It is the next generation of the web, where user experience and interaction will be more personalized, secure, and democratic. In Web 3.0, the crypto ecosystem is the essential component. Tokens, decentralized finance platforms, NFTs, staking with cryptocurrencies, and startups all open investment doors.

Web 3.0 (or Web3) is the third iteration of the web, this time decentralized and without a central controlling entity. That is the vision for a new Internet structured around cryptographic tokens (cryptocurrencies), a new era aiming to revolutionize the experience within an interconnected network. But what are the investment opportunities in such an environment? Where are the challenges? Is it possible to invest in Web 3.0 while minimizing risk?

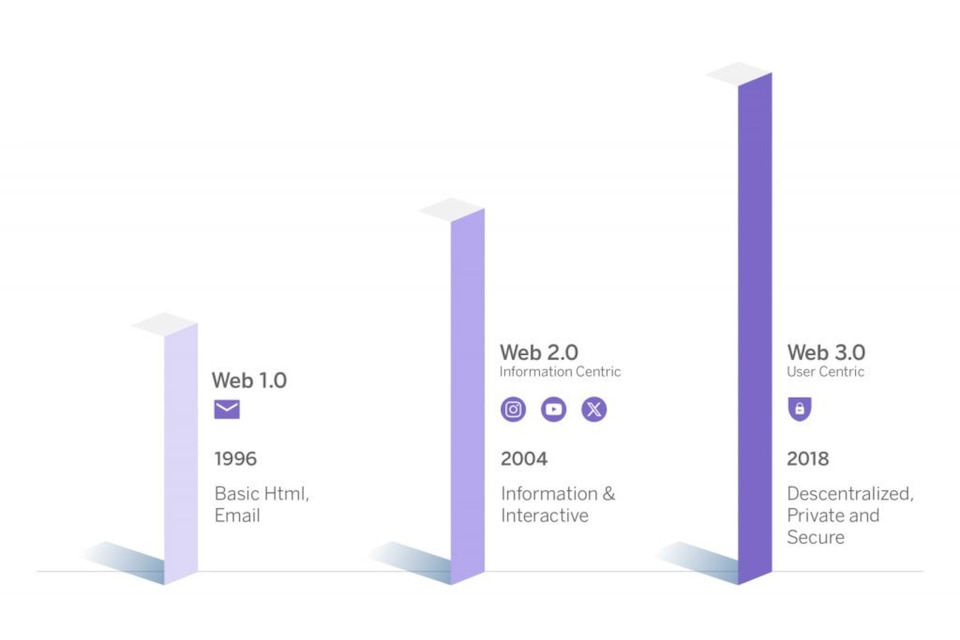

If we look back over the years, since the 1990s we have gone through Web 1.0, which is read-only, without any interaction, as in the case of Wikipedia; we were then met with Web 2.0, interactive with read-write capabilities, hosting blogs and social networks; and now we are approaching Web 3.0, a decentralized read-write-own web. As experts predict, it will be a more secure, reliable, and democratic web, where users can be rewarded for participating.

What is Web 3.0: imagining futures

The term Web 3.0 is a fascinating one because it has two completely different origins, although these are not mutually exclusive. First, there's Tim Berners-Lee's Semantic Web, an augmentation of the WWW (World Wide Web) standards that make internet data machine-readable. This Web 3.0 seeks to return the Internet to what its original designers intended it to be from the very start.

Additionally, there's the version of Web 3.0—conceptualized by libertarian thinkers as web3 or the third phase of the web following Web 2.0—founded on the principles of decentralization, blockchain technology, and a token-based economy. In other words, returning the Internet to the user, and giving that user more autonomy. It is emerging as an alternative to Web 2.0.

As previously mentioned, these two potential futures are not mutually exclusive and, in fact, both are becoming a reality in unison, making the third version of the Internet a fusion of the futures envisioned by both Tim Berners-Lee (father of the web) and Satoshi Nakamoto (creator of the Bitcoin protocol).

What does Web 3.0 have to do with cryptocurrencies?

Decentralized Web 3.0 is based on virtual and tokenized payments as an integral element of the functioning of the web, which is why decentralized finance or DeFi will be a fundamental part of the new web. If Internet users have the power, then their virtual assets will be what they use to express that power, as well as the way in which their contribution to the web is compensated.

Juan Merodio, founder of TEKDI Institute, points out the three key components to this new ecosystem: “Unlike Web2, where platforms and their data are owned by centralized companies, Web3 is based on decentralized networks where there is no single point of control and where it is normally the users that have control and access to all data or digital assets.” This expert highlights three aspects:

- Transparency. All blockchain technology is public and subject to audit.

- Security. Blockchain networks are inherently more secure.

- Inmutability. Blockchain records are permanent and cannot be modified.

Because it is distributed and follows a read-write-own model, Web 3.0 users can earn tokens by contributing to it, either by spending time on websites, helping to maintain them, collaborating with them, supporting their data flow, verifying that everything is running smoothly by validating transactions, reporting bugs, etc. "Blockchain technology facilitates the development of decentralized apps and the transfer and storage of value as tokens", Merodio explains.

Risks of and opportunities for investing in Web 3.0

Using data from 2021 and 2022, dappGambl analyzed figures released by NFT Scan and, in September 2023, unveiled a devastating statistic: 95% of NFT investments are essentially worthless, stemming from a smokescreen and a financial bubble akin to the cryptocurrency situation around 2017 and 2018, prior to any regulation. That is to say that less than 40% of companies make it to five years. What are the risks of investing in cryptographic assets?

The risk associated with cryptocurrencies, explains Felix Fuertes Argüello, CEO of Formación e Inversión, rests on three key factors: the treasury and consistent revenue of the protocol/blockchain, the active user community behind the token; and liquidity available on the exchanges or markets.”

The best of both worlds

Ways of investing in Web 3.0

As Juan Merodio explains, “although it has bad press because of scams that have occurred, that doesn’t mean there aren’t good asset investment opportunities in Web3, such as the following”:

- Tokens and cryptocurrencies. Direct purchase of assets – in a manner not unlike the way securities, currencies or commodities are acquired.

- DeFi Projects. There are platforms that allow transactions such as loans, trading, or secure token contracts.

- NFTs. Non-fungible tokens are unique digital assets that represent ownership of assets. For example, a cooperative social network can be converted into a series of interchangeable NFTs.

- Staking. This is among the most popular crypto investments and consists of locking in a certain amount of cryptocurrency in support of a transaction in the network.

- 'Classic’ investment in startups. Many companies are working to build an operational Web3, and investing in them is a chance to support the ecosystem.