Socially responsible investing post COVID-19

In recent years, socially responsible investing has become a key investment theme and a prime focus of the asset management industry.

One of the benefits often attributed to socially responsible investing is its strong defensive nature, something that we’ve been able to examine during the recent Covid-19 crisis. This article analyses that aspect and the reaction of investors when it comes to allocating their assets.

The classic return-risk ratio has gradually gained a third dimension: sustainability

There are various ways in which socially responsible criteria are applied to investment processes:

- The exclusion of certain sectors or industries,

- Active intervention by the asset management industry in company steering committees

- Direct financing of socially responsible projects

As end-investors we always start from the same premise: sustainability, yes, but not at any price

In view of this latter aspect, it is worth taking a look at how strategies that incorporate these criteria have performed during the Covid-19 crisis.

We are going to do this by focusing on two types of assets and one region: Corporate Fixed Income and Equities, and the United States.

To begin, we are going to compare two US corporate fixed-income indexes, one with a traditional approach and the other with a socially responsible approach (ESG). As we can see, the ESG index weathers the market decline that we saw in the period 24.02.2020–23.03.2020 better than the traditional index.

It also outperforms the traditional corporate fixed income index in the yearly comparison, in spite of the strong recovery of the market.

Secondly, if we compare equities we see very similar results.

In the month with the highest correction in US equities (24.02.2020–23.03.2020), the ESG index minimises the decline to 75 basis points compared with the traditional index.

Besides, over the year as a whole and taking into account the strong rebound of these assets, the S&P ESG Select index not only does not lag behind but increases its excess profitability compared with the traditional S&P 500 to 250 basis points.

The reaction of investors regarding their asset allocation

We see that the ESG strategies fare better. As in any negative market environment, investors tend to sell their risky assets driven by fear or uncertainty.

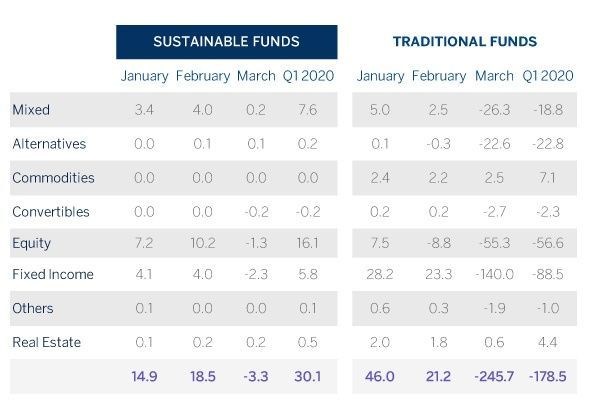

However, the net outflows in socially responsible strategies represent -3.3 trillion euros while in the case of traditional funds they amount to -245.5 trillion euros. In the yearly calculation, ESG funds add net inflows of 30.1 trillion euros, whereas traditional funds register net outflows of -178 trillion euros.

The following table shows the breakdown by fund type and underlying asset:

Socially responsible investing is a trend that is here to stay

Amongst his strong social component, it has also performed robustly in an unprecedented market environment. As the following chart shows, the number of assets allocated to this type of strategy has been rising steadily and everything suggests that it will continue to do so.

In short, there are many indices, ETFs and active management strategies on the market, some newly created and others reconverted from existing strategies. In general terms, it is possible to invest sustainably, boost economic development and still expect a good return.

Related news

-

How do you reconcile financial investment goals with sustainable development goals?

In 2015, the UN adopted a Sustainable Development agenda setting 17 goals that consider in aggregate terms the social, economic and environmental approach that together seek to end poverty and hunger, protect the planet and ensure that humanity enjoys peace and prosperity.

-

The importance of liquidity in fixed income vehicles

One of the most important decisions we must make when implementing our vision in an investment portfolio is to choose between traditional mutual funds or exchange-traded funds, better known as ETFs.

Become a client

If you are interested in this product and are not yet a New Gen client, become a customer now

Open an account