2023 is drawing to a close and it is time to take stock of the milestones and noteworthy events in the global economy. What has happened this year? How have the markets behaved? Have we now recovered after the pandemic? Just like we know that 2023 was the warmest year on record, we can also draw conclusions on global growth, the economic recovery and inflation. These are some of its highlights.

At BBVA Switzerland, our sights are already set on 2024. With the financial markets more stabilized and inflation more controlled, the objective now is economic growth. The appreciation of the euro and Swiss franc, the regulation of crypto-assets and the gradual decline of some raw materials are a few key points.

Return to pre-COVID levels

If we had to name one event to summarize what happened financially on a global scale, we would probably mention how financial markets have stabilized and how we are going back to an economic environment that is similar to pre-Covid levels.

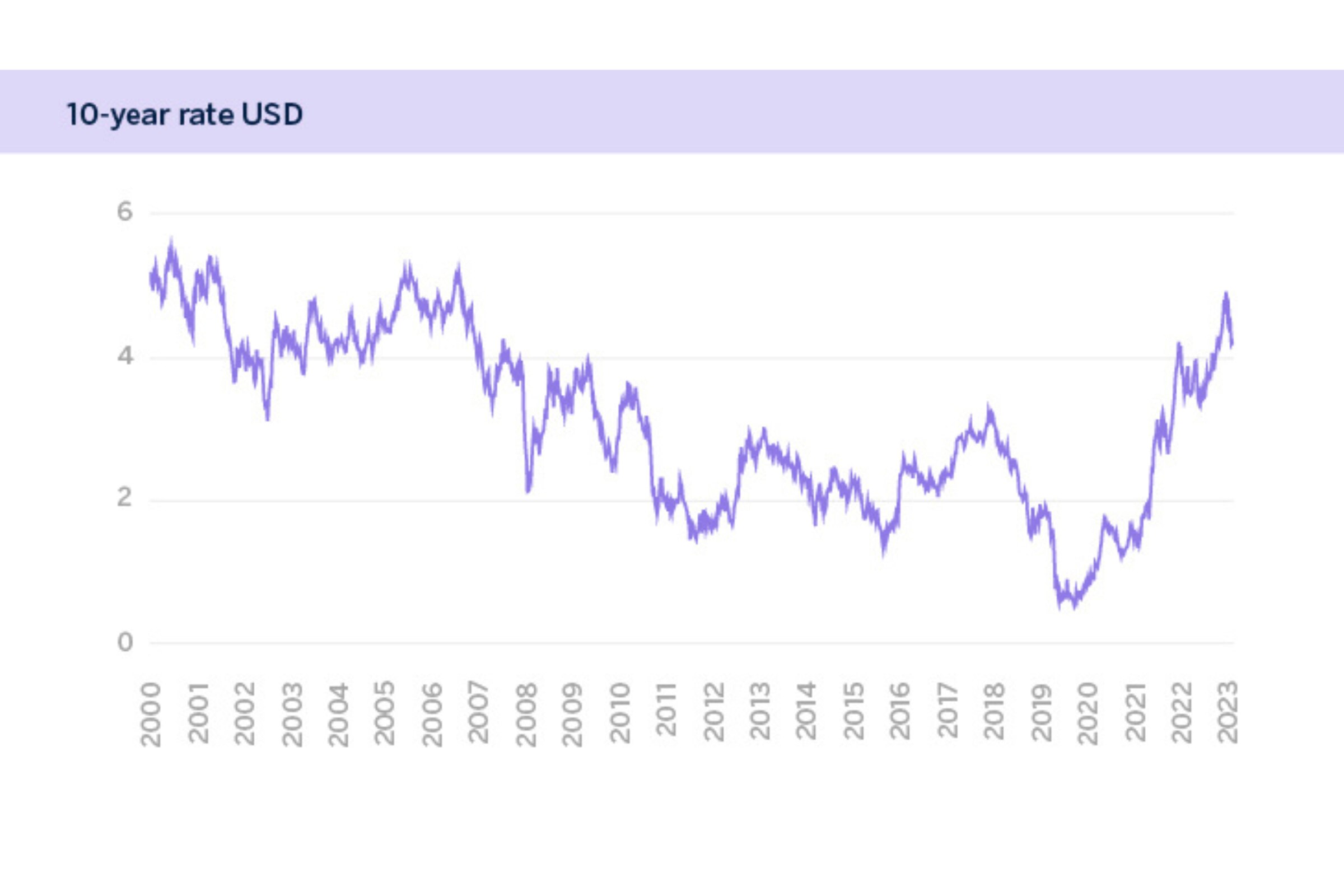

For their part, the central banks have had success controlling inflation, which has fallen at the same speed at which it rose, although the effects on the economy of far higher rates than in the pre-COVID period are yet to be seen.

