Monetary normalisation in the US and its effects

At the end of 2015, the Federal Reserve began the process of removing the extraordinary monetary policy accommodation that it had introduced to help stimulate the economy in the wake of the 2008 financial crisis (the "Great Recession"). However, the Fed's monetary normalisation could see this situation gradually change.

During this period 2008-2015, a large number of emerging countries took advantage of cheap dollar financing (rates close to 0%) to increase their public and private debt in this currency. In these years, the bonds issued by these economies attracted a multitude of investors who wanted to put their money in dollar assets at higher rates than those offered by US Treasury bonds 'risk-free assets'.

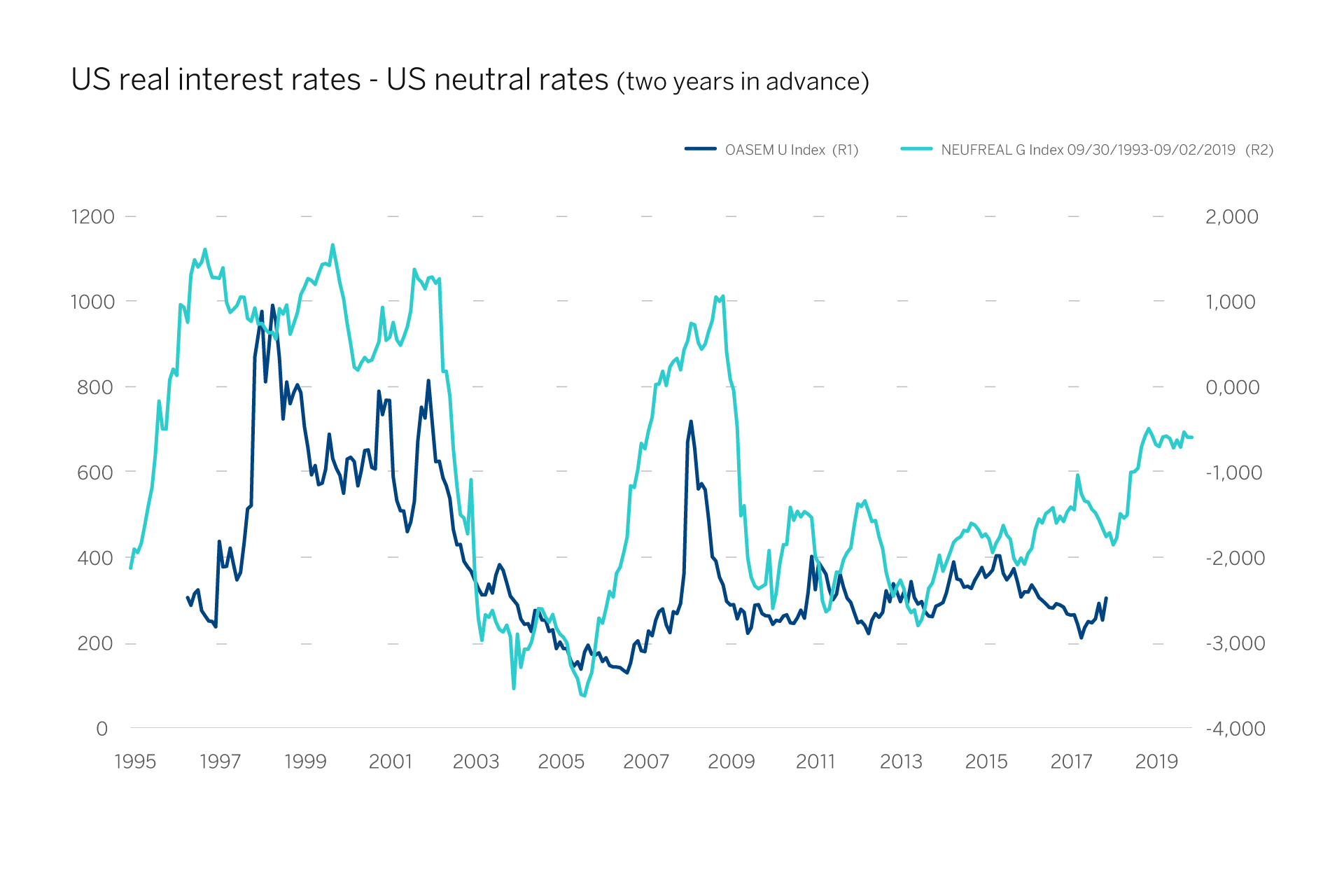

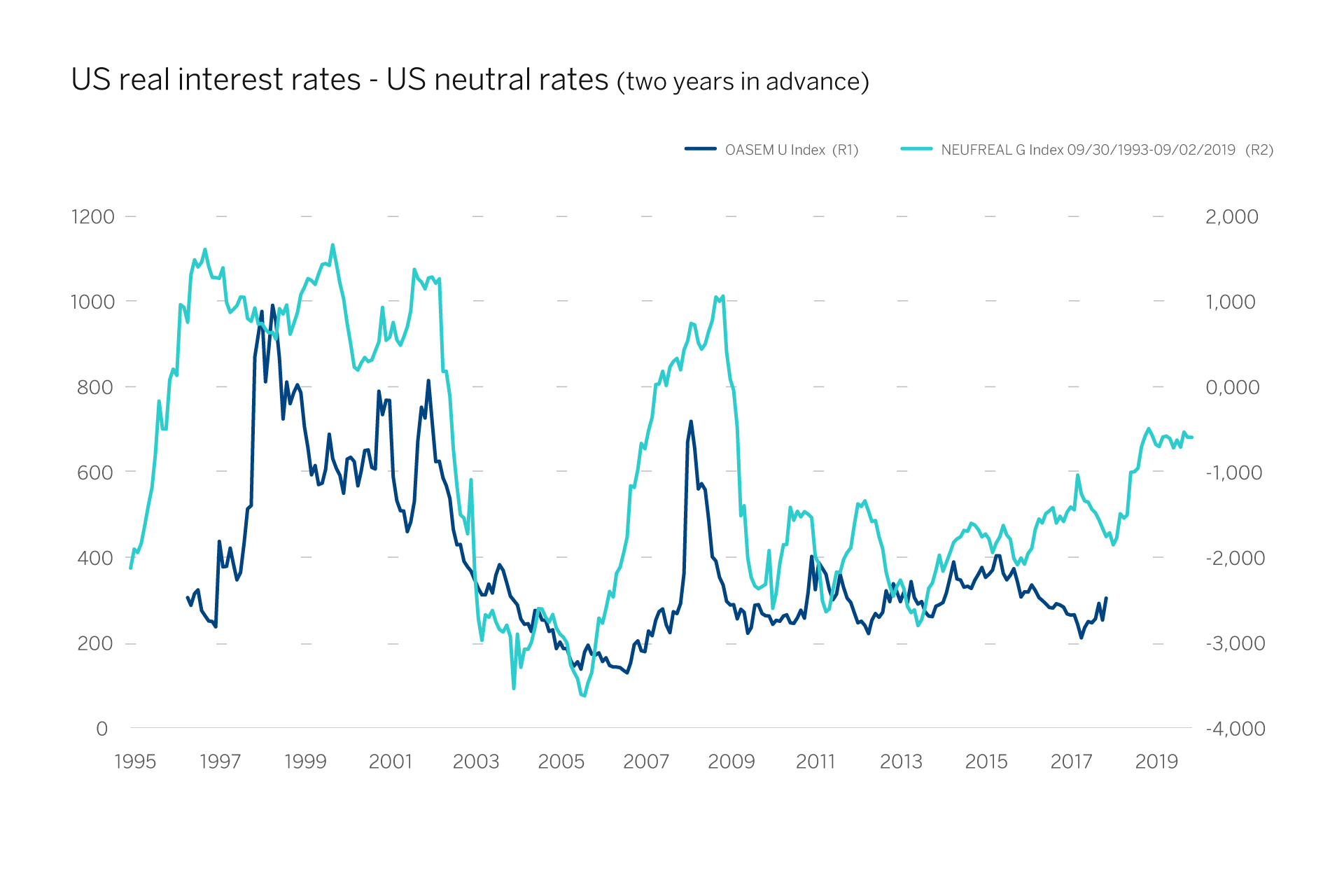

As we can see in the following chart, periods of US rate hikes -liquidity draining- are typically followed by episodes where international investors lose interest in these types of assets, while on the other hand demand increases for US fixed income.

In these phases, the yield required by dollar investors from emerging sovereign bonds above that offered by US treasury bonds (risk premium) tends to rise significantly. For example, in 2008 this risk premium increased from 2% to 7% and in 1998 from 3% (similar to current levels) to 10%.

Chart 1. Level of real interest rates in US - neutral interest rates in US (two years ahead) and annual return offered by all emerging sovereign bonds over US treasury bonds (risk premium)

In these phases, the yield required by dollar investors from emerging sovereign bonds above that offered by US treasury bonds (risk premium) tends to rise significantly. For example, in 2008 this risk premium increased from 2% to 7% and in 1998 from 3% (similar to current levels) to 10%.

