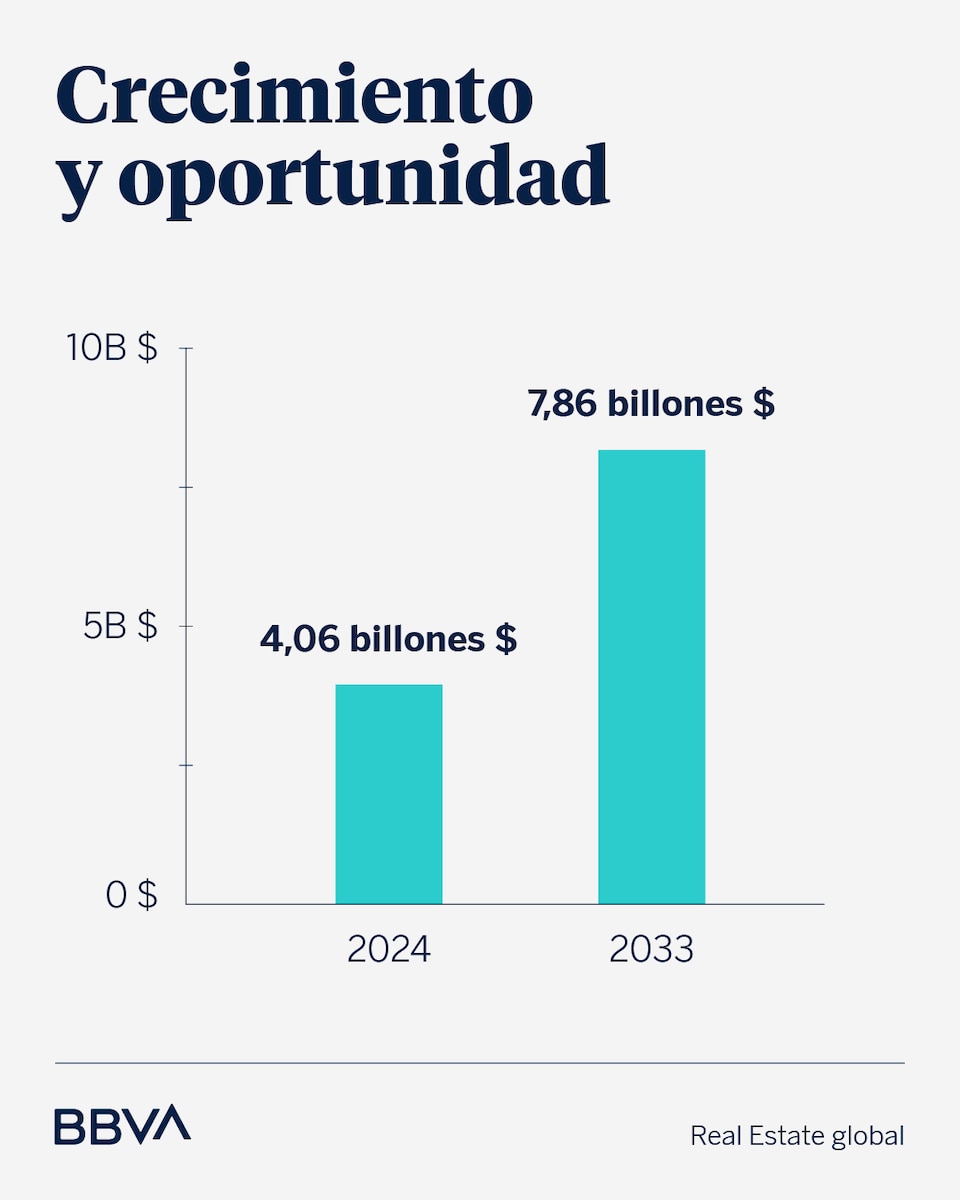

A market projected to exceed $4 trillion by 2024 with upward forecasts. The real estate sector has long been a staple for investors, transcending just residential properties. Interest has now broadened to include offices, hotels, data centers, retail, logistics, and the living segment.

The market's pulse: the current state of real estate

The latest report from consulting firm PwC expresses moderate optimism about the industry. In fact, 80% of survey respondents expect revenues to remain steady or increase by 2025. It appears numerous tailwinds are propelling the real estate market forward.

Technology is propelling data centers to the forefront, making them the top choice in investment, development, and global revenue prospects for 2025. The industry is also receiving a boost from countries like Germany, which has approved a $500 billion public spending plan for the coming years. This, along with lower and more stable interest rates, is increasing credit demand in Europe.

Real estate extends beyond residential properties. It encompasses much more. According to studies by Savills, interest is growing across Europe in offices located in central business districts (CBDs), hotels, data centers, retail, logistics spaces, and the living segment.

What makes real estate appealing?

For investors, this market offers some highly attractive features: stability, diversification, and portfolio protection. It is a sector that operates differently from other markets and does not exhibit the same volatility. This greater stability allows for portfolio decoupling, shielding it from the fluctuations typical of assets like fixed income or equities.

Most investments in this sector focus on construction for subsequent sale or rental management, as well as maintaining and managing various infrastructure projects. This leads to a stable cash flow, which helps protect against inflation and reduces volatility.

In addition to these strengths, the momentum of the market is another appealing aspect. According to Morningstar, a global financial services company, “there is a significant financial resource gap that must be bridged to achieve the United Nations' Sustainable Development Goals (SDGs), which Goldman Sachs AM estimates at around $4 trillion, particularly in energy, water, and transportation infrastructure”.

How to invest in real estate

Investing in real estate offers a wide range of approaches. Investors seeking more liquidity have the option of REITs, ETFs, or active investment funds that focus on this sector. While these are less volatile, they resemble equities since they involve investing in publicly listed companies.

Notably, infrastructure stocks emerge as the best assets in terms of risk/return among public assets, according to Blackrock's outlook on asset performance over the next ten years.

In the realm of private equity, the methods for investing in real estate are even more diverse. You can invest directly, through direct lending, or via private real estate investment funds. In these instances, it is true that liquidity is lower. This means investors need to wait longer to see their money returned with the expected profits.

According to the same BlackRock report, private fixed income investments in both real estate and infrastructure are highlighted as excellent options for expected returns. Best of all, investing in private infrastructure through funds is anticipated to yield around 8.5% annualized returns over the next decade.

Are there risks in real estate?

Like any market, this type of investment comes with risks. However, these risks vary significantly depending on the investment type. For offices or logistics centers, the global economy's trajectory can have an impact; if consumption decreases, businesses may suffer and be forced to close locations or offices.

The primary risk in real estate is rental defaults. Therefore, it is crucial for investors to make informed decisions about where to invest and to understand the types of buildings the fund manages. Having exposure to a fund that manages motorways, rail networks, car parks, or similar assets—which tend to remain stable regardless of global macroeconomic conditions—is not the same as investing in residential properties, where the risk of default can significantly increase.