Neither growth has stopped, nor does it show any signs of slowing down. The transition to a cashless society and the growing role of payments as more than just an exchange of value, is creating a unique opportunity in the ecommerce and financial services sector. Becoming a cornerstone of the global economy, payments can serve as a catalyst for economic growth, innovation and inclusion.

However, the shift towards a zero-cash society entails an even bigger and deeper change. This transformation not only affects traditional payment systems, but is also remodelling its entire infrastructure, leading to new business models. Instant payments, credit card or digital wallets are constantly evolving, while a wide range of options continue to emerge that are revolutionizing the ecosystem with huge structural changes (services such as “buy now, pay later”, the metaverse or the emergence of cryptocurrencies and digital currencies). Both the evolution and the revolution are spreading around the world, but in different ways and at different paces, creating a complex payments matrix. How the industry responds to these trends will define its success in the coming years and its impact on society globally.

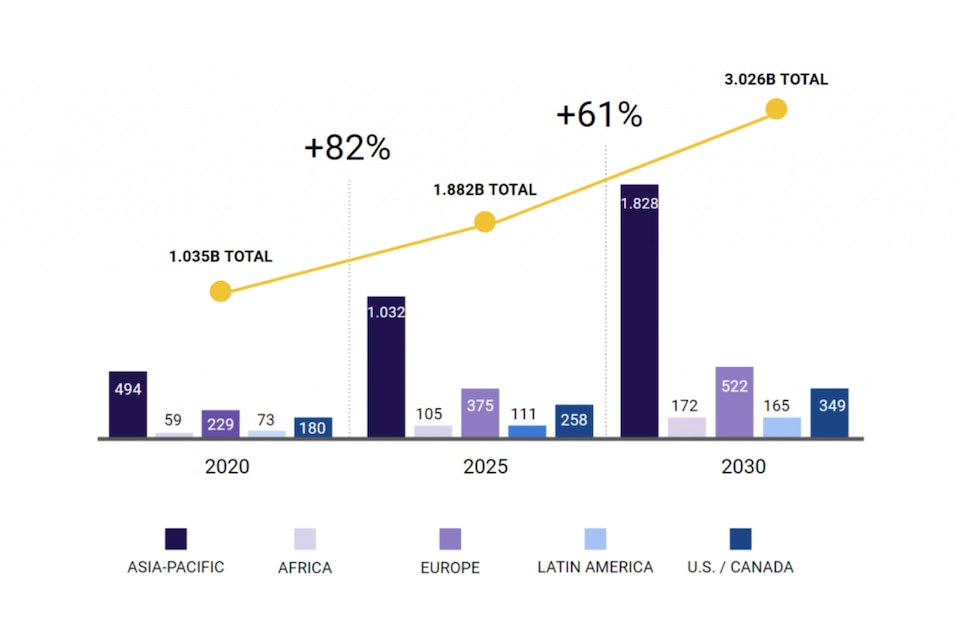

Online transactions are set to double by 2030 (billions)

At New Gen, we have spotted four macro trends – driven by a combination of consumer preferences, technology, regulation and mergers and acquisitions – that will shape business development over the next five years.

- Digital wallets and superapps: Unsurprisingly, the use of mobile payments will continue its inexorable rise (CAGR between 2019 and 2024 is estimated at 23%). Digital wallets will account for more than half of all commerce payments globally by 2024, as consumers shift from bank card transactions to account-based and QR code operations. In response, many banks and financial services companies are relying on technology providers and large-scale payment platforms.

- Digital money: Digital currencies have become too big to be ignored. 60% of central banks are exploring the use of digital currencies and 14% are already conducting pilot tests. Decentralized finance and cryptocurrencies are more than a reality and we will increasingly witness their involvement in payment companies with emerging opportunities.

- Metaverse : According to the World Economic Forum, the metaverse will change the way we buy products in retail and, instead of reducing physical sales, it will bridge the gap between physical and digital. The metaverse is at an early stage, but it has the potential to unleash the next digital disruption. According to the latest McKinsey report, it is estimated to be worth 5 trillion dollars by 2030, equivalent to the size of the world’s third largest economy, Japan.

- Cybersecurity: The average volume of attempted fraudulent purchases increased by almost 70% in 2020 compared to the previous year. All these changes entail a number of factors that cannot be overlooked. Security risks, compliance, data privacy and other related issues are the main concern for banks, fintechs and businesses irrespective of their sector when it comes to implementing fully integrated technology solutions to establish cybersecurity measures and consumer protection. This is an absolute must.

As investors, we need to understand each of them for a far-off future. We have included related stocks, funds and ETFs in our portfolio to facilitate the process of investing in these areas.

The best of both worlds

All your operational needs in one place. Invest in both traditional and digital assets with the backing and experience of the most secure Swiss banking.