Market volatility measures the frequency and intensity with which asset prices change. This aggressive fluctuation in price is a natural and inherent element of markets and investment. The important thing is knowing how to manage it because it also generates opportunities.

What is volatility?

Let's start with its definition. Market volatility is the aggressive fluctuation of prices. This can be due to a rapid rise in a short time or a sudden fall. However, it is usually associated with corrective or bearish periods. This makes sense because "the market goes up stairs and down in an elevator".

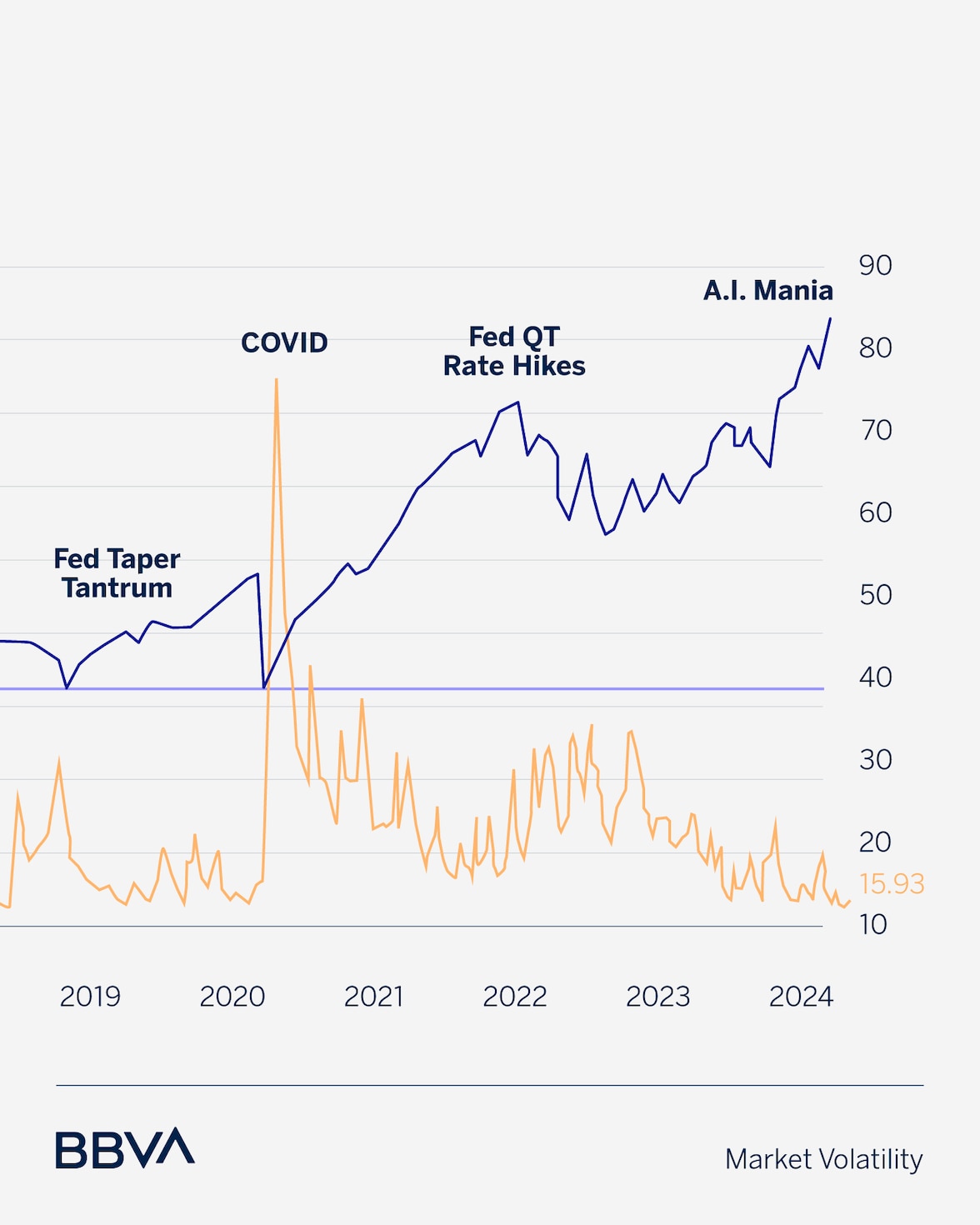

When strong periods of volatility are triggered, it is usually due to the spread of panic among investors. We saw it in March 2020 with the shutdown of economies around the world during the pandemic. We saw it again in 2025, when Donald Trump, president of the US, announced the infamous tariffs in early April, and we will undoubtedly witness it again in the future.

What causes volatility?

Volatility can be caused by multiple factors. Some causes are more circumstantial, others are deeper. An unexpected geopolitical event, such as Russia's invasion of Ukraine; the arrival of a pandemic, as in 2020; political and legal instability, such as the tariffs announced by Trump; and also due to surprisingly bad economic data, such as poor economic growth or employment figures.

