5G technology, an industry called to change the world

The 5G generation is expected to generate a worldwide economic value of 12.3 billion dollars by 2035, which represents an important field of action for investors. Read More

The 5G generation is expected to generate a worldwide economic value of 12.3 billion dollars by 2035, which represents an important field of action for investors. Read More

As soon as we start investing, we immediately come across the first two categories that we need to know and understand before making an investment decision, especially if the objective is to preserve and grow our assets. Read More

Countries such as the United States, Japan and China lead the list of the most automated countries, in which the consolidation of Industry 4.0 is directly involved. Read More

To make intelligent machines, to make machines think and have a cognitive process almost like that of humans, is what scientists specialized in this new branch of robotics that we know today as artificial intelligence (AI) dedicate their time to. Read More

Mixed investment funds are funds that in their structure include fixed income instruments, such as government or corporate bonds, and equity instruments, mainly stocks or ETFs. Read More

The genius of mathematics applied to finance was born in the state of Massachusetts, in the town of Newton, in 1938. Twenty years later, in anticipation, he was graduating from the Massachusetts Institute of Technology (MIT) and, three years later, he was receiving his doctorate. Read More

Although we are still far from self-aware AI, it is clear that this is the ultimate goal, efforts are focused on the development of memory, learning and the ability to make decisions based on previous experiences. Read More

Shared mobility has surpassed a market value of more than US$60 billion worldwide and is estimated to grow by 20 percent annually. Read More

Although a bit behind the scenes, Charlie Munger is not exactly an unknown, in fact, it is thanks to his advice and vision on "value investing", that Warren Buffett changed his methodology for selecting stocks, a method without which Berkshire Hathaway would hardly be what it is today. Read More

In the early 40's, a young boy, son of a stockbroker in Omaha, Nebraska, barely 11 years old, after studying the daily stock quotes, bought his first shares at a price of $38 dollars per share. Read More

The magic began on December 13, 1957, when Joel Greenblatt, who would later discover the "magic formula" to beat the market, was born into a Jewish family in Great Neck, New York. Read More

Projects aimed at developing hydrogen as a clean energy source will total an investment of up to $300 billion by 2030 worldwide. Read More

George Soros is a name that undoubtedly resonates in every part of the world. His fame transcends from Southeast Asia to North America, and he is cited, both in financial literature as a great strategist, as well as in the more eccentric conspiracy theories. Read More

The story of Bill Ackman is not the story of a man moving from middle class to bonanza, it is rather the story of the heir building his own legacy. William Albert Ackman was born on May 11, 1966, the son of a mortgage financier and a top New York executive. Read More

The transportation sector expects a major technological transition with the arrival of electromobility. The decrease in prices and increase in autonomy predict that electric vehicles will soon become competitive. Read More

Born on October 28, 1955 to a middle-class family, the son of a lawyer and a college teacher in Seattle, William (Bill) Henry Gates III spent his early years as an ordinary child in public school through at least the sixth grade. Read More

The mythical figure of Carl Icahn has inspired at least two endearing characters in Hollywood movies; and his investment character has earned him fame as the most ruthless man on Wall Street. Read More

Investing in Big Data means investing in the evolution of the human being, in their knowledge, in their needs and in improving decision-making based on their requirements. MacroData analysis allows companies and institutions to analyze how to improve their results in all areas. Read More

To increase its applications, IoT works with technologies such as Big Data, Artificial Intelligence (AI), Blockchain, Cloud and Edge Computing, Augmented Reality and 5G. Read More

In 1953, in the city of Pittsburgh, Pennsylvania, Stanley Druckenmiller was born on June 14. Although his early years were spent in the bosom of an average American family in the Philadelphia suburbs, the separation of his parents would force him to move with his father to New Jersey and later to Virginia. Read More

A family sabbatical year in New Zealand was what Julian Robertson needed to clear his head and decide to start what would become one of the first and most successful hedge funds in history. Read More

