The importance of liquidity in fixed income vehicles

One of the most important decisions we must make when implementing our vision in an investment portfolio is to choose between traditional mutual funds or exchange-traded funds, better known as ETFs. In this article, we are going to focus on fixed income funds and ETFs and we are going to explain one of the most important aspects to take into account when opting for one or the other.

Before we begin to analyze the differences between these two vehicles, it is important that we define them briefly:

- Traditional funds: Collective investment institutions whose assets are made up of the contributions of a large number of unitholders and are invested by a Management Company. They are quoted at their net asset value, generally calculated on a daily basis.

- Listed Funds (ETFs): Investment funds whose shares are traded on electronic stock markets in real-time in the same way as stocks or bonds and whose objective is to reliably replicate the evolution of an index or a basket of securities.

One of the most significant differences between both instruments lies precisely in this last point. The need for ETFs to faithfully replicate the index they represent prevents them from managing the illiquidity that may exist in times of market crisis. This can translate into an additional cost derived from the difference generated between the average sale and purchase price of the underlying asset to which the ETF replicates (For example US investment-grade bonds). Various situations have occurred in history that allows us to illustrate this effect:

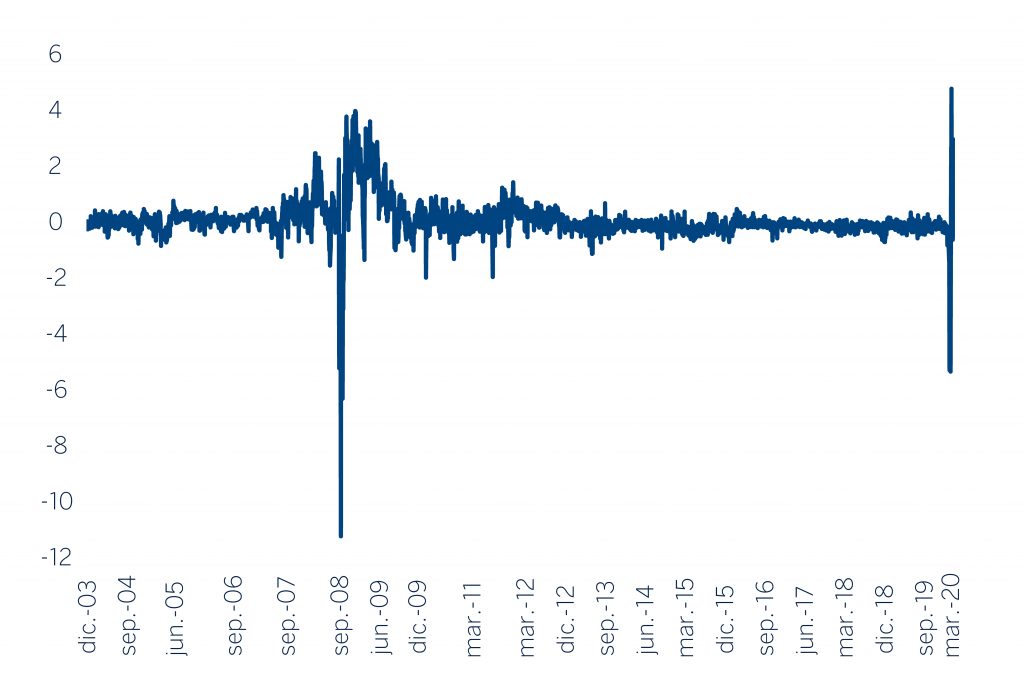

Graph 1 – Percentage of historical premium between the theoretical value of the LQD ETF and its price (2008 Crisis/COVID-19 Crisis)

Source: Bloomberg, BBVA

Chart 1 shows us how in complicated market situations such as the 2008 mortgage crisis or the COVID-19 crisis in 2020, the reference ETF trades at a discount, that is, the greater number of sellers than buyers causes the price of this sale to be well below the theoretical value of the assets making up the vehicle.

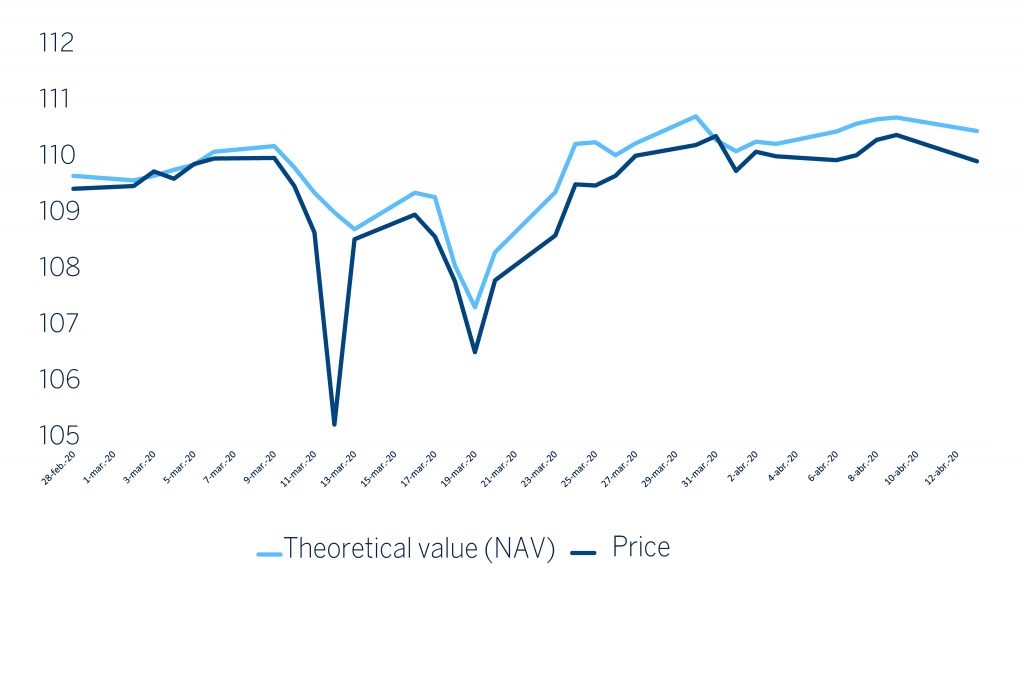

Source: Bloomberg, BBVA

The effect of trading at a discount that we have seen in the first graph is accentuated in less liquid markets, such as that of securitizations in the United States.

Meanwhile, actively managed funds do not have to replicate 100% at their benchmark, allowing them to be managed with greater flexibility. In other words, the fund management team has the power to avoid certain companies, types of debt or exposure to a certain region, thus avoiding a penalty in vehicle performance associated with the low level of liquidity that may exist in the market. Unlike ETFs, the fund’s ultimate return over a given period will also be determined by the management team’s ability to overweight or underweight certain countries, sectors, or companies within its investment universe.

In conclusion, we would not say that one instrument is always preferable to the other, but it is critical to analyze both vehicles from all angles. Not only their difference in terms of theoretical cost but the liquidity of the underlying asset or the market situation in terms of supply and demand, intervention by central banks and the phase of the economic cycle in which we find ourselves play an essential role.