From the most elementary levels, light is at the origin of life itself. Its exploration has led to the development of promising alternative energy sources, life-saving medical breakthroughs, high-speed Internet, and numerous other innovations that have transformed society and shaped our understanding of the universe.

In honor of International Day of Light, we at BBVA New Gen celebrate its contribution to various domains such as science, culture and the arts, education, and sustainable development. Therefore, to develop a more resilient, advantageous, and fair growth model, it is crucial to expedite the structural transformation in five essential economic sectors we aim to enhance today to generate a positive impact while maintaining profitability:

- Energy storage: Certain emerging technologies, especially batteries, low-emission hydrogen, and carbon capture utilization and storage (CCUS), are witnessing swift expansion. Investments in battery energy storage are projected to double, having approached nearly $20 billion in 2022

- Clean energies: The electricity sector, mainly in renewable energies and networks, and energy efficiency. At New Gen, we have selected the most relevant companies and investment vehicles worldwide, such as Vontobel Clean Technology or Schroder Global Energy Transition.

- Electric vehicles: The electrification of transportation is a major driver of the rise in consumer expenditures on clean end-use products. The electric vehicle market is expected to hit an impressive $693.7 billion by 2030, which corresponds to a CAGR of 17.3%.

- Circular economy: The growing demand for this new economic paradigm holds significant potential for businesses dedicated to the circular economy. Firms like Waste Connections, GFL Environmental, and ADS Pipe are at the forefront of this megatrend.

- Smart cities: More compact, connected and coordinated cities would save us $17 trillion by 2050 and spur economic growth by improving access to jobs and housing. The Lyxor MSCI Smart Cities exchange-traded fund provides exposure to the economic momentum of accelerating urbanization.

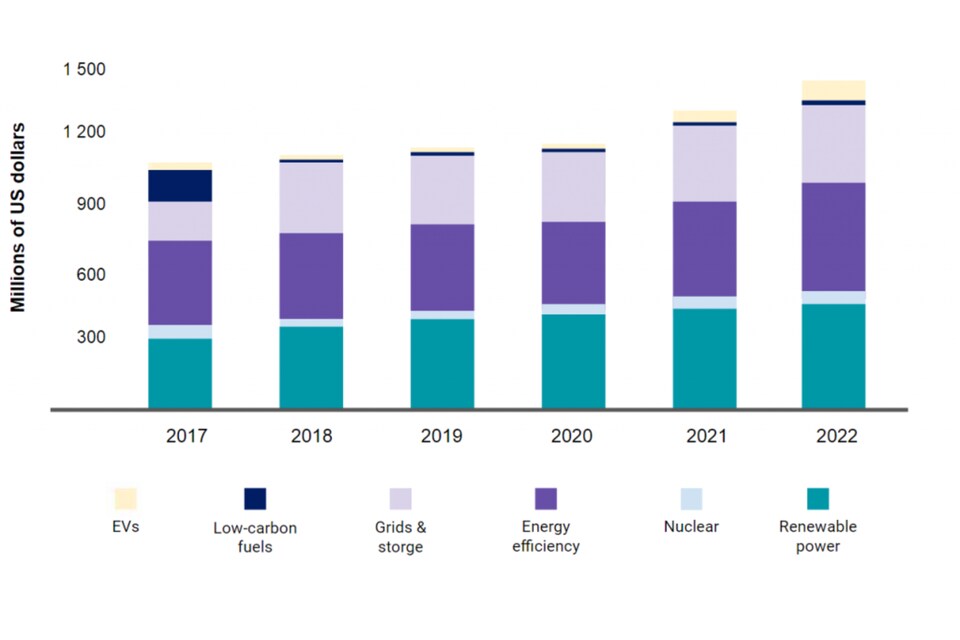

The energy crisis and political measures have catapulted global investment in low-carbon energies to a record-breaking $1.1 trillion in 2022, and for the first time, funding for the energy transition matched the investment in fossil fuel supplies, as reported by BloombergNEF. Although transitioning to a green economy will require time, the earlier we take action, the lower the costs and the more significant the benefits will be.

Global investment in energy