- Fixed income, a year of high volatility

Since the pandemic, fixed-income markets, which suffered so much in 2022, have shown a more positive and stable performance in every geographic area.

In fact, these assets, and most notably sovereign funds, are one of the assets that have best adapted to different environments. The latest statements from the main central banks point to a pause in monetary policies, which coincides with the evolution of the main economic indicators.

- Equities, on the road to recovery

Equity markets have recovered part of the ground lost during last year, led by companies with the largest capitalization, positioning themselves at around 10 % from the December 2021 highs.

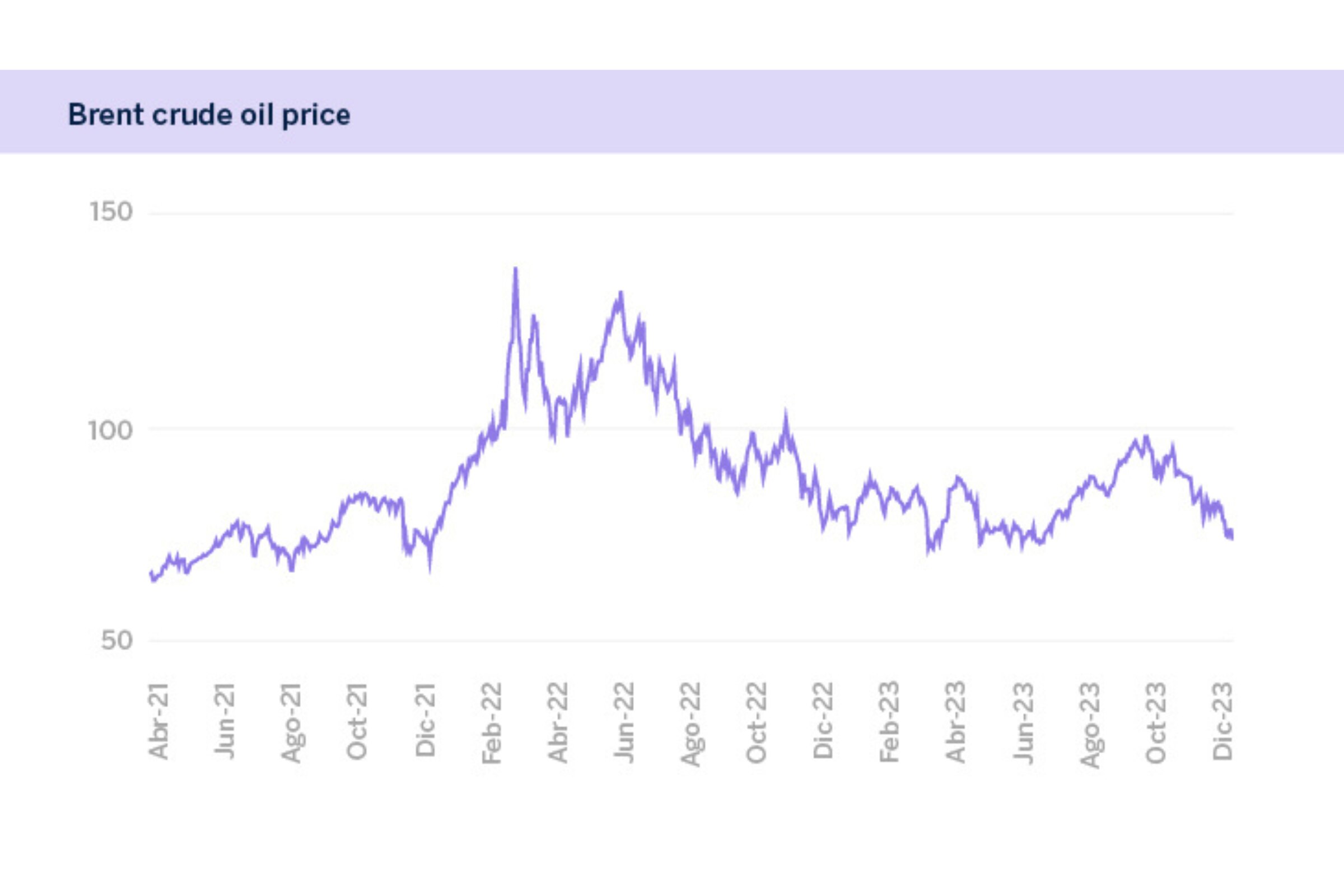

- Commodities, more accessible

Even the commodities markets have exhibited a stable downward trend in most cases. The price of a barrel of Brent Crude is around 82 USD, which represents a decrease of 40% from its record levels and 10% from the pre-Ukraine war levels.

