An increasing number of investment funds are focusing on the business of healthy nutrition, veganism, and other plant-based trends. The change in eating habits in a context of climate change is encouraging a sector that in 2030 will generate more than 150 billion euros.

Eating has evolved from a mere necessity to a declaration of principles. An increasing number of consumers are advocating for mindful nutrition and choosing not only how to eat but, more importantly, what not to eat. Projections indicate that by 2050, the global population will reach 10 billion, with 3 billion entering the middle class by 2030, which is expected to boost food demand by 60%, according to industry figures. This is in addition to the United Nations' major challenge: achieving zero hunger and ensuring food security.

This trend has not gone unnoticed by investors, who for some time now have been moving towards companies that will benefit from the evolution of consumer preferences in terms of nutrition and diet, for example, towards veganism or the consumption of proteins for athletes.

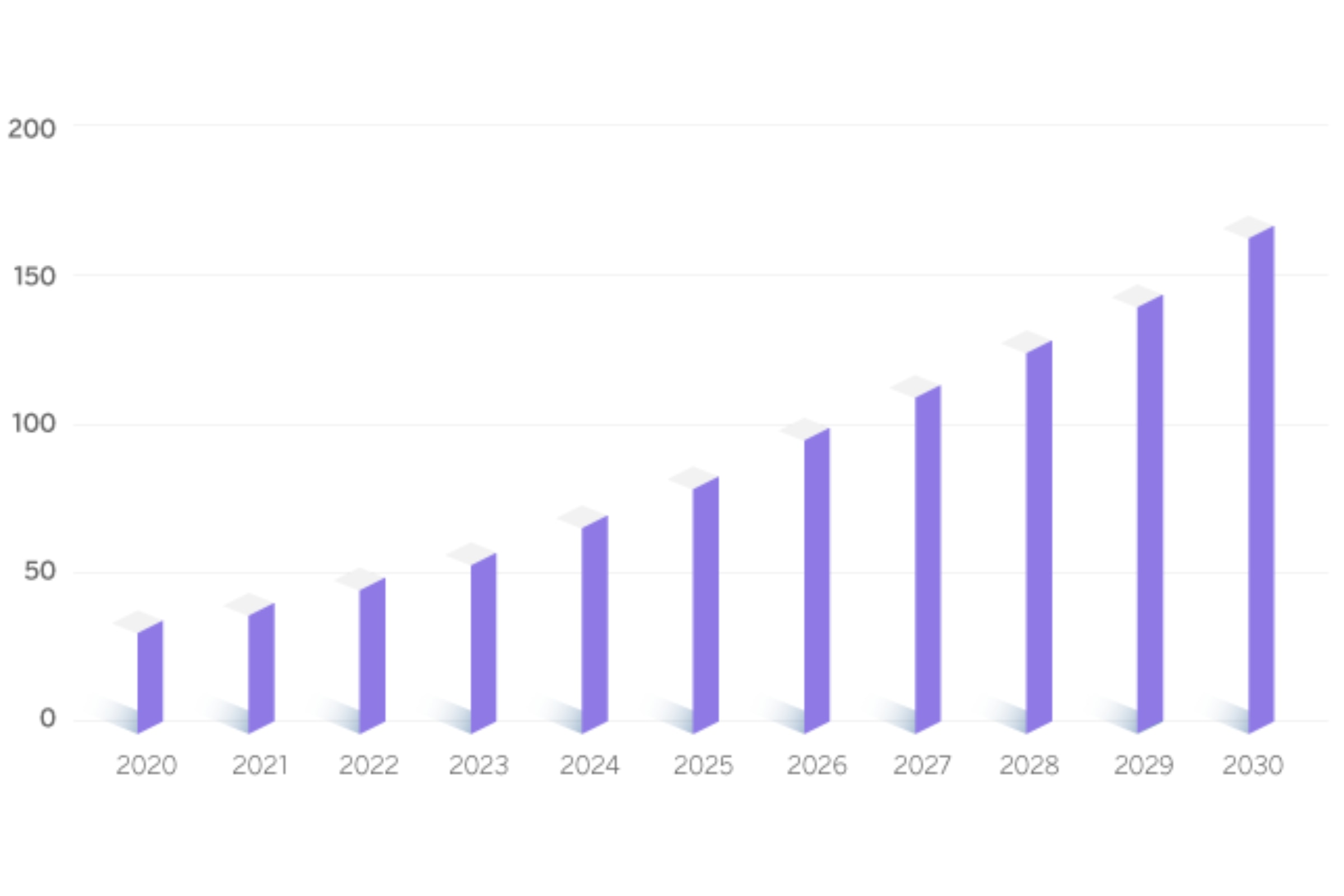

Some estimates indicate that there are currently 600 million self-identified vegans worldwide, with countries like India where 35% of the population exclusively consumes plant-based products, and Israel, where the figure has reached 13%. In fact, the financial advisory firm Bloomberg projects in a report that over the next decade, sales in the vegan product market - known as the plant-based sector - will increase fivefold. By 2030, businesses and companies focused on veganism are expected to surge from generating €27 billion in 2020 to €150 billion, marking a 250% increase.

If we want to invest to benefit from that trend while helping the planet, we can do so in several ways:

- The stock market. One straightforward approach is to purchase stock in companies specializing in specific food segments. The range of choices is broad; not only are there firms wholly devoted to these dietary movements, but major industry players have also introduced their own lines of vegan and sports nutrition products, and are increasingly focusing on vegetable-based and alternative protein ranges.

Moreover, the scope of these products extends well beyond food. For instance, vegan cosmetics are gaining popularity, and the textile industry is moving toward eliminating leather and embracing plant-based fibers.

- Unlisted companies. Investing in unlisted companies through venture capital or alternative investment vehicles is another option that can offer exposure to private businesses. This is worth considering, particularly because many companies in the sector are very small and may not be listed on the stock exchange due to their size or because they are in the initial stages of development.

- Investment funds. Investment funds are also appealing due to the professional management they offer. Management teams are tasked with identifying the most promising companies and determining the optimal times for investment and divestiture.

Value of the global plant-based food market from 2020 to 2030,(in billions of US dollars).

The best of both worlds

All your operational needs in one place. Invest in both traditional and digital assets with the backing and experience of the most secure Swiss banking.

In fact, many large international fund managers include thematic funds with a focus on food within their array of products. Moreover, these funds frequently integrate ESG (Environmental, Social, and Governance) criteria into their asset selection process, considering factors related to social wellbeing and planetary sustainability. It is important to remember that as the world's population grows and prosperity increases, the impacts on climate change and resource scarcity intensify.

- Commodities. Another avenue, which necessitates financial expertise or professional advice, is trading in the agricultural commodities fundamental to vegan and plant-based diets. The strategy is to capitalize on the dynamic whereby decreasing meat consumption corresponds with rising demand for plant-based products, thus likely boosting the need for staple crops.

The preferred approach for taking a position is through an ETF (Exchange-Traded Fund), which tracks indices associated with the target sector in the investment portfolio.