The rate at which the crypto-asset ecosystem is evolving requires regulation to ensure strong, transparent and secure markets. BBVA is the first bank in the eurozone, through its subsidiary in Switzerland, to offer a cryptocurrency custody service.

An interesting fact: as of mid-March 2023, the total market capitalization of the cryptocurrency market reached $1.16 trillion. The growing importance of cryptoassets requires a regulatory framework that increases trust, a regulation that aims to make markets more transparent and secure. And the first steps are being taken in Switzerland.

BBVA, through its subsidiary in Switzerland, became the first bank in the Eurozone to have a cryptocurrency custody service (Bitcoin and Ethereum). The idea first started in 2018, the first tests were done in 2020 and in 2021 the custody service was launched at the same time as the Swiss DLT (Distributed Ledger Technology) regulation, the so-called blockchain law, came into force. How regulated is the crypto market? Why Switzerland? What will the Markets in Crypto-assets (MiCA) regulation bring?

What is crypto-asset custody?

Banking custody is a mechanism through which a bank takes care of storing the customer's securities, whether in euros, shares, funds or, in this case, cryptocurrencies. “BBVA customers in Switzerland have the possibility of keeping their Bitcoin and Ether in their portfolios, in a convenient and secure way”, explains Alfonso Gómez, CEO of BBVA Switzerland. This Bitcoin (BTC) and Ethereum (ETH) custody service allows customers to bank with these assets 24/7, not very different from how they bank with a portfolio in euros and a bank card. “In some Swiss municipalities, such as Lugano or Zug, it is already possible for citizens to pay their taxes in Bitcoin (Lugano and Zug), Tether (Lugano), or Ether (Zug). The city of Lugano even has its own legal tender token, the local cryptocurrency LVGA,” says the bank’s CEO.

Switzerland has been known for years for its crypto regulation, which, although it still needs to be expanded and requires more work, is certainly one of the most advanced. Perhaps this is due, as Gómez points out, to the fact that "its system of government is based on decentralization, without a head of state, just as happens in a blockchain”. Here are some relevant dates to understand the progress of this regulation.

The Wild West of cryptocurrencies

Since 2014, the canton of Zug, a few kilometers away from Zurich, has been known as Crypto Valley, when decentralization advocate Johann Gevers popularized the idea of Mihai Alisie, co-founder of Ethereum. In fact, in 2017 the Crypto Valley Association (CVA), to which BBVA Switzerland belongs, was founded with the aim of “supporting the development of technologies and businesses related to blockchain and the crypto ecosystem”.

That same year, the federal government defined virtual currencies not as currencies, but as a “digital representation of a security that can be traded on the internet”, including them de facto within the concept of assets. This small historical period in Switzerland has frequently been called the 'Wild West' of crypto, but it lasted barely three or four years.

The best of both worlds

All your operational needs in one place. Invest in both traditional and digital assets with the backing and experience of the most secure Swiss banking.

The first Swiss regulations

In 2017, the Swiss Financial Market Supervisory Authority (FINMA) granted the country's first cryptocurrency asset management license; and in 2021 it regulated the Crypto Market Index Fund, the first crypto fund. In 2018, FINMA established three different blockchain tokens based on their purpose and economic function, within its regulation on the Initial Coin Offering (ICO), which is still non-binding:

- Payment tokens are synonymous with cryptocurrencies and have no more functions or links with other development projects. In some cases, tokens can only develop the necessary functionality and become accepted as a means of payment for a period of time.

- Utility tokens are tokens intended to provide digital access to an application or service.

- Asset tokens represent physical assets such as shares in real physical underlying assets, companies or profit streams, or a right to dividends or interest payments. In terms of their economic function, tokens are analogous to shares, bonds or derivatives.

Tough regulation and a solid future

Approved in 2020, but in force since February 1, 2021, the blockchain law - formally, the Federal Law to Developments in Distributed Electronic Register Technology (DLT) - regulates the book-based securities through a blockchain. It highlights the regulation of elements such as tokenization, DLT licensing and collective ownership.

Among other concepts, the blockchain law regulates what happens in the event of bankruptcy of a custodian: crypto-assets must remain constantly available to customers. For crypto custody services, such as the one offered by BBVA Switzerland, this was a turning point. Alfonso Gómez highlights “legal security that allows innovation and growth in this industry” when countries establish standards.

