How can investors avoid financial repression in euros?

After the last meeting (FOMC) of the Federal Reserve, the central bank made it clear that the monetary normalisation that began in December 2015 would be very close to completion, and could even be undone to some extent if there were an economic slowdown. The European Central Bank, for its part, ruled out raising official rates during 2019, thus maintaining rates in negative territory, a phenomenon is known as “financial repression”.

This monetary policy clearly harms savers and benefits borrowers.

The official euro interest rates are in negative territory

The divergences between the US and the eurozone, in terms of economic growth, inflation, labour force growth, and productivity have translated into a strong differential in favour of the North American country. The official dollar interest rates set by the Federal Reserve stand at 2.5% while the official euro interest rates set by the European Central Bank are in negative territory: specifically at -0.4%.

Invest capital in a well-diversified portfolio of bonds (debt) issued by North American companies

To avoid this fact, a euro investor could change their capital in this currency for dollars and invest it in a well-diversified portfolio of bonds (debt) issued by US companies with high levels of income generation and solvency, such as Apple, Amazon, Microsoft, McDonald’s, Coca-Cola, Nike, etc. In return, they would receive a significant yield spread resulting from the coupon rates for these bonds. On the other hand, it would be assuming an exchange rate risk, which would benefit them if the dollar had appreciated at the end of the investment or would harm them, reducing their yield, in the event that it had depreciated.

In this case, it is very important to bear in mind that, the lower the maturity of the bonds invested in, the greater would be the risk of the operation, because the reinvestment risk would have to be added to the exchange rate risk at maturity. In other words, if, when the bonds acquired mature, the Fed has cut official US interest rates to the level of the official euro rates set by the ECB, the loss due to the depreciation of the dollar would most likely be higher than the coupon yield from the bonds acquired and, in addition.

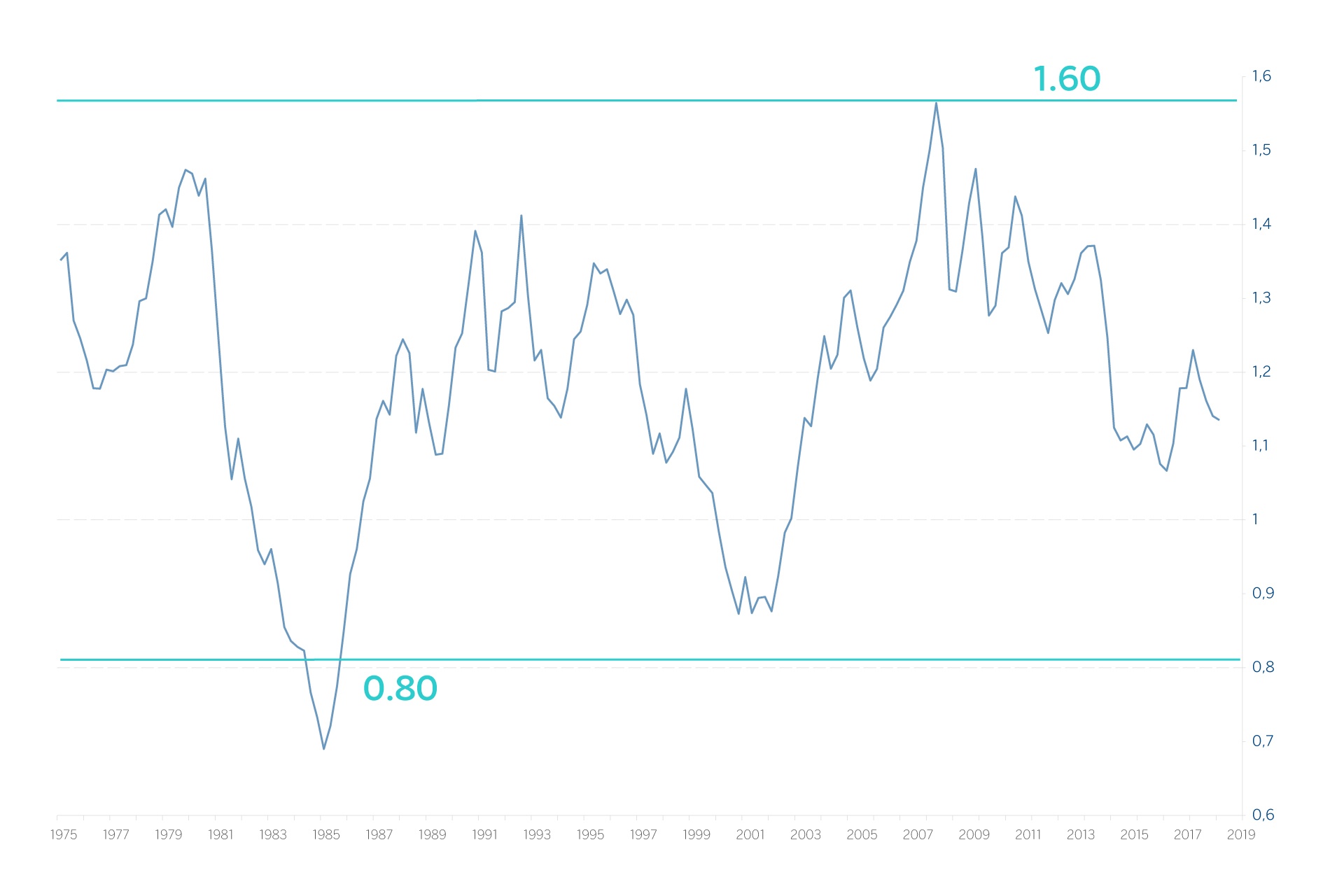

EUR/USD historical exchange rate (1975-2019)

Históricamente, como podemos observar en el gráfico siguiente, la cotización del euro -anteriormente a la entrada del euro se utilizaba el marco alemán- frente al dólar ha oscilado entre 0,8 y 1,6.

