The market size for semiconductors, those essential small components in the automotive, computer and data storage industries, is growing steadily. Experts estimate that the sector will exceed 1 trillion dollars by 2030. The investment is in Asia.

Cars, computers, smartphones, appliances... —all these everyday products and many more require chips or semiconductors to function. In a world that is becoming increasingly connected and that is steadily moving towards almost total digitalization, the industry responsible for the creation of these indispensable components has been in the spotlight in recent years. Both because of the expected high growth and investment opportunities, but also due to certain intrinsic challenges. Therefore, it is necessary to analyze the semiconductor industry in detail.

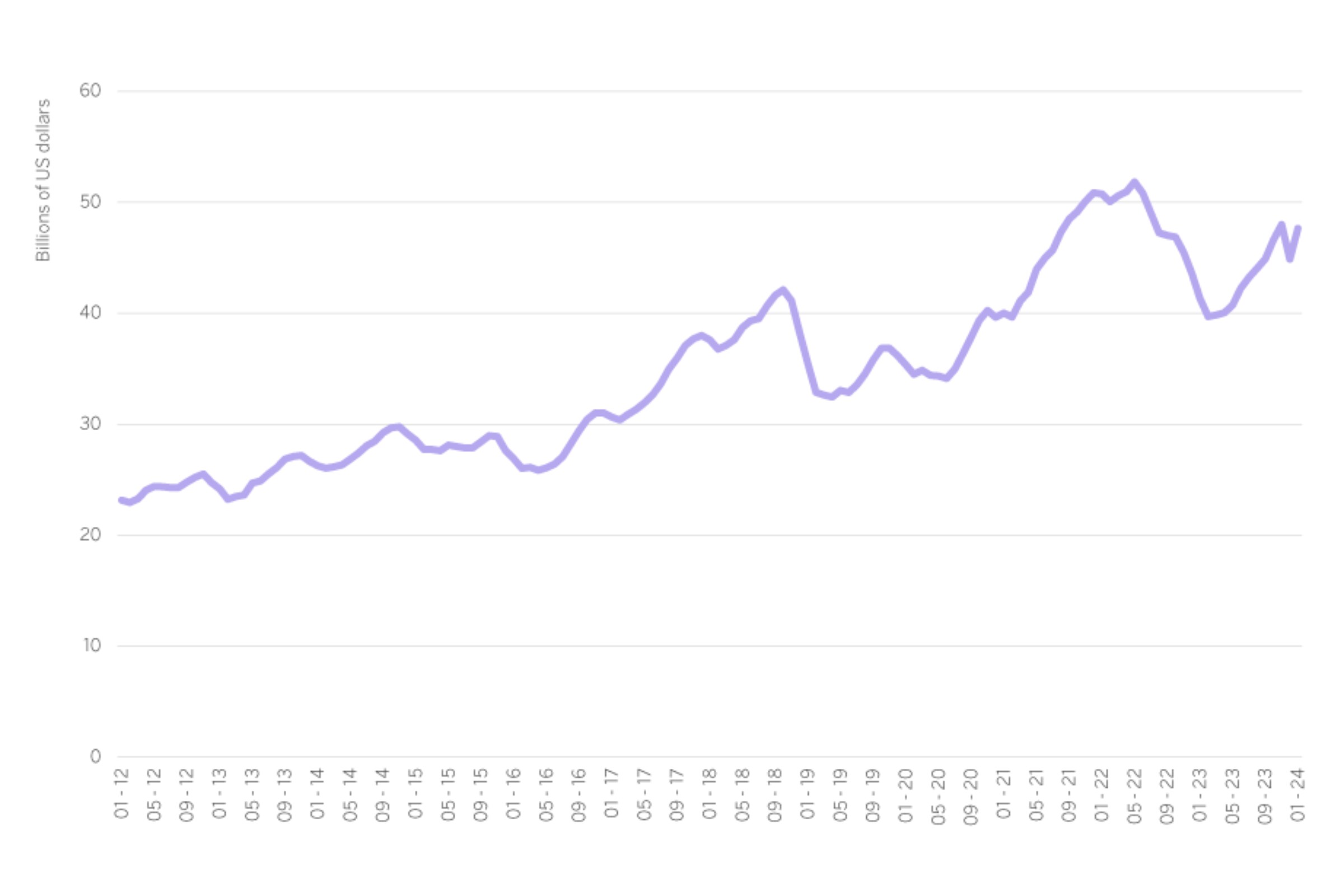

In 2021, according to the consulting company McKinsey, chip sales reached 600 billion dollars. The same analysts anticipate that the growth rate will remain robust, between 6 and 8% annually, potentially resulting in sales reaching one trillion dollars by the end of the decade. Similarly, Statista forecasts the size of the market at $750 billion by 2025 and $1.1 trillion by 2030. In other words, the size of this market would more than double in just ten years.

Of course, these figures would be reflected in the companies and their stock market valuations, according to McKinsey. "Assuming an EBITDA of 25-30%, current stock valuations support average revenue growth of 6-10% through 2030 across the industry, according to our study of 48 listed companies," they note.

This information clearly illustrates the potential growth of the sector in the years ahead. However, not all companies are equally well positioned, nor do all the sub-sectors involved show the same strength.

The fastest growing sectors

An estimated 70 % of the total growth in the sector is expected to be driven by three main areas: automotive, IT and data storage. Thus, servers and data centers would grow from a 100 billion market in 2022 to more than 249 billion in 2030. While automotive sales would grow from 63 billion to 149 billion by the end of the decade.

In fact, trends such as electric and autonomous mobility might not just stimulate demand but could potentially triple it. By 2030, the cost of semiconductors in a Level 4 electric powertrain vehicle, as defined by the Society of Automotive Engineers (SAE), could reach $4,000—up from $500 for a SAE Level 1 internal combustion engine vehicle.

Risks: fragmentation and delay