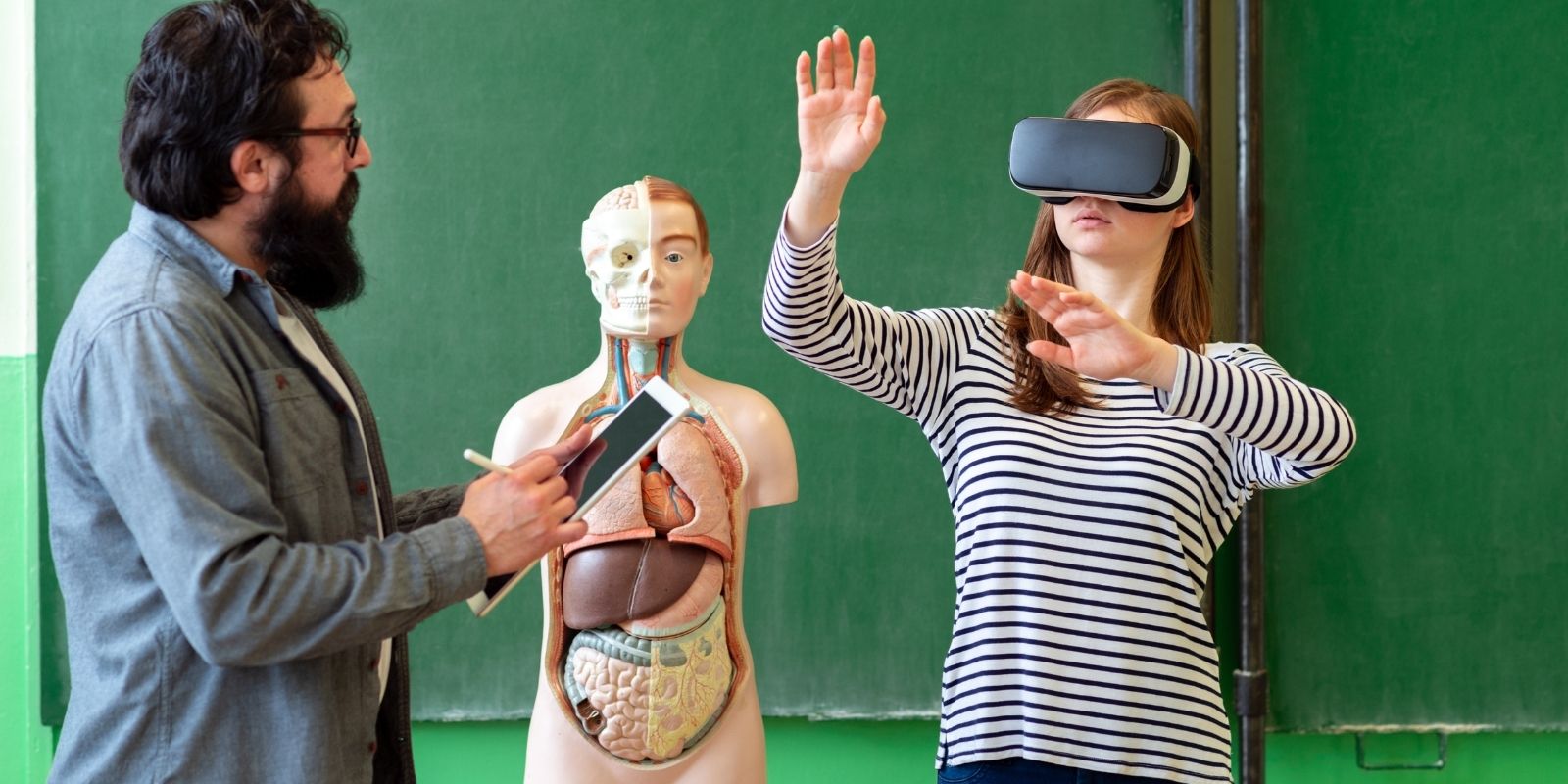

Investing in educational technologies is a method that could guarantee the democratization of knowledge at various levels of education and trigger opportunities for individuals, sectors, countries and even entire regions. Read More

In 1987, a young Harvard student with only two years of college and 19 years of age, founded his first hedge fund in his dorm room, with the money obtained from his grandmother, friends and acquaintances. Read More

On November 26, 1955, Catherine Duddy Wood was born in Los Angeles, California. The daughter of Irish immigrants and a devout Catholic, she learned from her father, a radar system engineer, the importance of the use of technology and the impact it can have on society. Read More

Electric motors achieve 90% energy efficiency, compared to 25% for traditional motors. In addition, recharging an electric vehicle is much cheaper than doing it at a gas station. Read More

Is the concept of biotechnology something new? It is surprising to many how recent and diverse the trajectory of biotechnology has been for mankind that only a hundred years, since 1919, when the Hungarian agronomist Karl Ereky established a definition of biotechnology, seeing it as the use of raw materials to the maximum to satisfy the needs of society. Read More

Born on June 19, 1971, in San Jose, California, victim of a cancer that caused him to lose an eye at the age of two, Michael Burry spent his childhood as a withdrawn child without many social skills. Read More

If there is a man in this world who is not afraid of failure, it is Ray Dalio, investor, philanthropist, writer and manager of the world's largest hedge fund. Read More

eSports tournaments take place as in conventional sports; they bring together renowned players of each video game, use stadiums to play the games and there is a massive sale of tickets, as well as an audience that watches directly from their homes. Read More

The term ‘fintech’ is heard with greater volume in different areas of the financial industry and its evolution has attracted the attention of investors from all over the world creating a new financial landscape. Read More

Become a client

If you are interested in this product and are not yet a New Gen client, become a customer now

Open an account