Obesity is a disease that affects 500 million people; the fifth leading cause of mortality in the world. A huge problem that governments, institutions and private companies are looking for solutions to. While the benefits of these efforts will materialize in the medium to long term, the battle against obesity engages numerous sectors of society.

Obesity may be on borrowed time —years, to be more precise. This encouraging news finds its roots in the field of medicine. To grasp this and to substantiate such an optimistic outlook, one must consider the work of various European and American pharmaceutical companies. These firms are developing drugs that have shown promise as powerful tools in the fight against obesity. According to the World Health Organization (WHO), this health condition had already affected 650 million adults and 340 million children globally by 2016. These figures underscore a sobering reality: the prevalence of overweight or obese individuals has tripled since 1975.

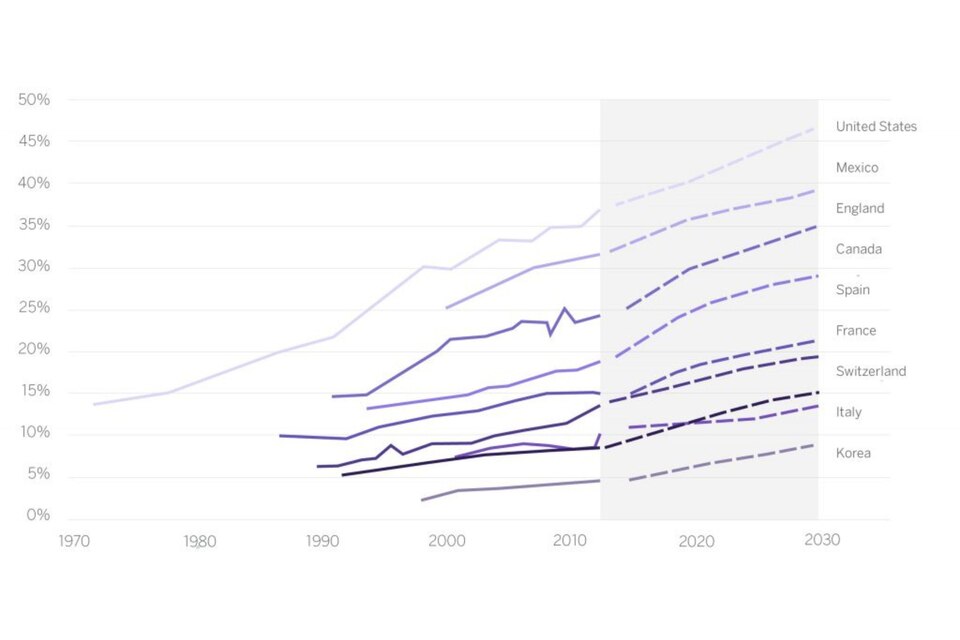

However, if the exponential increase of the past 35 years is alarming, the forecast for the future is potentially even more concerning. The World Obesity Federation's 2023 Atlas predicts that within the next twelve years, an estimated 51% of the global population – over 4 billion individuals – will either be overweight or suffer from obesity. Currently, the U.S. U.S., has a strikingly high proportion of nearly 40% of its population afflicted by this condition, which is the highest rate worldwide. Following close behind are China, Brazil, India, and Mexico. Interestingly, Germany stands as the only European country among the top ten nations with the highest obesity rates.

Discussing obesity means addressing not only health but also economic concerns. This condition has a significant financial impact on the economies of various countries. In the United States U.S., alone, the direct costs amount to $149 billion. Should this trend persist globally, the annual global economic impact could reach approximately $4 trillion, equating to 3% of global GDP. These figures, reported by the World Obesity Observatory, are compelling governments to implement a variety of measures, including fiscal policies and nutritional regulations, to discourage the consumption of products that are detrimental to health.

Weight loss medications: a light at the end of the tunnel?

Over the past five years, medical advancements in the battle against obesity have emerged, thanks to the development of several drugs shown to reduce patients' body volume by 20%, as confirmed by the Hospital Clínic de Barcelona. These breakthroughs have piqued investor interest due to the apparent effectiveness of these medications and the potential financial commitment they could command from health systems worldwide. This is exemplified by the stock market performance of two companies, Novo Nordisk and Eli Lilly The former has become the largest in Europe with a stock market valuation exceeding $446 billion. Meanwhile, the latter's value has surged 80% in just twelve months.

Currently, the FDA U.S., (U.S. Food and Drug Administration) has approved five medications for the treatment of obesity. However, the side effects of some can render them unsuitable for all patient types. Additionally, while these drugs have proven somewhat effective, they may be supplanted by future alternatives that are both more effective and less harmful.

Presently, research is focused on developing a new drug that aligns with intestinal hormones, targets the specific genes that elevate obesity risk, promotes loss of fat over muscle mass, and ultimately alters the gut's own bacteria.

Thus, the fight against obesity must be seen as a future trend in which various actors can intervene.

50 years growing at your side

Fitness industry

In line with this investment trend in solutions for obesity, health concerns have also risen. The market encompassing health, wellness, and fitness sectors grew by 30% between 2009 and 2019, from $67 billion to $96.7 billion a decade later. Forecasts indicate that this upward trajectory is expected to persist and escalate in the years to come. For instance, the fitness industry’s projected compound annual growth rate between 2021 and 2026 stands at 7.21%.

This market includes companies involved in sports nutrition, those manufacturing sports equipment, and gym chains. Specifically, the whey protein market scaled to $13.5 billion in 2020, up from $9.2 billion in 2015. Companies producing sports equipment approached a revenue of nearly $9 billion in 2022, while gym chains are still on the mend from the impact suffered during the pandemic.

Millennials, the generation of change

Millennials appear to be the most health-conscious and concerned: 79% of this generation in the USA U.S., prioritize health as the second most important aspect of their lives, just after family. They represent the highest percentage of users of gyms and sports clubs, with a 35% participation rate, in the US. U.S., Generation X and baby boomers follow as the age groups that also regularly frequent gyms and health clubs, with attendance rates of 22% and 21%, respectively.

Expected obesity rates until 2030