From branches to algorithms and new financial products. From traditional banking to personalized experiences… New technologies such as artificial intelligence and process digitalization have revolutionized the banking sector. We’re combining Internet Day and AI Day to analyze this evolution.

Analyzing large volumes of data in real time to detect risks, automating customer service processes, offering personalized solutions, strengthening cybersecurity, promoting financial inclusion, launching new products… The list of opportunities that digitalization and the use of artificial intelligence bring to banking is extensive.

If we translate it into numbers, it’s no small feat. Global spending on digitalization by the banking sector will reach one trillion dollars within three years, in 2028. This figure will be driven by a compound annual growth rate (CAGR) of 9.3%, according to a report by Gartner. These numbers highlight the enormous importance the entire financial industry is placing on this major technological transformation.

While the internet has brought about a major revolution in the world—including in banking—the arrival and implementation of Artificial Intelligence (AI) is a new catalyst. Digitalization has made financial services more dynamic, accessible, and user-friendly. Now, AI promises to bring significant improvements in security, customer service, personalization, engagement, and expanded financial and investment services.

Coinciding with Internet Day (May 16) and AI Day (May 17), we take a closer look at the revolution the banking sector could undergo in coming years—and how AI is poised to become (it almost already is) a powerful new source of innovation.

An inside look at digitalization in banking

While we've already noted the financial effort made by the banking sector to drive the digital transformation, it’s also worth focusing on how it has been received by society. After all, if demand and usefulness weren’t growing, the commitment to digitalization wouldn’t be either.

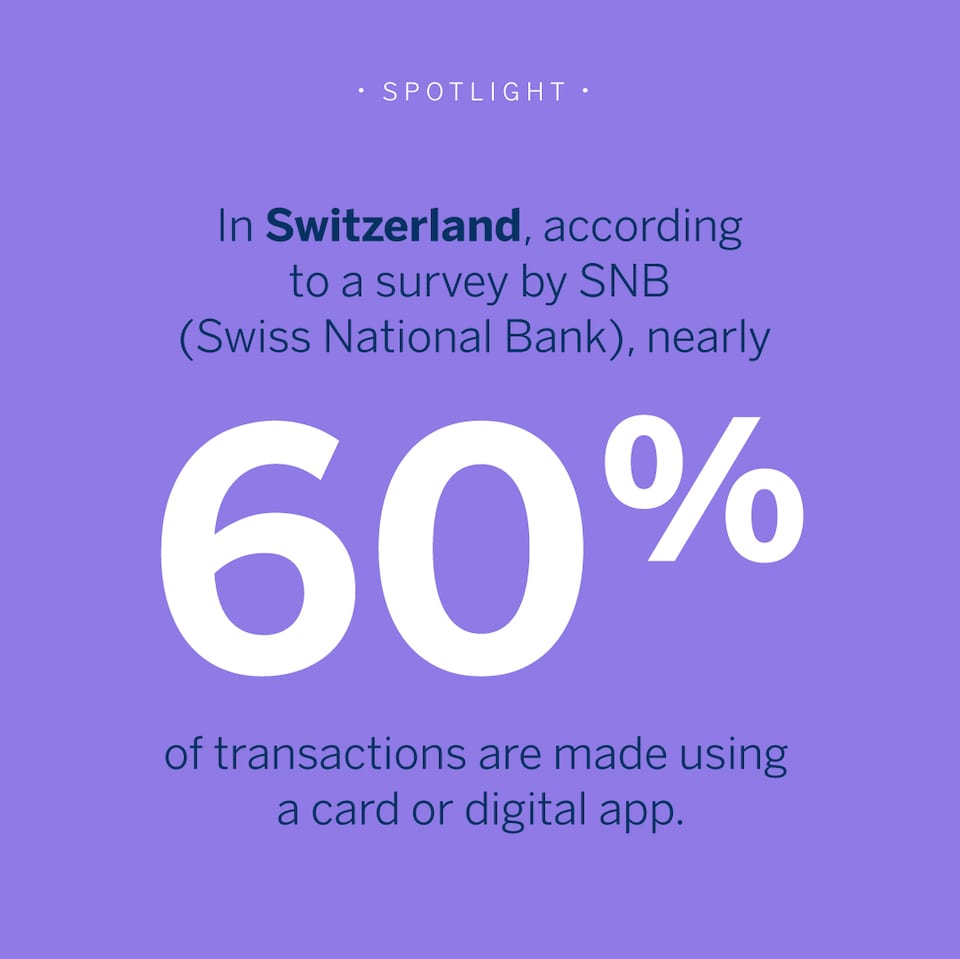

Since the pandemic, when in-person activity came to a near halt, the use of digital banking has surged. In the European Union, an average of 60% of the population uses digital services. In Spain alone, usage jumped from 30% before 2020 to 70% of the population after the pandemic. In some Nordic countries, that figure exceeds 90%. In Switzerland, according to a survey by SNB (Swiss National Bank), nearly 60% of transactions are made using a card or digital app. All of this is detailed in the report Digitalization as the Axis of Banking Transformation by the Funcas-KPMG Financial Digitalization Observatory.

We are starting to see that this growth is becoming unstoppable. By 2027, according to the same study, in Spain alone the sector will reach 85%, adding another six million digital customers. However, perhaps the most striking fact is that in the coming years, digital contracting of financial products is expected to reach 75%. In other words, three out of every four transactions will be digital.

And along comes AI...

"It is estimated that the use of artificial intelligence in the banking sector will have an annual impact of between 200 billion and 340 billion dollars (equivalent to 9-15% of operating revenue), largely due to increased productivity," according to consulting firm McKinsey.

While the economic impact is high and seemingly positive, so are the benefits. According to Funcas, this technology will improve the accuracy of banking risk models, optimize portfolio management, and enhance fraud detection. This is on the management side.

For the user, AI can become an ally in the banking sector, as it will be a technology that makes banking more personal with more “humanized” virtual assistants that can better respond to customer demands.

There are also some objections. This is what the International Monetary Fund mentions: "The adoption of the latest versions of artificial intelligence (AI) by financial markets can improve risk management and expand liquidity; but it could also generate opacity in the markets, make supervision more difficult, and increase vulnerability to cyberattacks and manipulation risks."

It seems that there are two sides to the same coin. AI and digitalization can improve banking management processes for both institutions and customers, but they can also create some distortion in the capital markets.

The digitization of banking

Main transformations of AI in the banking sector

The first major change observed by AI experts is in the way customers interact with the bank itself. "Part of the processes developed in customer service departments will be automated, providing greater convenience and agility for customers when interacting with their bank," explains a report from the Spanish Banking Association.

In addition to improving the user experience, AI also helps enhance the role of the robo-advisor, an online service that acts as an investment portfolio advisor and manager. So far, robo-advisors have become a popular, affordable, and emotion-free tool for analyzing investment opportunities. With the arrival of artificial intelligence, this existing role could undergo updates to resemble a sort of automated financial advisor. However, the major risk remains the depersonalization of the service, which could hinder its ability to provide the closeness and reassurance that investors need. A short-term solution could involve a hybrid system that integrates traditional advisors with robo-advisors.

Among many other impacts and improvements, artificial intelligence will also help banks establish faster and more optimized profiles when granting loans to assist in risk management. "The ability to access more information about a credit applicant and process data that technology previously couldn't handle can improve the process of creating the applicant’s credit profile and generate more accurate information about the risks of a transaction," according to AEB.

Finally, the challenges and risks of implementing these new management models in banking are being studied by both the European Commission and various international organizations to ensure that their development and expansion do not pose future risks.