In 2022, the Swiss Financial Stability Board pointed out the need and intention of regulating cryptocurrencies following the pattern of "same activity, same risk, the same regulation" at the heart of BBVA and within the European Commission's Regulation on Markets in Crypto-assets (MiCA).

A changing market with continuous learning

The idea of cryptocurrencies is not new. It was being discussed in academic circles as early as the 1980s, and in 1998 Wei Dai presented the B-money. But it was not until 2009 that Satoshi Nakamoto published a paper on the Bitcoin blockchain network, which formed the foundation for a new economy.

Since then, cryptocurrencies have evolved at cruise speed, with their ups and downs, although if there is one thing the experts agree on, then it is the need to keep up to date. “70% of the staff have been trained and continue to take courses on a frequent basis, as it is a subject that requires constant updating,” says Alfonso Gómez with regard to staff education.

In addition, “we also focus on educating our customers on this topic” because it is important for them to have access to first-hand information and, at the same time, to be able to understand trends and opportunities. “As a bank we have a responsibility to create new investment avenues for our customers,” explains the CEO of BBVA Switzerland.

For example, customers need to understand what tokenization is (a process that allows digital representation of real world assets or objects), the role of Ethereum within the economy, what smart contracts are and how they work, or why Switzerland acts as an innovation hub.

MiCA, the future European framework for crypto regulation

The European Union, through the Commission, proposed in 2020 an amendment to Directive (EU) 2019/1937 to include cryptoasset markets in the EU regulation, which has been creating standards in other related matters (like PSD2). What is the new European framework for crypto regulation?

The aim of the MiCA proposal is to create a regulatory framework that is consistent for cryptoassets between the EU member states, covering non-backed cryptoasset issuers, stablecoins, trading platforms or portfolios where cryptoassets are stored.

Like Switzerland, the European Union seeks to protect investors while preserving financial stability; enabling innovation and promoting the appeal of the crypto-asset sector. Although it will not be approved until 2024, it is expected to set some guidelines and perhaps allow for the consolidation of standards.

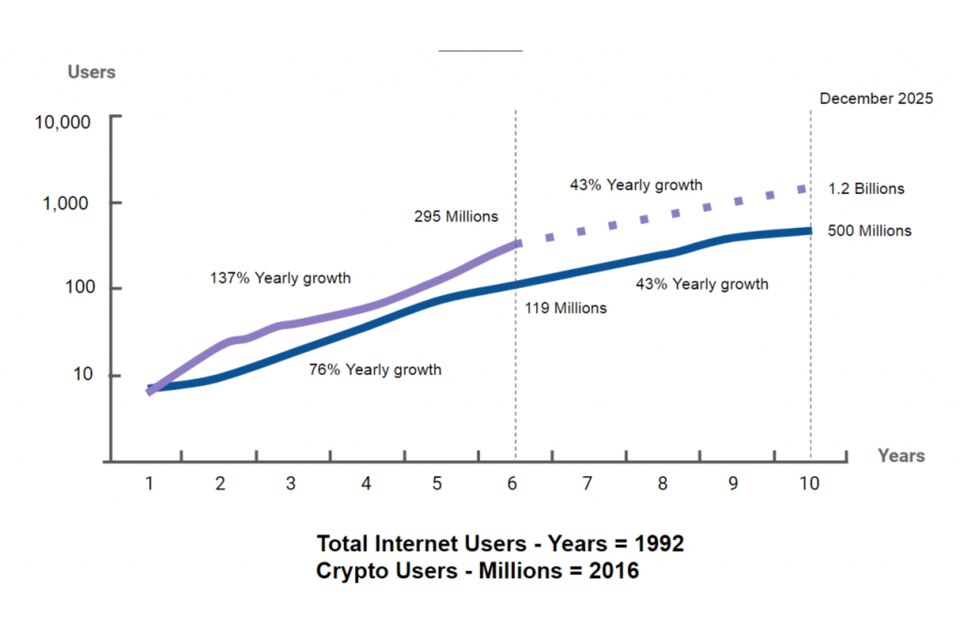

Annual growth of Crypto Users vs. Internet Users

In terms of regulation, user experience, scalability and security, cryptoassets are at a point very similar to the internet in the 1990s, although cryptoassets have exhibited a higher adoption rate.