Therefore, to minimise the capital reinvestment risk, an investor could buy a diversified portfolio of corporate bonds of the same type with an average maturity of 15 years, although in return for this benefit the investor would experience greater swings in the price of their bond portfolio, as a result of the increased sensitivity of a bond with a higher maturity in the face of changes in the market IRR.

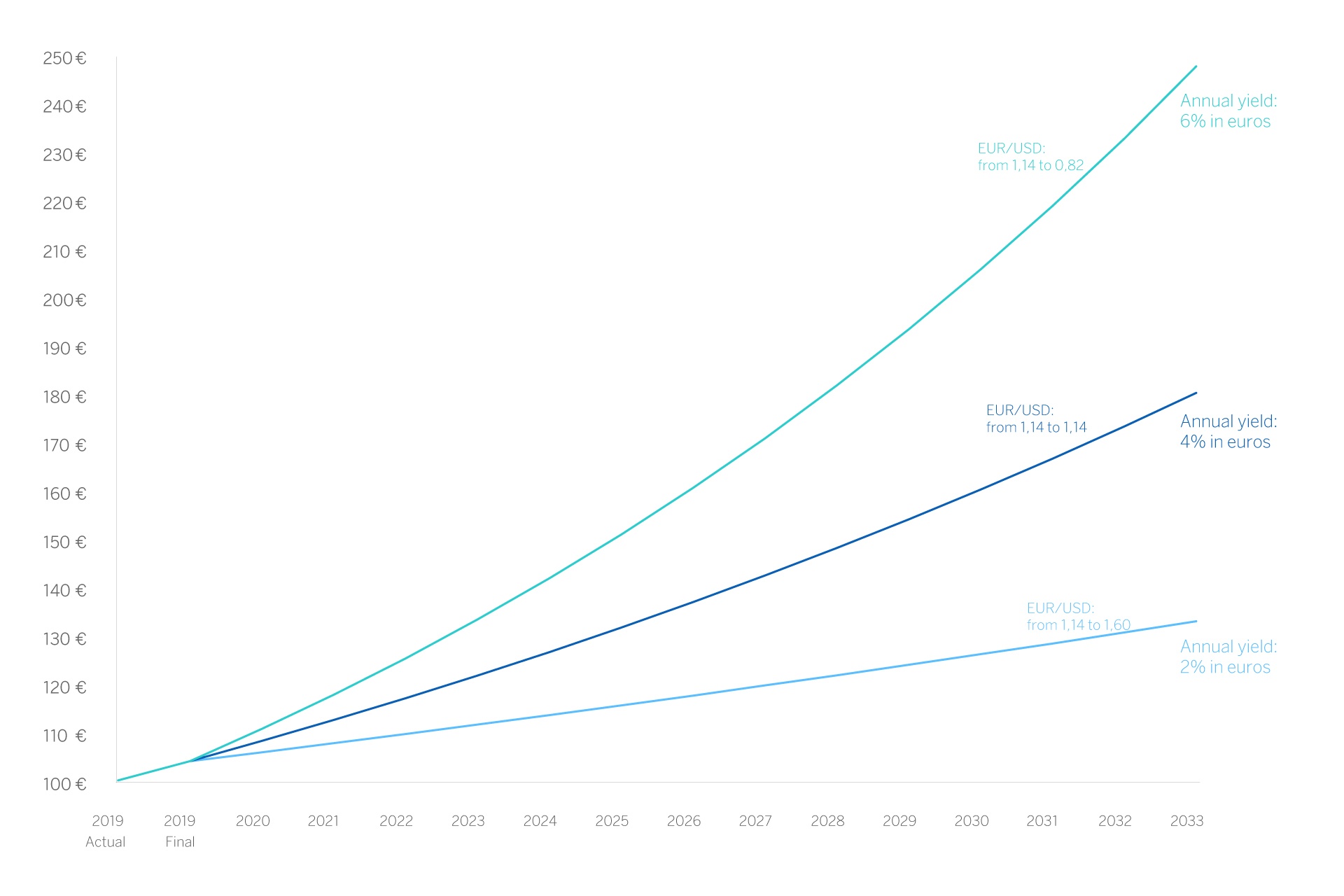

Simulation of the total return in euros of the investment in “High Solvency 15” bonds

Three possibilities:

- Annual yield around 6% in euros

If in this period the dollar appreciated to its historical maximum level (1 euro = $0.82) the return on investment in euros could exceed 6% per year.

- Annual yield around 4% in euros

If in this period the Eur/USD rate remains at current levels of 1.14

- Annual yield around 2% in euros

If the dollar depreciates at fifteen years, to its historical low against the euro (1 euro = $1.60) the return on investment in euros would be close to 2% per year.

Related news

-

Monetary normalisation in the US and its effects

At the end of 2015, the Federal Reserve began the process of removing the extraordinary monetary policy accommodation that it had introduced to help stimulate the economy in the wake of the 2008 financial crisis (the "Great Recession"). However, the Fed's monetary normalisation could see this situation gradually change.

-

How to release cash through changes between US Treasury bonds?

The yield offered by thirty-year US treasury bonds reduces progressively with respect to the return provided by the Fed funds rates