It is important to keep in mind that the market is always under threat and that investors can rarely feel completely calm. It is part of their nature and the best thing to do is to live with it in order to find opportunities and protect oneself.

What are the advantages of a volatile market?

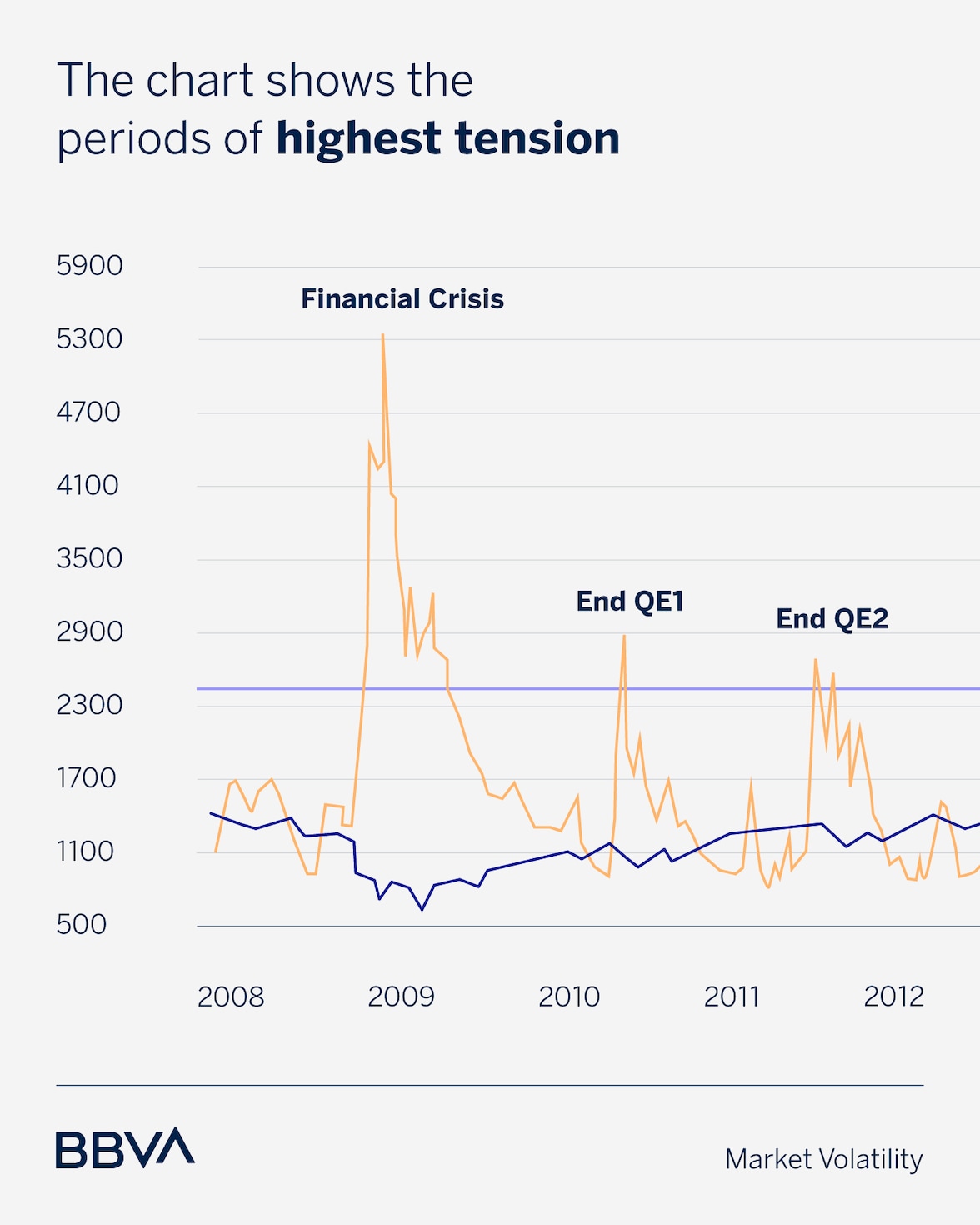

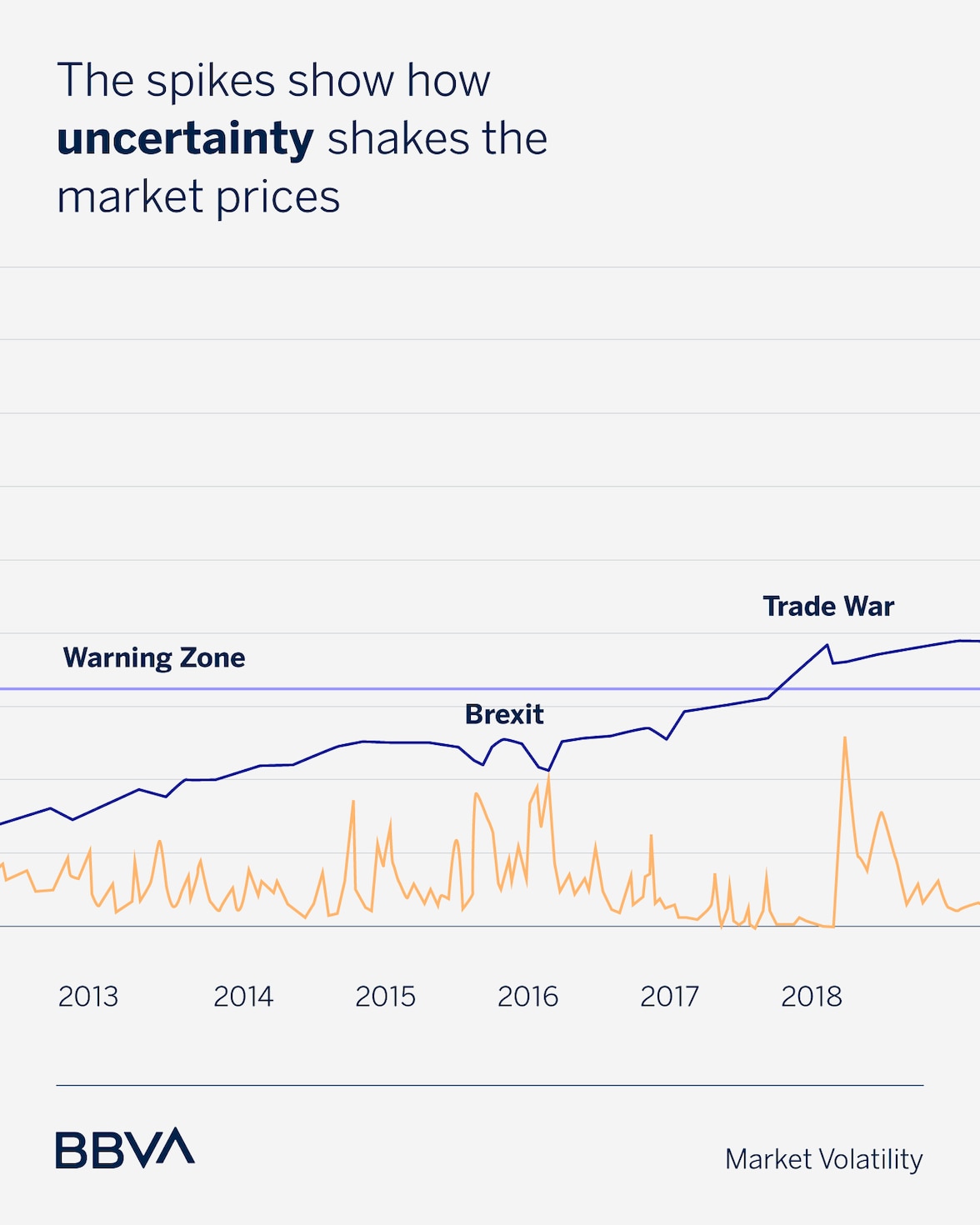

As we have said, and as can be seen in the chart, volatility is generated during moments of maximum tension or panic in the market. That's when the emotion of fear takes center stage, and many, possessed by that feeling, irrationally sell their assets.

Did it make sense for Amazon or Netflix to plummet for weeks in the middle of a pandemic when they could have profited greatly from the situation? Probably not, but that's what happened.

That example serves to illustrate the opportunities that the sensible investor should take advantage of. The market always has periods of volatility; in fact, it is most common for it to have at least one episode every year. That's where keeping a cool head and knowing how to buy cheap can be crucial.

Advantages and risks associated with market volatility

Bitcoin and its volatility, a great example

How to manage the risks of volatility?

While episodes of high volatility create great opportunities for those who prioritize reason over emotion, it is equally important to manage risks. Not all investors have the same profile or the same objective.

Some investors have portfolios for different time periods: in the shorter term, one should look for lower volatility. For example, for someone who needs to recover their money within 18 months, managing volatility is crucial. This means that he has to turn to much more conservative products, such as money market funds or ultra-short-term bonds, with very low volatility.

Most investment funds, among all the metrics they offer, show volatility. Not only that, but for an advisor and for an investor, this should be fundamental. For example, if you are building a portfolio for 24 months, a fund with a volatility of 8% would not be advisable. However, if the portfolio is for 15 years, that 8% is quite manageable, depending on the type of asset.

So, it can be said that volatility is neither good nor bad, but inherent to the market and investment. For those looking to invest long-term, it can be an excellent way to find great opportunities. However, for those investing in the short or medium term, its management is essential to avoid losing money.

What is the fear index or VIX?