Gold has behaved differently, rising around 10% in value during 2023, closing the year 2% below the maximum highs of 2,080 USD per ounce.

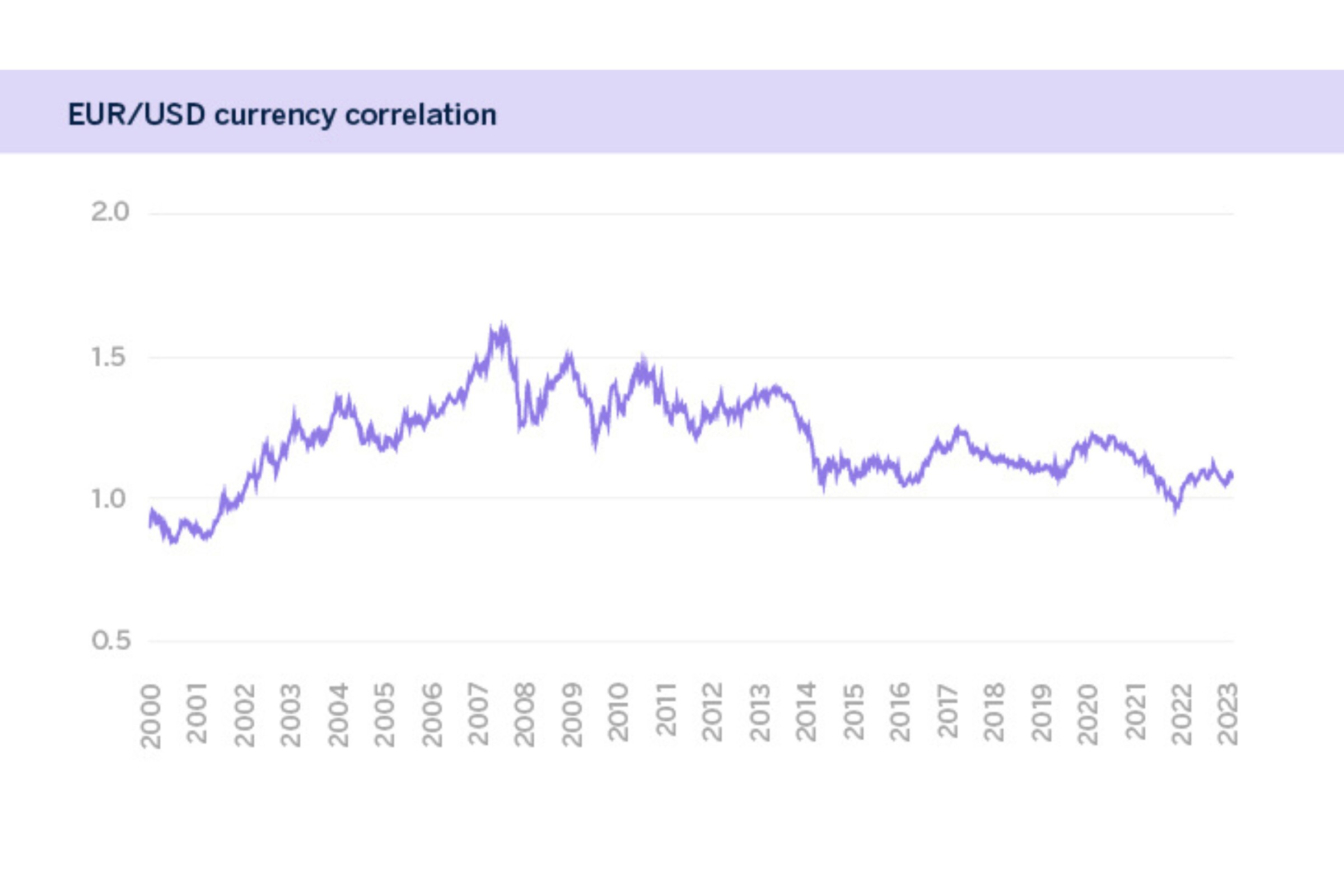

- Currencies, stability with slight changes

During this year, the foreign exchange market was characterized by a slight appreciation of the euro and the Swiss franc against the American dollar (USD), as well as the significant strength of the Mexican peso, with no sharp variations in the different ratios.

- Crypto-assets, no longer the Wild West