Are gold mining stocks an opportunity?

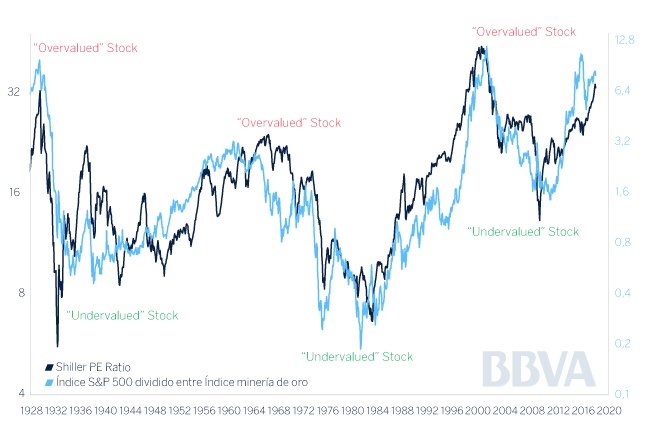

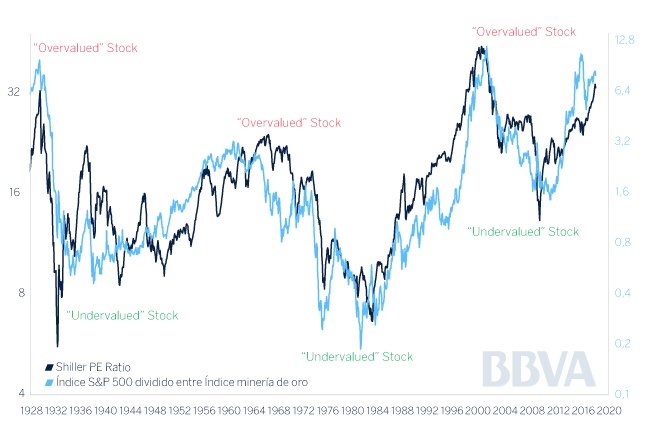

Historically the performance of gold mining share prices following periods in which the price to earnings paid by the American stock exchange was, statistically speaking, very high, has been excellent and an opportunity as we are going to analyse below.

To do this we are going to introduce three concepts:

Conclusions:

Conclusions:

- Standard & Poor's 500 Index: perhaps the most important stock market index in the United States. It is based on the market capitalization of 500 large companies that own shares listed on the NYSE or NASDAQ stock exchanges.

- Barron's Gold Mining Index: shows the price history of the main gold mining companies by market capitalization.

- Adjusted PER or Shiller PE Ratio: cyclically adjusted price to earnings, which is one of the stock valuation measures (against the S&P 500 index) most used by investors. When this ratio is very high, it means that the ratio of the price an investor pays on the stock market to the earnings it offers cyclically is very high, and, therefore, this investment could offer a low or even negative return in subsequent years. But when the ratio is low it means precisely the opposite.

Conclusions:

Conclusions:

- At times when the American stock exchange was "expensive",e., the price to earnings paid was very high, as at the end of the 1920s, during the 1960s and at the start of 2000, what happened in the years that followed was that the revaluation of the group of gold mining companies was respectively 19 (from 1929 to 1935), 17 (from 1960 to 1980) and 8 (from 2000 to 2010) times higher than the stock market itself (S&P 500 index).

- Conversely, at times when the American stock exchange was "cheap", i.e., the price to earnings paid was very low, as at the end of the 1930s, at the start of the 1980s and following the financial crisis in the USA from 2008-2009, what happened in the years that followed was that the revaluation of the stock market was respectively 6 (1934 to 1960), 63 (1980 to 2000) and 7 (2000 to 2015) times higher than that of the group of gold mining companies.