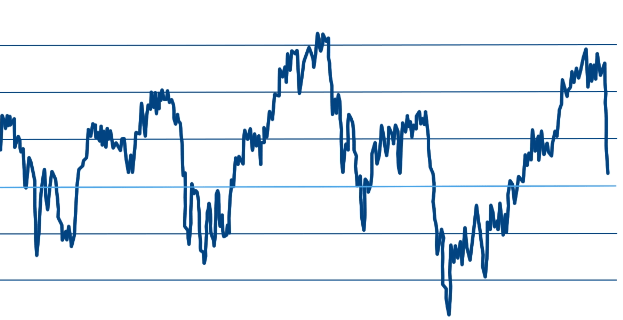

The evolution of financial markets

Several weeks have passed since the market crisis associated with the global spread of COVID-19: weeks during which we have witnessed extreme financial market developments.

Emerging-market currencies beaten down by COVID-19

The surge to the U.S. dollar given its perceived safe-haven status has driven several EM currencies to record lows against the greenback in recent weeks, such as the Turkish lira, Mexican peso and Brazilian real.

Long-term economic risks associated to Coronavirus crisis

The substantial fiscal and monetary stimuli being implemented around the world are from our point of view essential to counter the strong negative effects of the paralysis we are currently suffering from in many segments of the economy.

COVID-19: How to spend time at home in the best way possible

Preventive actions are proving to be key in stopping the spread of Covid-19.

Analysis of the fall in the price of oil

The price of West Texas Intermediate crude, closed last 19th April 2020 at - $ 37.63, something that seemed impossible. It has never closed negative at maturity before. The Price on the spot contract was also negative, due to the lack of storage

The importance of liquidity in fixed income vehicles

One of the most important decisions we must make when implementing our vision in an investment portfolio is to choose between traditional mutual funds or exchange-traded funds, better known as ETFs.

Market outlook: April 2020

The increase in economic uncertainty due to the spread of the coronavirus outside China may last a few weeks. The expansionary cycle should continue negative impact concentrated in Q1 and recovery from Q2, with an impact of -0.2% of global GDP. The alternative high-risk scenario is that the virus becomes a pandemic, with a negative impact on Q1 and Q2 and -0.5% on global GDP. This uncertainty has occurred at a time of improvement in global cyclical indicators, which will help rebuild confidence. In China, there has already been an upturn in production levels and they are also currently implementing tax incentives, a pattern that can be repeated in other regions.

Risks of investing in gold in times of crisis

Gold is considered by many investors to be the perfect safe-haven asset during an economic recession or crises

BBVA-sourced medical supplies to fight coronavirus arrive in Spain

On Tuesday, March 31st, health care supplies to be used in the fight against the coronavirus pandemic arrived at the Zaragoza airport in northern Spain.

Home office: tips to stay productive

Many people have had to adapt their usual routines to work from home due to the coronavirus. In the past, working from home was an added benefit; today, it has become a necessity for many employees in the financial sector

BBVA to donate €25 million in the fight against COVID-19

The Group is to donate €25 million to combat the coronavirus outbreak across its footprint. This week, BBVA will deliver an initial batch of medical equipment, respirators and surgical masks, worth approximately €3 million to Spanish health officials.

What's the minimum amount to open an account in a private bank in Switzerland?

Opening a bank account in Switzerland is a simple procedure. Not only complies with every international legislation but also offers excellent advantages by diversifying your savings in a neutral and stable country with a triple-A (AAA) rating.

Investment in fixed income against Coronavirus

The worldwide spread of the COVID-19 virus (coronavirus) in recent weeks has led to strong movements in the fixed-income markets. The possible impact of the new virus on the world economy (its precise dimensions are still unknown) and a marked drop in oil prices (caused by the announced increase in production by Saudi Arabia) have pushed investors to take refuge in developed government bonds instead of high-yield corporate bonds; the latter are more sensitive to the economic cycle and registered price drops of around 10% in the last two weeks.