Beyond Crypto Winter, the adoption and long-term overview for digital assets has only expanded lately, as well as the list of investors participating in this space.

The popularity that Blockchain technology has achieved, playing a significant role in the global economic and geopolitical game, has made the entire cryptocurrency universe too big to be ignored. As long as institutional investors join the Blockchain ecosystem, the confluence between the traditional financial system and this new emerging digital economy is starting to become more sensible than ever.

Currently, there are several solutions on the market for the storage or custody of cryptocurrencies based on the degree of security and convenience required to manage a portfolio, known as Cold, Hot and Warm wallet. As a result, it is proliferating a wide range of products and services provided by fintechs, exchangers and major banks, such as BBVA Switzerland, which are established as trusted intermediaries in the custody of digital assets. Certainly, institutional investment in digital assets is strongly accelerating the adoption and regulation of the industry worldwide.

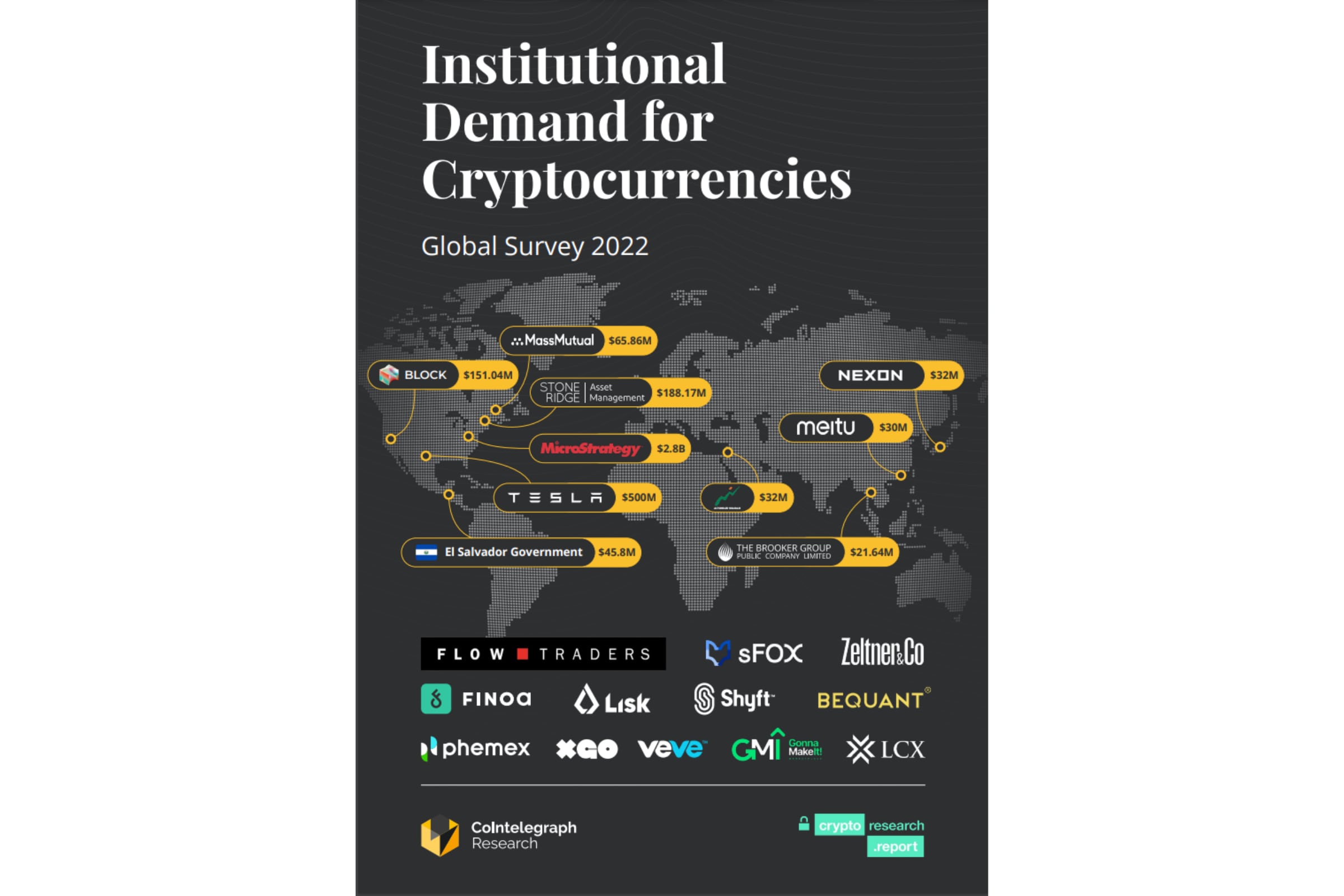

Cointelegraph Research‘s latest report, Institutional Demand for Cryptocurrencies Global Survey 2022, in which BBVA Switzerland has participated as one of the pioneering financial institutions offering custody and trading of cryptoassets, seeks to respond these inquiries to gain a deeper understanding of how institutional investors are accessing the crypto market and what infrastructure they demand. The survey, which collects 32 questions answered by 84 institutional investors distributed in Asia, the United States and Europe, has revealed that 43% have exposure to digital assets and 19% plan to buy them in the future. On the other hand, Switzerland is the leading jurisdiction in terms of value of investment in digital assets.

The best of both worlds

All your operational needs in one place. Invest in both traditional and digital assets with the backing and experience of the most secure Swiss banking.