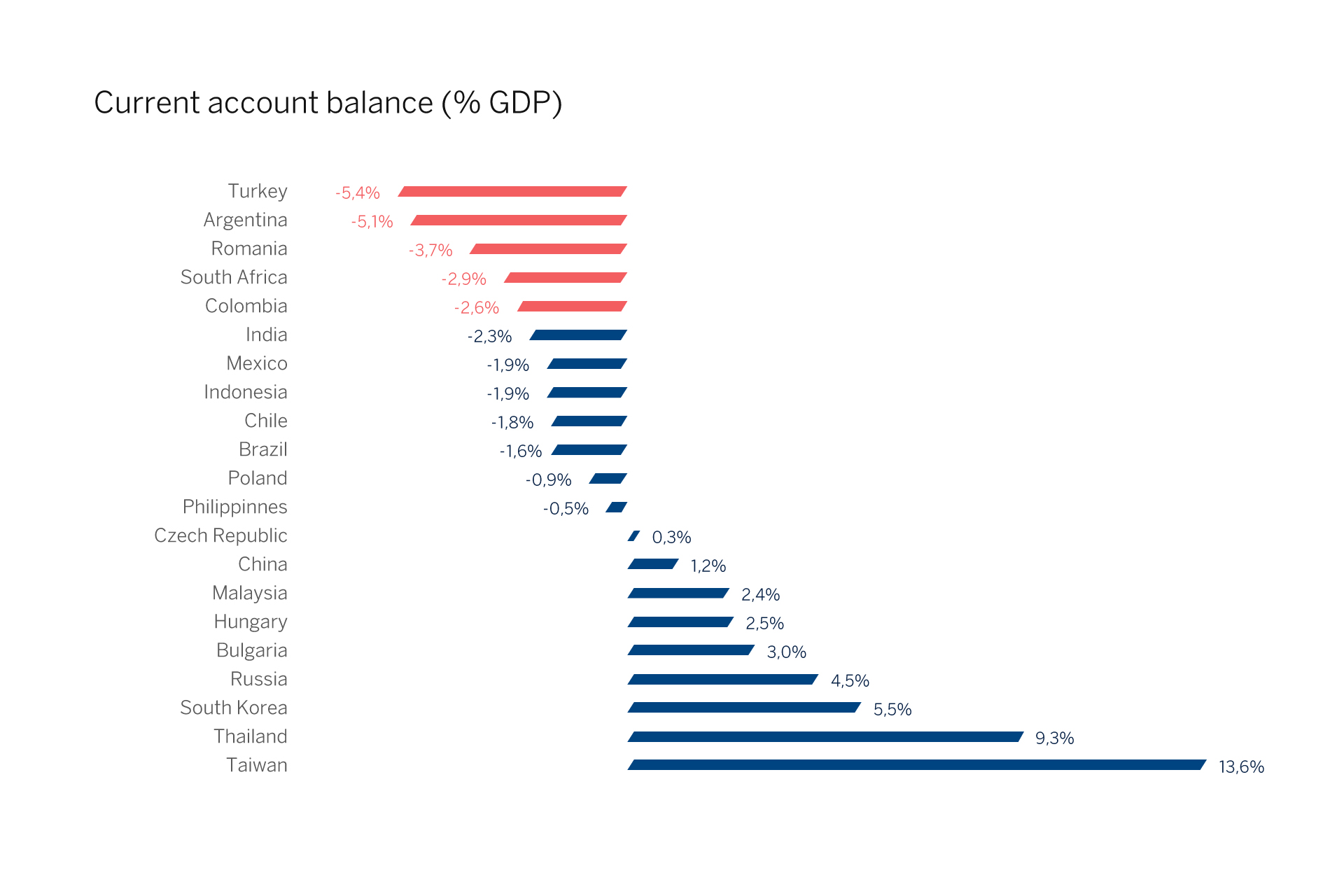

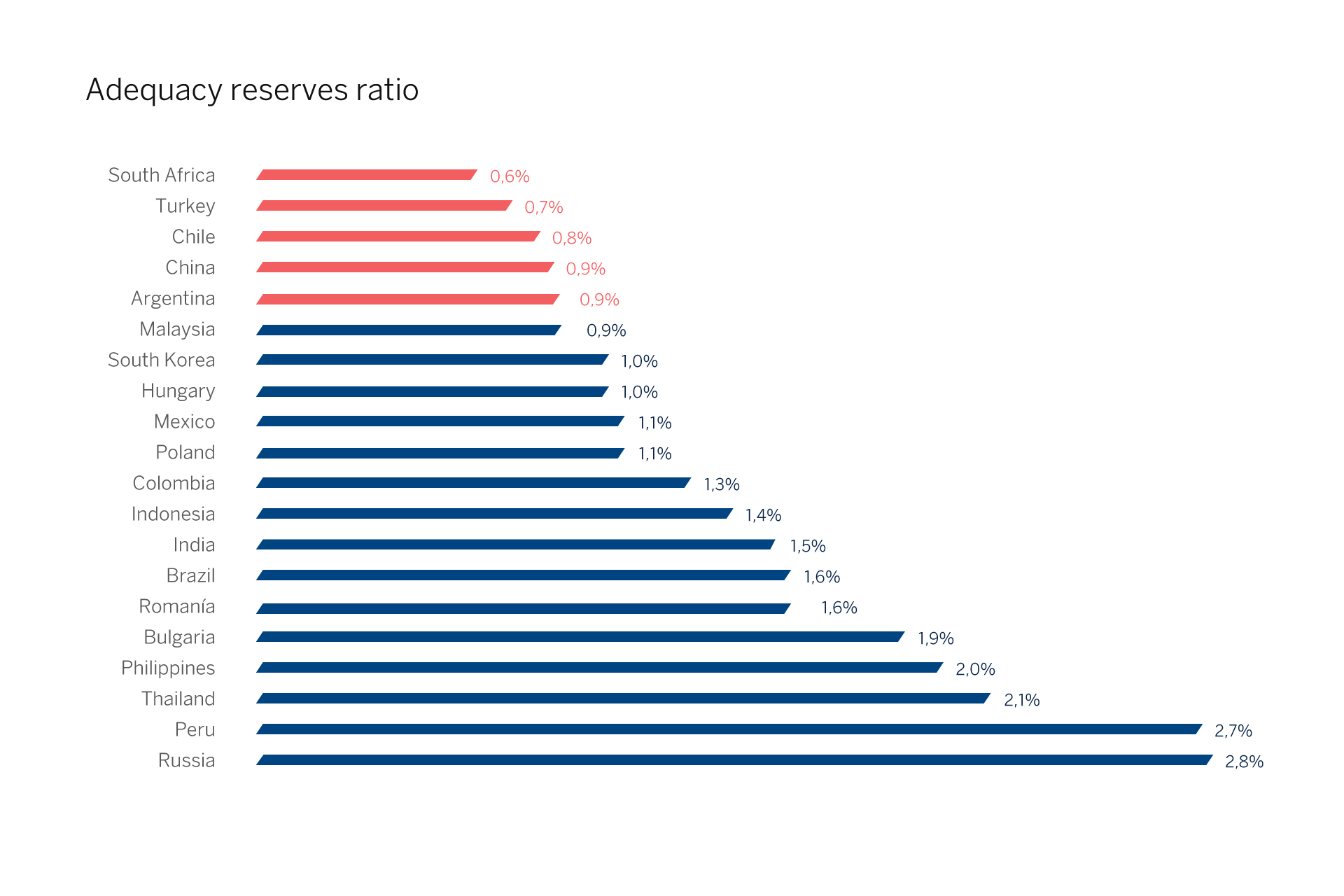

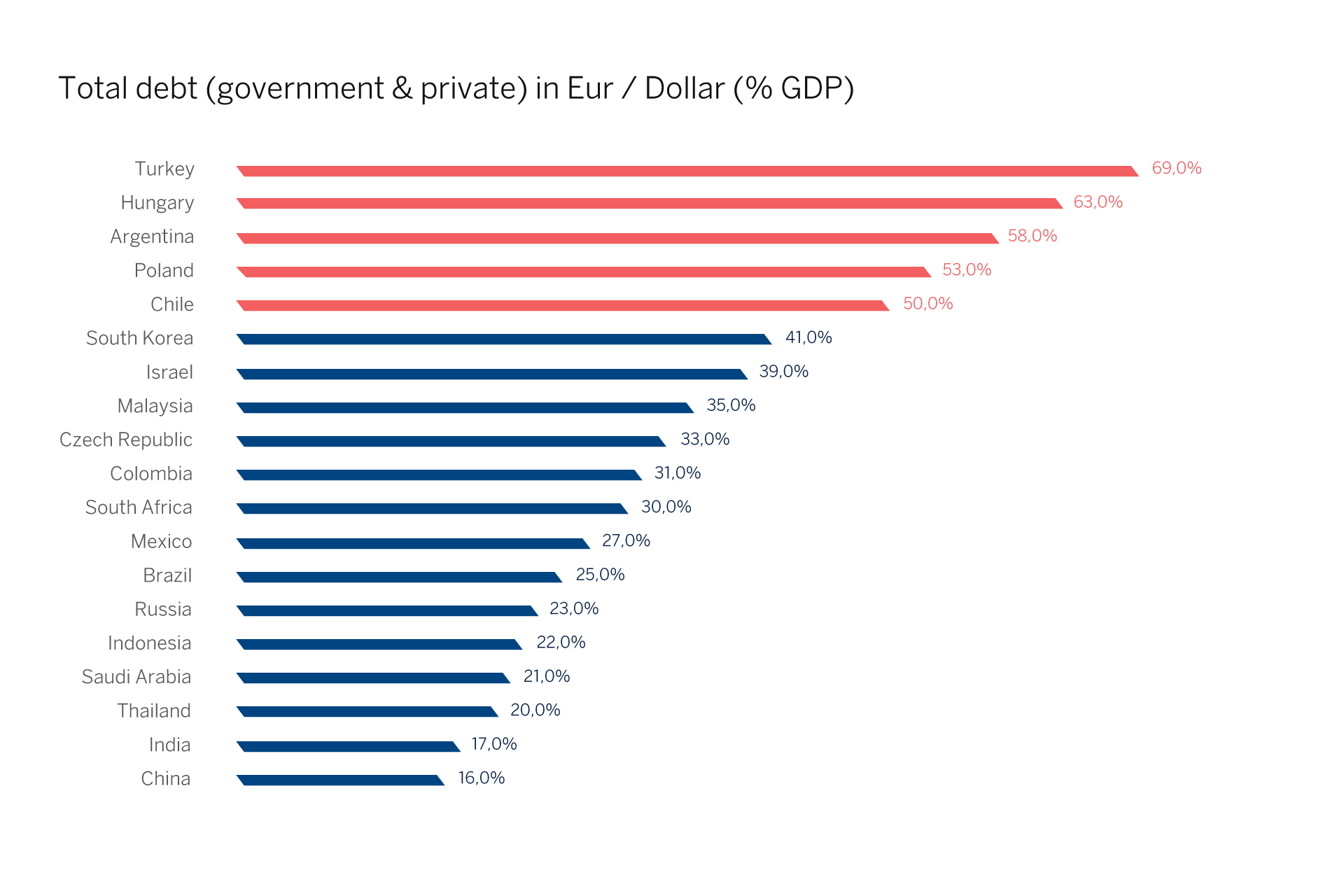

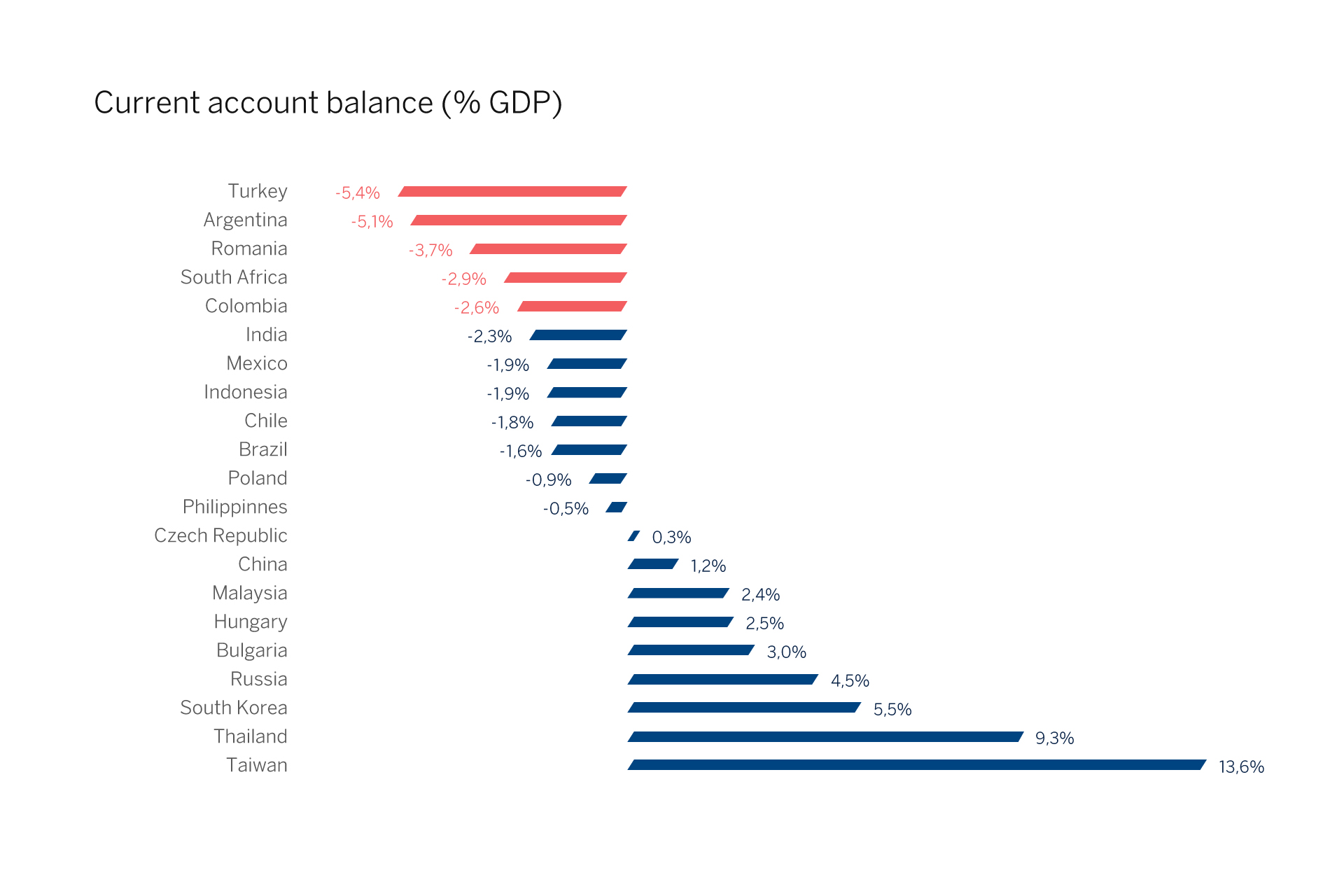

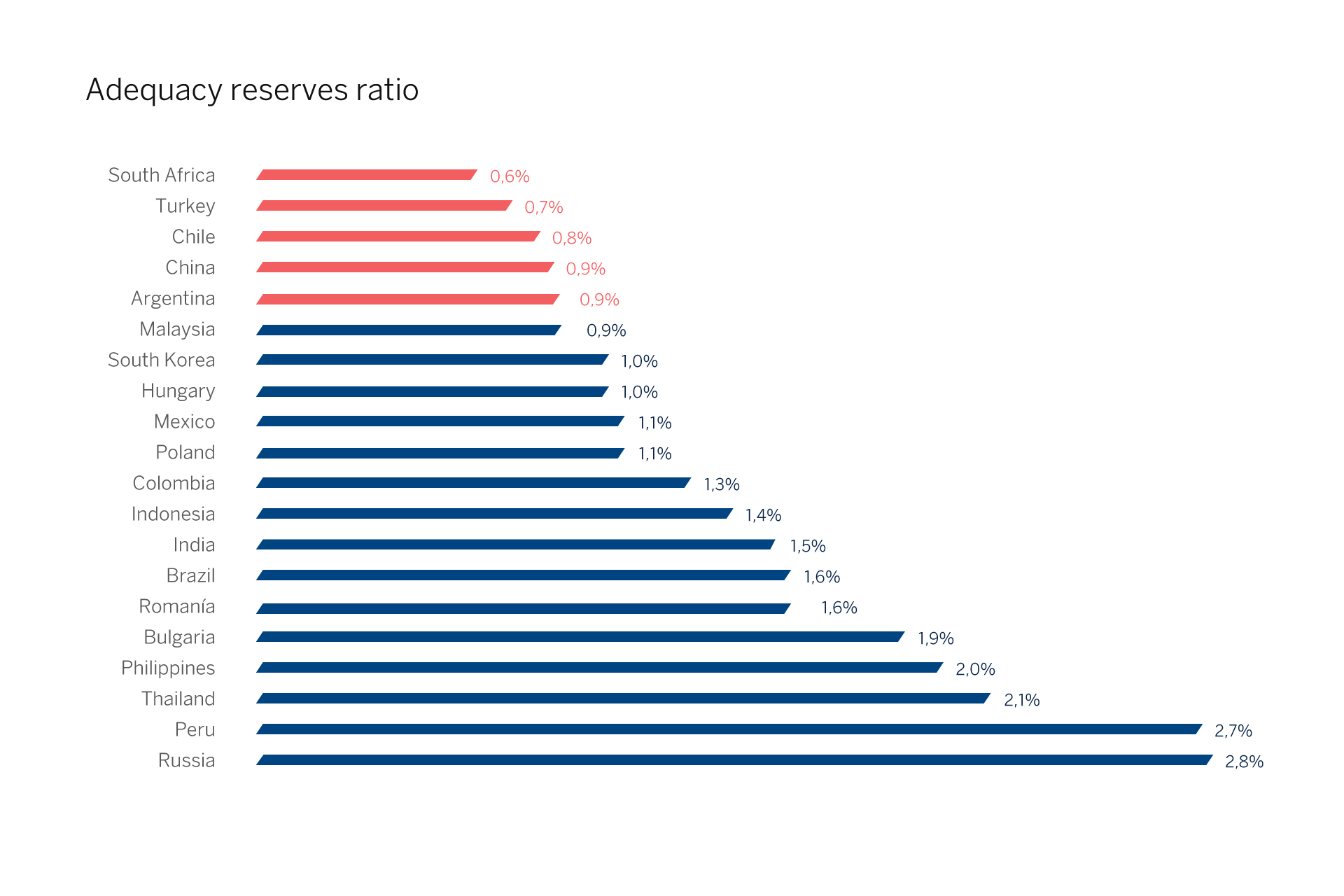

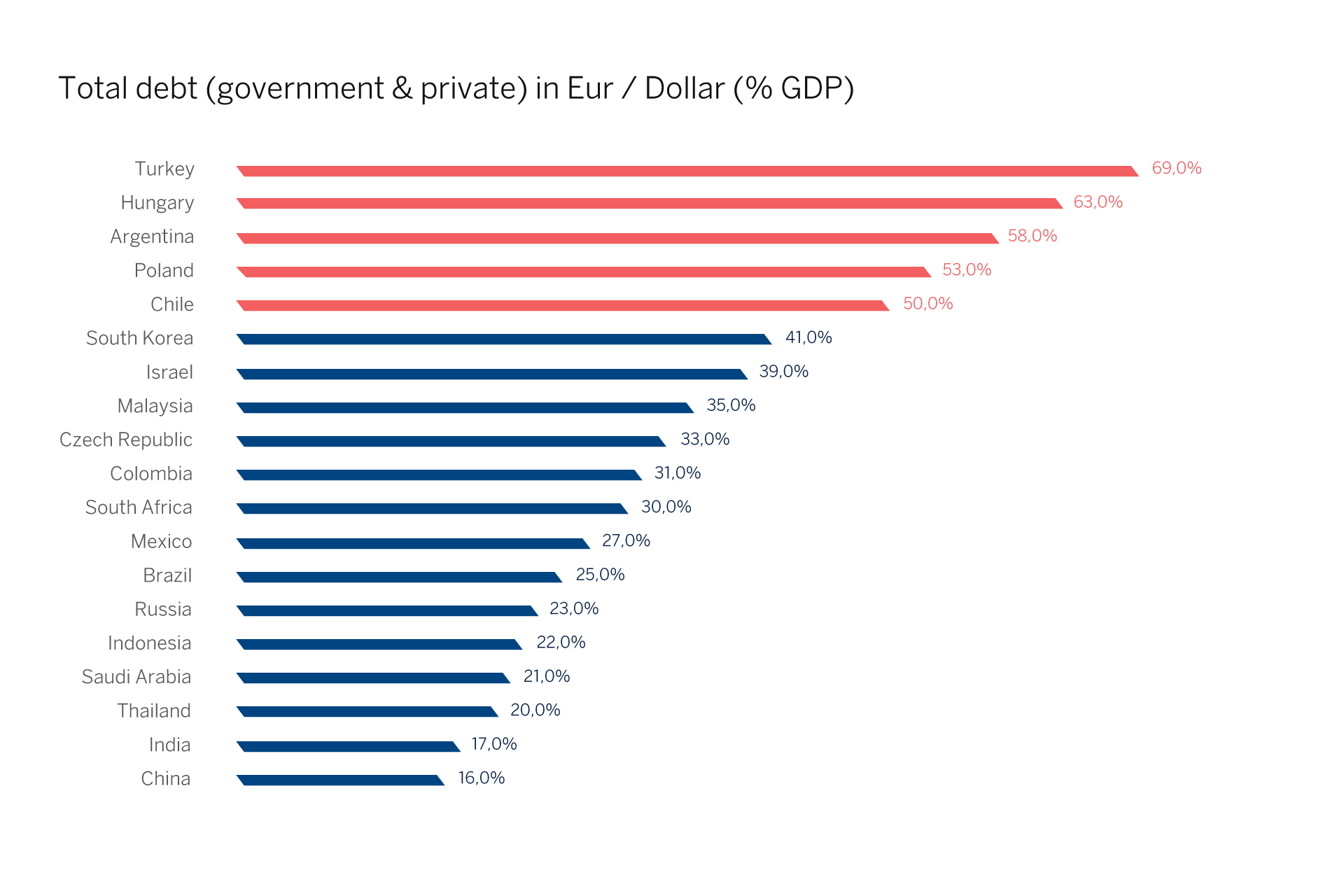

For the moment, as we can see in the following tables, the weakest emerging economies as regards current account deficits, reserve adequacy ratios in dollars or total debt (public and private) issued in USD in relation to GDP, are suffering a high degree of economic instability with heavy punishment of their bonds, due to the withdrawal of international investment, and this is causing them problems in accessing dollar financing.

There was an accumulated fall in the price of the 10-year dollar bonds of Argentina, Turkey and Brazil, in the year of 28%, 22% and 12%, and now offer annual yields above those of US Treasury bonds with the same term of 8%, 7% and 4%, respectively.

In these phases, the yield required by dollar investors from emerging sovereign bonds above that offered by US treasury bonds (risk premium) tends to rise significantly. For example, in 2008 this risk premium increased from 2% to 7% and in 1998 from 3% (similar to current levels) to 10%.

