How to release cash through changes between US Treasury bonds?

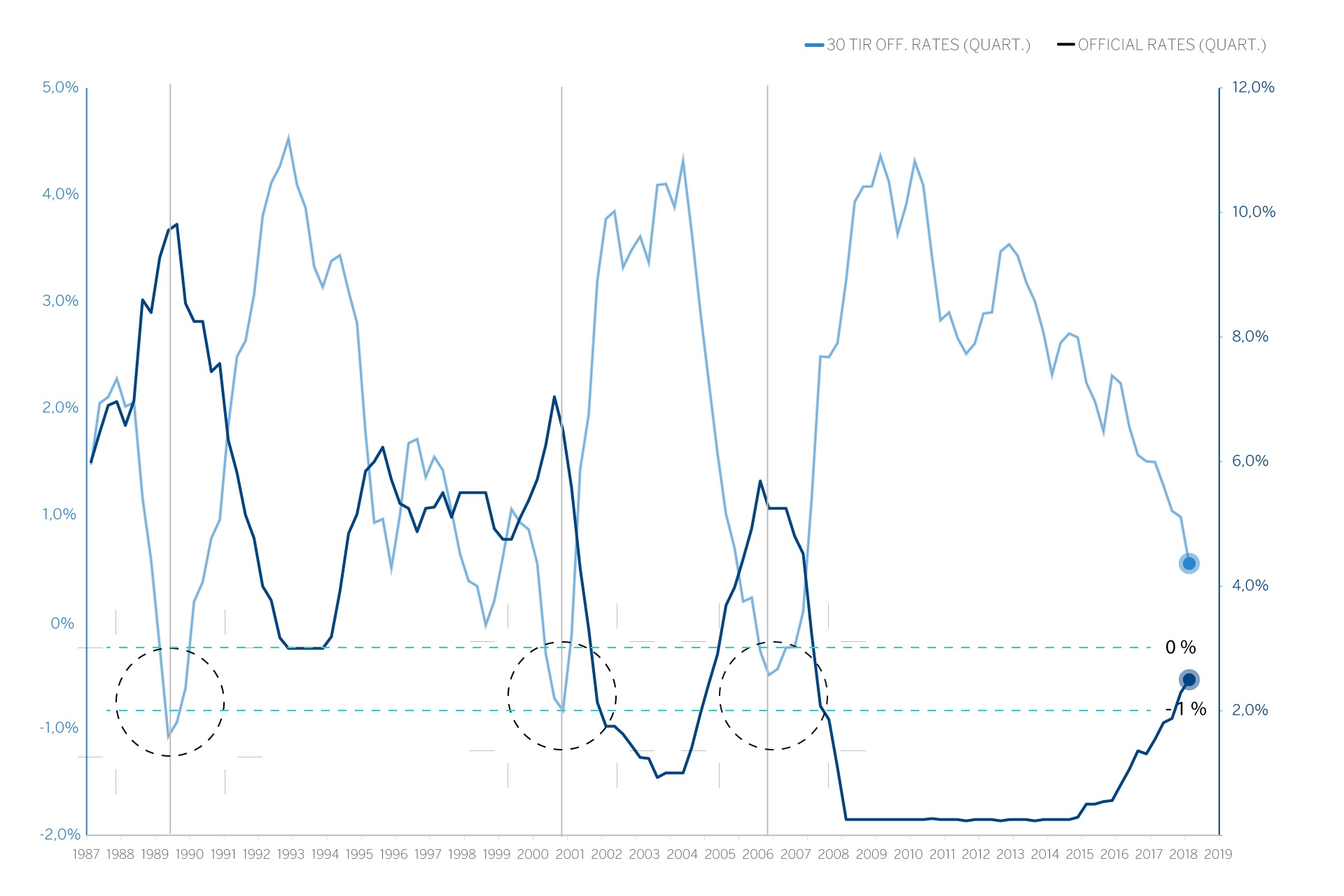

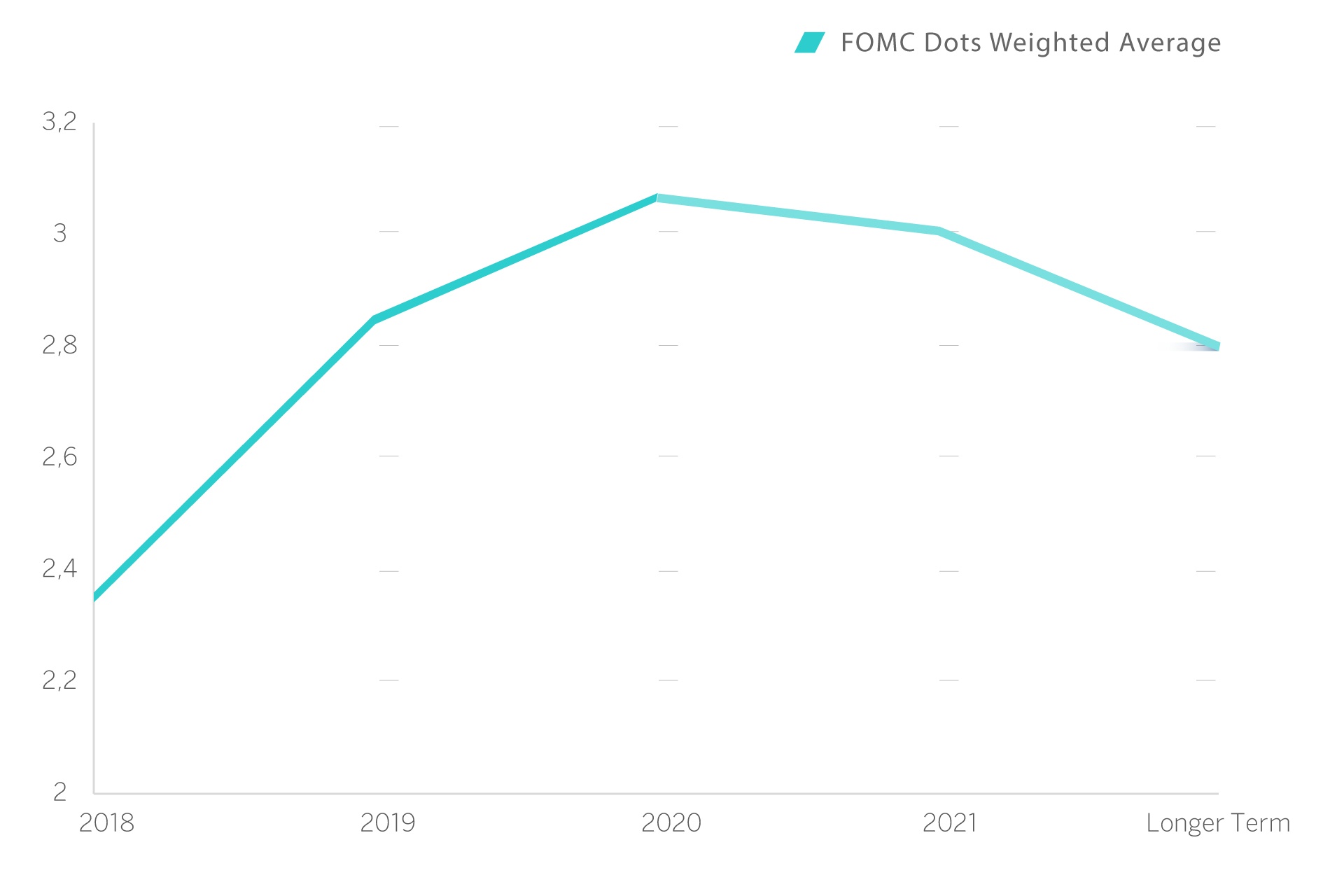

Taking into account that, as we can see in the following chart, the Fed's members estimate that the Fed funds rate will reach its maximum level of around 3% by the end of 2019, if the same "yield curve inversion" which occurred in the previous monetary normalisation processes is repeated, the return (IRR) on thirty-year US treasury bonds could fall to 2% (with a yield spread of -1% as in 1989 and 2000) or 2.25% (with a yield spread of -0.75% as in 2006) from its current level of close to 3%.

Fed funds rate forecasts of the various Federal Reserve members

Taking into account that, as we can see in the following chart, the Fed's members estimate that the Fed funds rate will reach its maximum level of around 3% by the end of 2019, if the same "yield curve inversion" which occurred in the previous monetary normalisation processes is repeated, the return (IRR) on thirty-year US treasury bonds could fall to 2% (with a yield spread of -1% as in 1989 and 2000) or 2.25% (with a yield spread of -0.75% as in 2006) from its current level of close to 3%.

Fed funds rate forecasts of the various Federal Reserve members

Conclusion

As a result, we propose to switch exposure from US treasury bonds with maturities of ten years or less to thirty-year US treasury bonds, maintaining the portfolio's same sensitivity to changes in US treasury bond prices (same modified duration). This will mean that in addition to obtaining extra yield, should such an inversion of the yield curve slope occur, we would also free up cash to invest in other assets that provide a higher coupon rate than that offered by US treasury bonds.

Practical example of the proposed change

An investor has 30% of their portfolio invested in five-year US treasury bonds. This bond has a duration of approximately 4.8 years. Therefore, the sensitivity of the total portfolio to variations of 1% in the yield of this bond would be + 1.44% (if IRR decreases by 1%) and -1.44% (if IRR increases by 1%). This 1.44 years of modified duration (the portfolio's sensitivity to changes in the IRR offered by the five-year US treasury bond) is the result of multiplying the 30% exposure to this bond by 4.8 years, which is the bond's approximate modified duration.

