Over the last decade, the financial services marked has reached 5 billion dollars. In this regard, financial inclusion - or the global drive to ensure that people have access to useful and affordable financial products and services - has a lot to do with it.

Broadly speaking, the finance sector not only has broad political support around the world, but in the wake of the pandemic it has received a strong boost from consumers with the digitization of financial services and the growing acceptance of Blockchain technology. As a result, the sector's gross profits have far exceeded those of the software, e-commerce, semiconductors and healthcare sectors. Since financial services are integrated in almost every aspect of our lives and our work, it is a natural target for disruption and innovation.

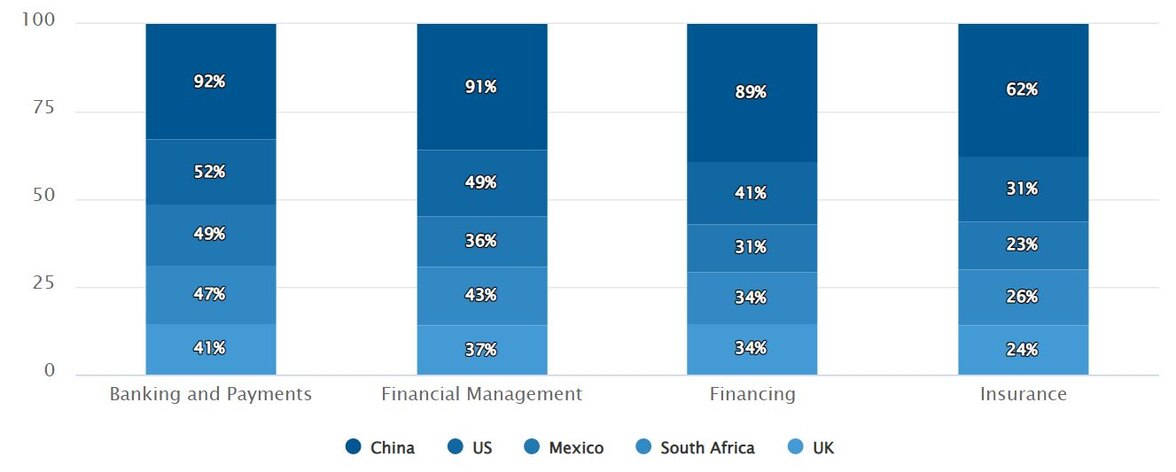

According to Technavio, the size of the global market for fintechs (or financial technology companies) is estimated to increase to 277.22 billion dollars from 2022 to 2027, with a CAGR of 20.5%, with Asia and the Pacific holding the highest market share in the world in 2022, and estimated to grow an additional 39%.

On top of all this is the certainty that the world is shifting towards sustainable economic models, which by 2030 could be creating economic opportunities worth $12 billion a year. Through technologies such as blockchain, big data, artificial intelligence and cybersecurity, fintech companies can help companies assess and reduce their environmental impact, and investors can channel their operations towards the most sustainable assets.

Although macroeconomic obstacles have been affecting consumer-oriented companies recently, at New Gen we still believe that it's a good time to build. After all, some of the world's largest technology companies (such as Airbnb and WhatsApp) were created during the last recession.

It is precisely these market conditions that have led investors to focus on the B2B Fintechs, which are apparently more shielded from market volatility and prepared for strong growth in the midst of the effort to digitize, demonstrating the relative strength that the sector is experiencing, as well as the strong activity of venture capital financing.

Thus, we find a wide variety of secular trends stimulating innovation and disruption in the global economy, creating what we feel are attractive investment opportunities in areas such as:

- Consumer loans

- Microloans

- Insurance

- Access to capital markets

- Saving/investment

50 years growing at your side

Our team of high-net-worth experts offers its extensive experience in advising and designing sophisticated strategies tailored to your needs and values.