The leading company in cryptocurrency mining now boasts a market capitalization exceeding $5 billion, surpassing that of many companies in the traditional materials mining sector. But Wait. How is making that much money out of a virtual coin that only exists within our phones and computers even possible? And how do you mine something that does not physically exist? To tackle these questions and to grasp how value is generated within the world of cryptocurrencies, an exploration into the fundamental principles of Bitcoin mining is essential.

What is Bitcoin mining?

Humans have mined the earth for resources almost since the dawn of civilization, extracting materials such as gold, iron, and copper. Similarly, we generate Bitcoins, though through an entirely different process.

Bitcoin (BTC) mining is a digital process that validates transactions and prevents double-spending by adding new Bitcoins to the network. It involves thousands of computers solving complex mathematical problems by using sophisticated hardware and software to verify and make transactions immutable in the Bitcoin blockchain, a virtual ledger in which every operation is stored.

New Bitcoins are minted as a reward for completing these verifications. The BTC mining protocol is highly energy-intensive. Given that energy cannot be replicated, it powers the algorithm that secures the transactions. To reverse a transaction, an entity would need to control at least 51% of the network's total computational power.

50 years growing at your side

Our team of high-net-worth experts offers its extensive experience in advising and designing sophisticated strategies tailored to your needs and values.

How does Bitcoin mining work?

Mining is an essential part of the BTC ecosystem. It involves working with the Bitcoin blockchain, the decentralized structure that has been key to the success of this cryptocurrency. Through mining, transactions are recorded, making them immutable, and at the same time, new Bitcoins are generated. Miners validate the transactions and maintain the blockchain, guaranteeing their integrity and chronological order.

The process works as follows: Miners put their computing power to work on the Bitcoin network. They perform calculations in order to be the first to guess a 64-digit hexadecimal number known as a nonce. The miner who successfully finds this number is rewarded with newly minted Bitcoins and transaction fees.

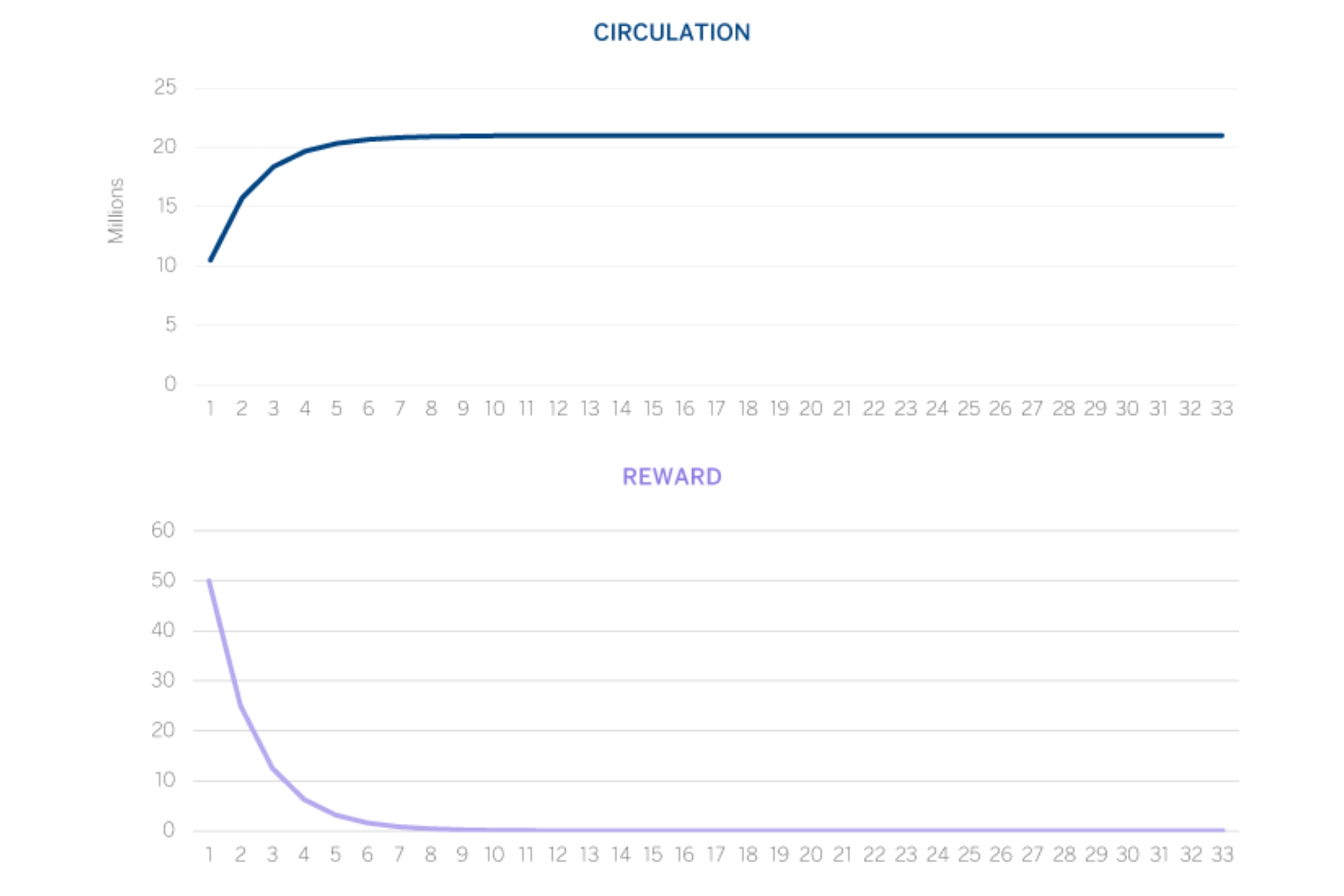

The mining difficulty adjustment algorithm regulates the complexity of the mining process for a given block. Since by design there will be a maximum of 21 million Bitcoins in circulation, and as the number of miners has increased over the years, this algorithm has been increasing the mining difficulty.

What reward do miners receive?

To keep up with the increasing difficulty of Bitcoin mining, miners need to acquire expensive, advanced computing equipment, such as application-specific integrated circuits (ASICs). ASICs can cost tens of thousands of dollars, and miners also have to bear the cost of the electricity consumed.

However, this financial investment is rewarded. Each time miners solve a block, they are rewarded through two components: a payment in newly minted Bitcoin and the transaction fees paid by users for the work of including their transactions in the block.

Bitcoin payments have been declining over the years. Mining a block in 2009 earned the miner 50 BTC. In 2012, the block reward was halved to 25 BTC, four years later to 12.5 BTC, and in 2020 to 6.25 BTC. The reward will undergo a halving again in April 2024, decreasing to 3.125 BTC. This is mainly due to the fact that, by design, BTC is limited to 21 million, in contrast to the infinite printing of traditional fiat currencies. Therefore, new coins cannot always be introduced at the same rate.

BTC in circulation in 2009