If, as we propose, this investor sold their entire 30% in the five-year treasury bond and bought 8% in the thirty-year treasury bond out of the resulting cash, it would mean that:

Conclusion

As a result, we propose to switch exposure from US treasury bonds with maturities of ten years or less to thirty-year US treasury bonds, maintaining the portfolio's same sensitivity to changes in US treasury bond prices (same modified duration). This will mean that in addition to obtaining extra yield, should such an inversion of the yield curve slope occur, we would also free up cash to invest in other assets that provide a higher coupon rate than that offered by US treasury bonds.

Practical example of the proposed change

An investor has 30% of their portfolio invested in five-year US treasury bonds. This bond has a duration of approximately 4.8 years. Therefore, the sensitivity of the total portfolio to variations of 1% in the yield of this bond would be + 1.44% (if IRR decreases by 1%) and -1.44% (if IRR increases by 1%). This 1.44 years of modified duration (the portfolio's sensitivity to changes in the IRR offered by the five-year US treasury bond) is the result of multiplying the 30% exposure to this bond by 4.8 years, which is the bond's approximate modified duration.

If, as we propose, this investor sold their entire 30% in the five-year treasury bond and bought 8% in the thirty-year treasury bond out of the resulting cash, it would mean that:

- The investor would have 22% in cash (the 30% they would receive from the sale of their five-year US treasury bonds minus the 8% they would use to invest in the thirty-year bond) from which they could acquire other assets offering a higher coupon yield than the US treasury bond.

- The investor's portfolio would maintain the same sensitivity to variations in IRR offered by US treasury bonds (modified duration).

Related news

-

Are gold mining stocks an opportunity?

Historically the performance of gold mining share prices following periods in which the price to earnings paid by the American stock exchange was, statistically speaking, very high, has been excellent and a opportunity as we are going to analyse below.