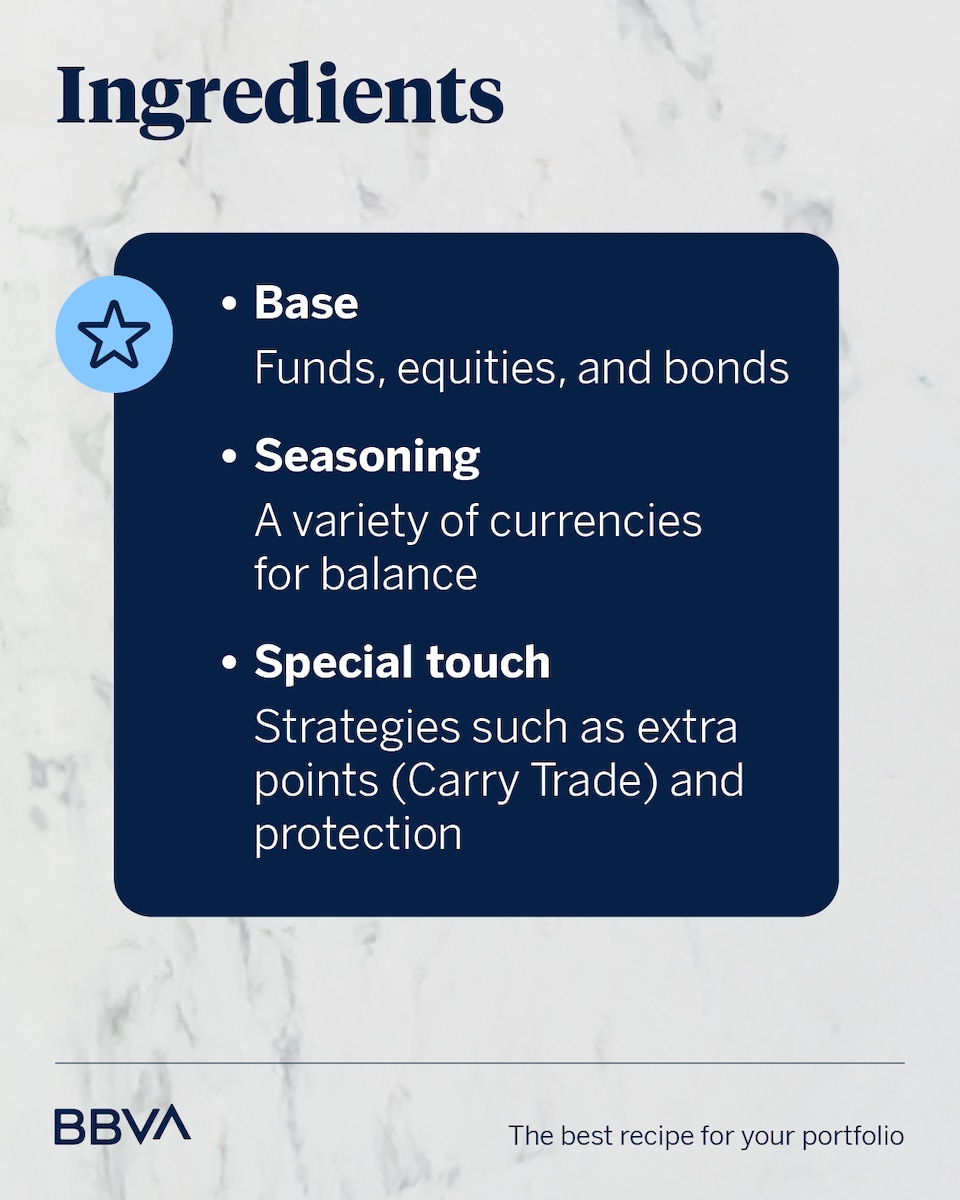

Building a good investment portfolio is very similar to the process of cooking a recipe. You need ingredients, incorporate them in the right measure and at the right time, and correct them throughout the process to achieve an irresistible dish. Currencies would be the salt and pepper.

This is how currencies impact a portfolio

Currency risk is known as the fluctuation that a certain asset has in a portfolio due to the revaluation or devaluation of two different currencies. For example, for a European investor, purchasing a dollar-denominated asset, such as gold or an American stock, implies currency risk if not hedged.

If the stock rises 5% that year, but the dollar falls 10% against the euro, the investor will most likely lose money due to the currency effect. The same thing happens the other way around: the stock may fall, but the dollar may rise and the investor may then earn a positive return.

This brief example illustrates how important it is to consider the impact of foreign currencies on any portfolio. But they don't just influence profitability; they can also serve as protection and investment depending on market conditions.

Hard currency or currency protection

Most investors, especially those in countries with highly volatile currencies, seek to protect themselves in hard currencies first. Currencies that tend to be more stable over time are known as hard currencies, although they are also affected by inflation.

In this segment, the dollar, Swiss franc, pound sterling, and euro play a leading role because they are more reliable currencies. We must not forget that money is trust. Therefore, for a Hispanic American investor, exchanging their local currency for these “strong” currencies provides protection against the volatility that their home currency may experience.

Beyond protection, large institutional investors often prefer to invest in assets denominated in one of these currencies because they provide a more stable and diversifying role. They are not only buying European or American stocks or bonds, but also the currency. It can be seen as a double investment.

Diversify a portfolio by currency

When building a portfolio, risk management is just as important, if not more so, than the pursuit of profitability. Therefore, to better manage risk, one of the most commonly used techniques is to diversify by currency type, rather than by asset type.

An investor in euros who only invests in euros or euro-denominated assets may be more affected by a possible future devaluation of the euro against the dollar or the Swiss franc. However, if the portfolio is diversified across several currencies, it would be less affected in the event of a devaluation of the home currency. This is especially important for those in areas with currencies that are not considered strong.

Investing in currencies: the carry trade

Currencies should not only be perceived as a risk to protect against or an asset with which to diversify, but they also offer investment opportunities that are little known but widely used by professional investors. In fact, it is very common for large fortunes to use the carry trade technique.

The carry trade is nothing more than borrow in a currency with low interest rates, as the Japanese yen usually does, to invest in another currency with higher rates, such as the Australian dollar. This can be done with many others, such as the Swiss franc instead of the yen, and any other currency that has higher rates.

This difference between the interest rates of two different currencies is reflected in FX forwards. The forward curve shows the cost or gain of hedging a currency based on that rate difference, which can affect international investments.

Hedging currency for business or asset protection

Managing this currency risk is very important for maintaining margins in a business or preserving assets from this volatility. When investing in certain assets, such as fixed income, it is thus highly recommended to implement a hedging strategy.

Currency hedging strategies are usually carried out using forwards, which are derivative products that allow the future purchase or sale exchange rate to be fixed at the time of the transaction. This is very important for international business and investment as well. To carry out more complex operations of this type, it is recommended to do so with the help of Forex market experts.

Forward strategies as a protection option

The Swiss franc is vying for the Japanese yen's throne.