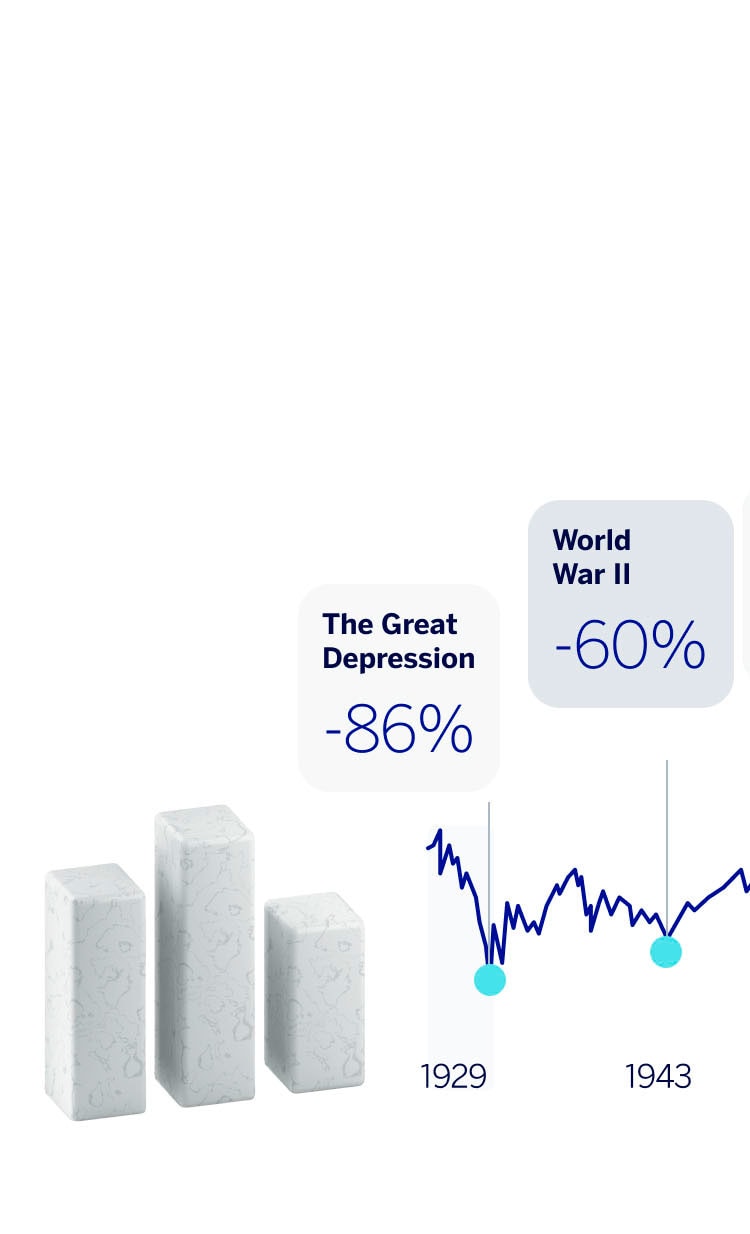

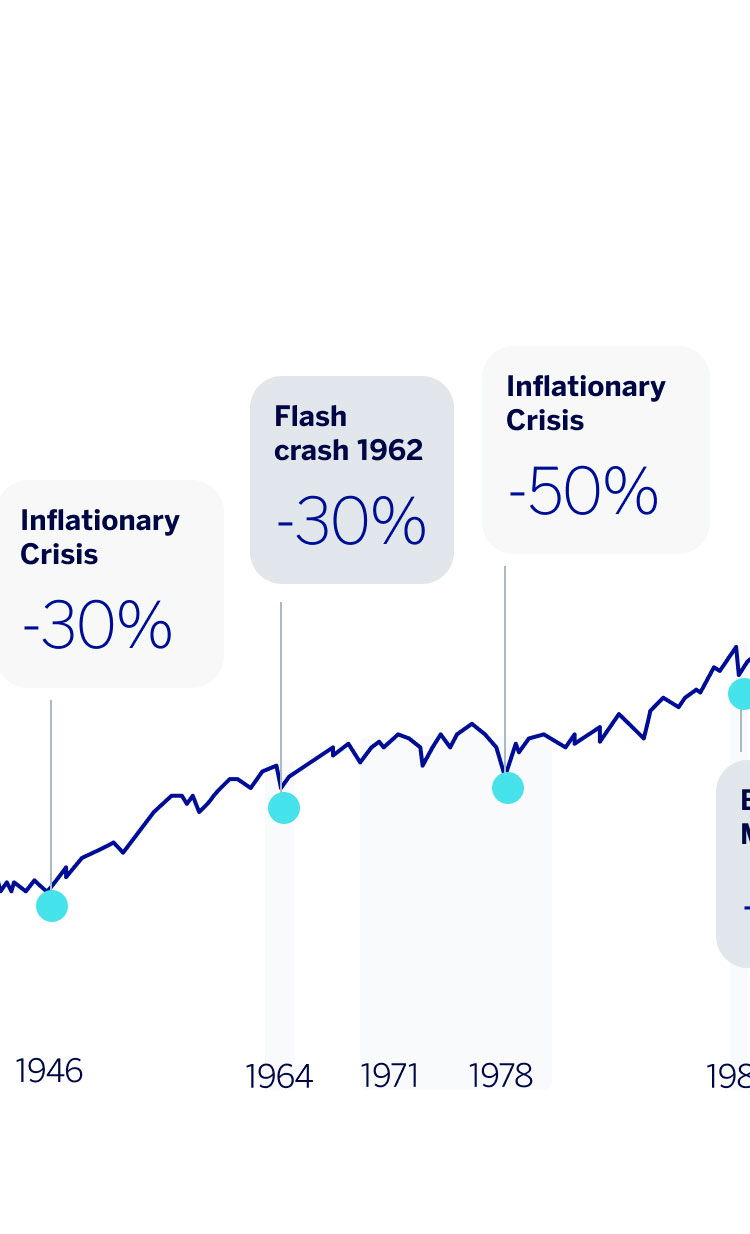

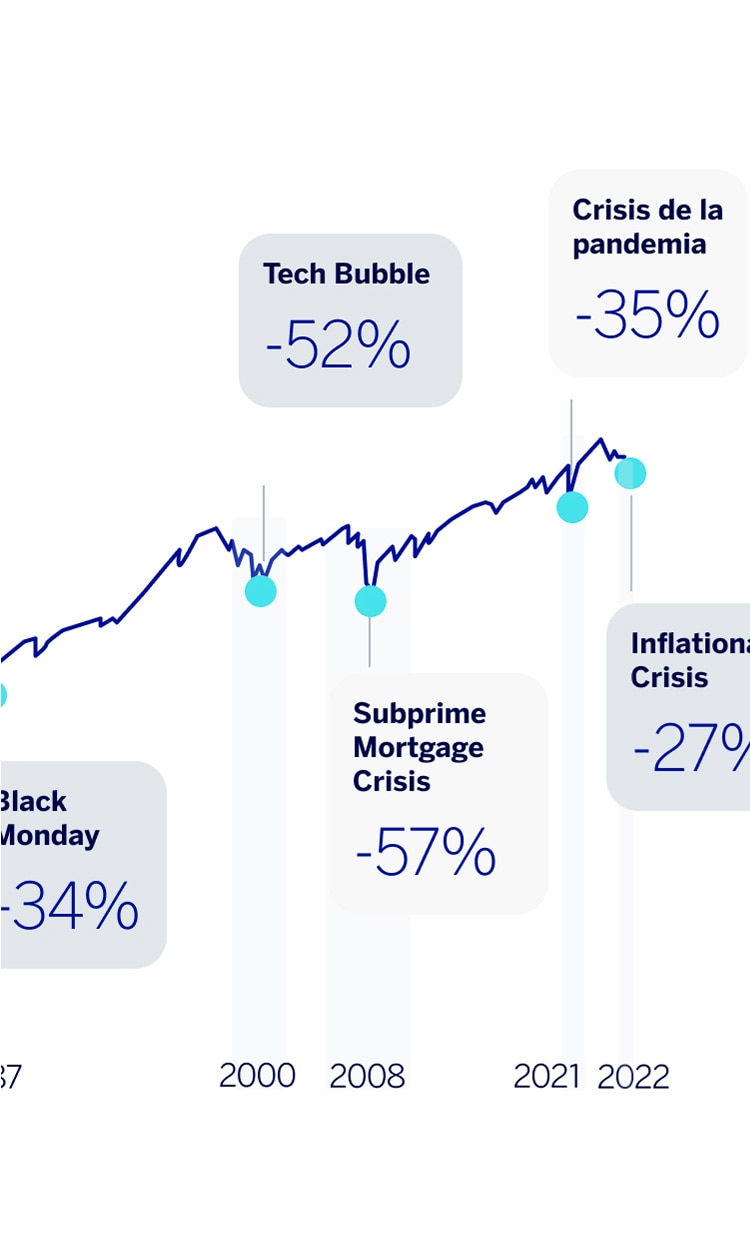

Behavioral economics has grown in popularity across various industries. Originally focused on public and social policy, it is now also being used to address a variety of challenges in business, health, sustainability and more. Events such as the financial crisis have highlighted the importance of helping customers make better financial decisions to avoid excessive debt, encourage saving, pursue medium and long-term planning and consider alternatives in the current inflationary environment. Today’s approach aims to promote customers' understanding of the benefits of certain behaviors and make them tangible so that they are more easily adopted.

He worked in other farmers' fields for years, learning every technique and saving enough to buy a small plot of land and quality seeds.