An application on your cell phone that combines dozens of features: chatting, navigation, wallet, booking system... Super-apps allow you to access many services, all the time and from everywhere. These aggregators of specific applications also allow investments and financing. The app ecosystem is moving.

In 2018, the Chinese province of Guangdong allowed divorce petitions through the versatile WeChat, an instant messaging app. The super app added this service to others such as chat, yuan and corporate profiles. Initial super apps have become app aggregators in a market saturated of specific applications, acting as a Swiss army knife that centralizes services and includes virtual wallets and investments. How will super apps change the ecosystem of social media in the Web 2.0 to money in Web 3.0?

It is estimated that there are 2.5 million specific apps in the Android ecosystem, the most widely used in the world; and the average user has approximately 40 apps installed on their device. This figure was 26 a decade ago and millennials are now reported to have around 67 apps installed on their devices (although they only use about 25).

More than an app, a platform

A super app should be understood more as a platform than as an app, a sort of base on which to build more layers. They should not be cataloged by a function, but rather as a system capable of multiple functions: many are chats, web browsers, wallets and smart booking systems, among other things.

Super apps are, first of all, a convenient solution, as a centralized place from which to access everything, all the time, everywhere. A space that also allows the same data to be used for everything according to need. Users not having to register again and again with multiple services makes them particularly useful.

Virtual wallets and mobile payments

Initially launched in 2010 as a messaging project to compete with WhatsApp, WeChat, the first super app, added a mobile payment service in 2013. After that, nothing was the same. The number of active users grew from 100 million to 400 million, and the Chinese government began to promote the use of the platform by Tencent. Today it monopolizes business activity, communications and payments in China, with more than 1.2 billion active users.

The virtual wallet and the sending of money between users was the great success of Tencent to build its super app, which is now open to the whole planet. WeChat made sure that most young people were already registered as a chat user so they could start paying with their phone. This trend is also coming to Europe thanks to banking applications such as the BBVA app, which brings together dozens of services all in one place.

Super apps to invest in the future

Super apps are the future, but they will also help build it by channelling investments and facilitating a financial framework. Applications such as the BBVA app, which were created as a mirror of the operations available on the website, are now the financial hub for many families.

This banking super app not only allows you to carry out all the classic banking transactions from your phone, including payments or investments, but also makes it possible to access financial health services, calculate your carbon footprint, pay bills, savings system, value cars or homes to buy or buy, sign remotely, invest in funds, merge insurance, etc.

A look at other regions of the world allows us to glimpse the nearest future. In Asia, Grab was created as a mobility service to make the leap to payments; in Europe, Revolut integrates bank services; iIn Costa Rica, OMNi groups together services of all types, from medical care to finance or transport. However, the trend is similar: all are born to grow and absorb all types of financial services.

In the case of BBVA, the application is already part of the digital ecosystem, and it helps to consolidate it in Europe thanks to regulations such as PSD2 and the opening up of data, making it possible for BBVA to build an ecosystem around it.

Super apps feature are a "before and after" in the way app ecosystems are understood. If Web 2.0 was based on social profiles to integrate services, Web 3.0 uses identity for engaging these services. Unlike the GAFAM model (Google, Amazon, Facebook, Apple and Microsoft), this opens the door for these users to be owners of their data, and puts power in the hands of super apps that allow people to do exactly this.

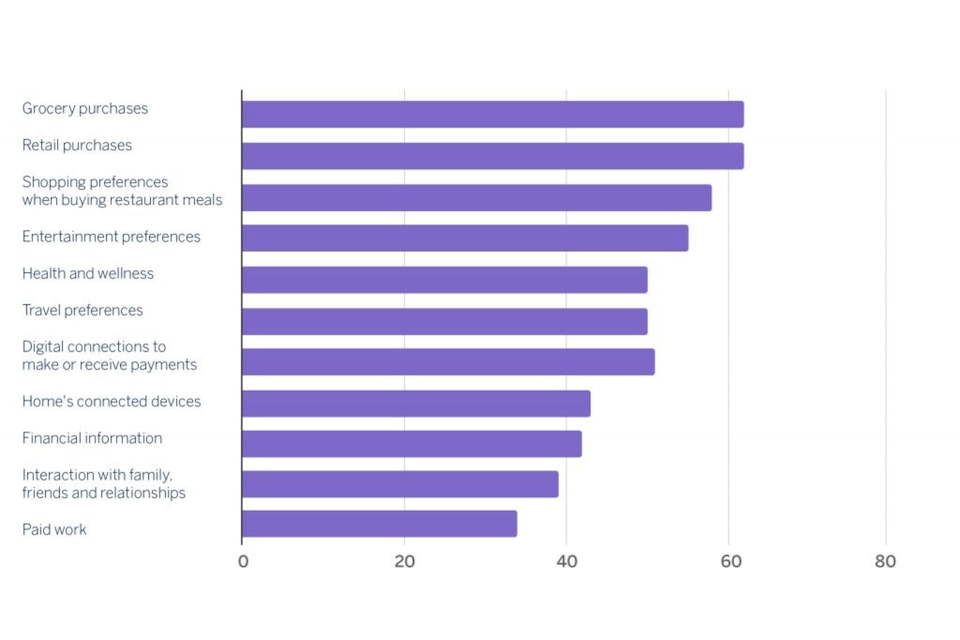

Worldwide share of consumers who would integrate super apps into their life experiences (%)