For the moment, as we can see in the following tables, the weakest emerging economies as regards current account deficits, reserve adequacy ratios in dollars or total debt (public and private) issued in USD in relation to GDP, are suffering a high degree of economic instability with heavy punishment of their bonds, due to the withdrawal of international investment, and this is causing them problems in accessing dollar financing.

There was an accumulated fall in the price of the 10-year dollar bonds of Argentina, Turkey and Brazil, in the year of 28%, 22% and 12%, and now offer annual yields above those of US Treasury bonds with the same term of 8%, 7% and 4%, respectively.

Conclusions for investors:

Looking at previous US monetary normalisation processes, we would recommend that an investor wishing to maintain exposure to these assets (emerging-market sovereign dollar bonds) does so in a very diversified way, avoiding a high concentration of individual securities in their portfolio and, if it is possible to do so, through vehicles managed by teams specialising in these assets.

Another option is to swap part of the exposure to these assets for a well-diversified portfolio of investment grade bonds issued by US companies, which are currently offering an annual return (via coupon) from 4.5% at five years to 5.5% at thirty years.

This is a financial education article. However, if you have any further questions, please do not hesitate to contact your adviser before taking any decision.

Conclusions for investors:

Looking at previous US monetary normalisation processes, we would recommend that an investor wishing to maintain exposure to these assets (emerging-market sovereign dollar bonds) does so in a very diversified way, avoiding a high concentration of individual securities in their portfolio and, if it is possible to do so, through vehicles managed by teams specialising in these assets.

Another option is to swap part of the exposure to these assets for a well-diversified portfolio of investment grade bonds issued by US companies, which are currently offering an annual return (via coupon) from 4.5% at five years to 5.5% at thirty years.

This is a financial education article. However, if you have any further questions, please do not hesitate to contact your adviser before taking any decision.

In these phases, the yield required by dollar investors from emerging sovereign bonds above that offered by US treasury bonds (risk premium) tends to rise significantly. For example, in 2008 this risk premium increased from 2% to 7% and in 1998 from 3% (similar to current levels) to 10%.

For the moment, as we can see in the following tables, the weakest emerging economies as regards current account deficits, reserve adequacy ratios in dollars or total debt (public and private) issued in USD in relation to GDP, are suffering a high degree of economic instability with heavy punishment of their bonds, due to the withdrawal of international investment, and this is causing them problems in accessing dollar financing.

There was an accumulated fall in the price of the 10-year dollar bonds of Argentina, Turkey and Brazil, in the year of 28%, 22% and 12%, and now offer annual yields above those of US Treasury bonds with the same term of 8%, 7% and 4%, respectively.

In these phases, the yield required by dollar investors from emerging sovereign bonds above that offered by US treasury bonds (risk premium) tends to rise significantly. For example, in 2008 this risk premium increased from 2% to 7% and in 1998 from 3% (similar to current levels) to 10%.

For the moment, as we can see in the following tables, the weakest emerging economies as regards current account deficits, reserve adequacy ratios in dollars or total debt (public and private) issued in USD in relation to GDP, are suffering a high degree of economic instability with heavy punishment of their bonds, due to the withdrawal of international investment, and this is causing them problems in accessing dollar financing.

There was an accumulated fall in the price of the 10-year dollar bonds of Argentina, Turkey and Brazil, in the year of 28%, 22% and 12%, and now offer annual yields above those of US Treasury bonds with the same term of 8%, 7% and 4%, respectively.

Conclusions for investors:

Looking at previous US monetary normalisation processes, we would recommend that an investor wishing to maintain exposure to these assets (emerging-market sovereign dollar bonds) does so in a very diversified way, avoiding a high concentration of individual securities in their portfolio and, if it is possible to do so, through vehicles managed by teams specialising in these assets.

Another option is to swap part of the exposure to these assets for a well-diversified portfolio of investment grade bonds issued by US companies, which are currently offering an annual return (via coupon) from 4.5% at five years to 5.5% at thirty years.

This is a financial education article. However, if you have any further questions, please do not hesitate to contact your adviser before taking any decision.

Conclusions for investors:

Looking at previous US monetary normalisation processes, we would recommend that an investor wishing to maintain exposure to these assets (emerging-market sovereign dollar bonds) does so in a very diversified way, avoiding a high concentration of individual securities in their portfolio and, if it is possible to do so, through vehicles managed by teams specialising in these assets.

Another option is to swap part of the exposure to these assets for a well-diversified portfolio of investment grade bonds issued by US companies, which are currently offering an annual return (via coupon) from 4.5% at five years to 5.5% at thirty years.

This is a financial education article. However, if you have any further questions, please do not hesitate to contact your adviser before taking any decision.