Nevertheless, the risks of the sector cannot be overlooked. The profit margins of these companies are generally low, and companies must operate continuously (24 hours a day, 7 days a week) to amortize their investment. Furthermore, achieving a competitive yield (the percentage of functional chips per batch) of 80-90% takes years of expertise. It is also a lengthy process, taking up to 26 weeks to manufacture a chip for a consumer.

Currently, the sector is highly fragmented and heavily reliant on the dominant player: TSMC, which commands 54% of the market and is a key supplier for companies like Apple and Nvidia. Perhaps for this reason, many companies have begun to announce major investment plans to develop chips. Intel and Micron have approved $20 billion for the creation of factories in the US, while China - at the public level - is drawing up a $143 billion support package to boost the industry.

The future, our best investment

Capitalize on opportunities in a way that is positive, conscientious and committed, with solutions designed for you by our investment experts in your bank in Switzerland.

Queens of the chip market

When looking at the key players in the industry who stand to benefit from this growth, it is necessary to look to Asia. A significant share of chip manufacturing is concentrated on this continent, with TSMC alone holding 56% of the market share. The second largest giant is Korea's Samsung with 16 % and third place goes to the Taiwanese company UMC with 7 %. The highest-ranking American company is Global Foundries, producing 6% of the global chip supply. Thus, Taiwan alone accounts for 66 %.

However, the semiconductor market is also dominated by other names of particular relevance, such as Nvidia and ASML. Nvidia has witnessed a remarkable stock market surge in the past year due to its chip designs for artificial intelligence—a sector that in itself is projected to surpass $230 billion by 2030. The European company ASML, meanwhile, does not make chips, but it plays a key role in providing players such as TSMC and Samsung with the tools they need to make their products.

The importance of understanding the supply chain

The semiconductor industry is not just about the producers. Instead, we have to understand that it is an industry in which design, assembly and manufacturing are equally fundamental. For instance, TSMC and Samsung are involved in chip production, Nvidia specializes in their design, and ASML creates the essential machinery for chip fabrication. Therefore, comprehending the role of each company and its potential advantages is crucial in this field.

Chart of the global volume of semiconductor turnover from 2012 to 2024, by months