The cryptocurrency market is beset by sharp and sudden changes. It makes sense that the more people who are interested in them, the more the price will rise. And vice versa. But it’s not that simple: reputation, trust, use and capacity to adapt also count.

For fiat money —regulated by the central banks— one of its strengths derives from the trust that society places in regulatory mechanisms like central banks. But for decentralized cryptoassets, such as Bitcoin (BTC), there are other ways of delivering perceived value. We analyze some of these factors below:

Scarcity and supply & demand.

When an asset is scarce and in demand, its value is perceived as higher. This is the classic example of precious metals such as gold, considered a 'safe haven' asset. Direct competition also has an influence.

Bitcoin is a scarce asset by definition, given that there will be a maximum of 21 million divisible tokens in circulation. There are currently more than 19 million in circulation. Looking to the future, scarcity is undoubtedly one of its strengths. As with any other type of asset, its price will drop or rise depending on demand.

In the cryptocurrency market, more alternative coins have emerged (altcoins), leading to a shift in investment. This competition can also influence price suppression.

The reputation of the asset to be valued.

All assets have a certain reputation associated with their social perception. For example, the “barrel of oil” asset is influenced by knowledge of the climate crisis. In cryptocurrencies, use of the asset usually creates that reputation.

Bitcoin has gone through different reputational phases, from a worthless asset to a quick buck. Focus then shifted to the impact of its technology and, now it is in the process of being regulated, it seems that it will move towards stability.

The effects of cryptoasset networks. Metcalfe's Law states that large networks have more value than small ones, and with cryptoassets supported by blockchain technology, this method of asset valuation works very well. The two factors that follow are closely related to this.

Almost everyone holding cryptocurrencies owns BTC, which in turn is one of the highest volume networks. According to mathematical models by Chun Wei and You, their expected value is high.

Adaptability of the token and use in decentralized applications.

The more versatile an asset, the more it is worth. This can clearly be seen in the use of decentralized applications in the Ethereum network, in which the token is used for a multitude of environments.

Unlike ETH, Bitcoin is not highly adaptable, and no applications are built on its network. At this point, the relative value of ETH is somewhat lower.

- People holding this token.

Similarly, the more people use an asset, the more stable it is. In part, because there are more exchanges, and according to the classic quantity theory of money, faster movement means more value. But also because there is a certain shared social value that provides stability, which Yuval Noah Harari calls “shared fiction”.

Bitcoin is undoubtedly the most commonly held coin and the most widely-accepted for payment. Plus, its market value is more than twice as high as Ethereum (ETH), the next most common coin.

Investing is more than money

Take part in the most innovative investment trends that matter to you most with your digital account in Switzerland, from 10 thousand dollars, francs or euros.

Can we compare it with the digital economy?

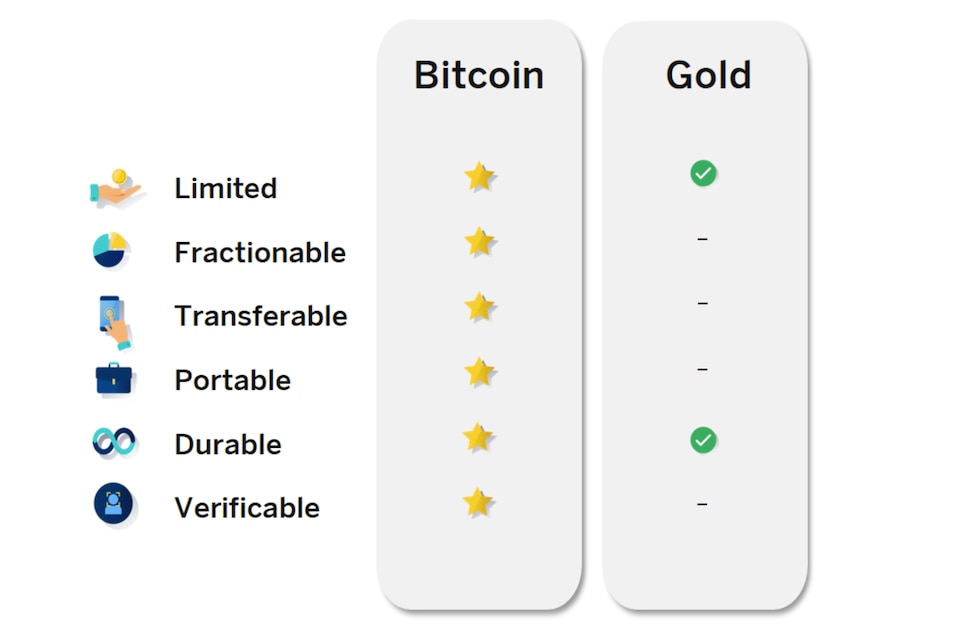

When the world made the leap from the analog economy to digital, a huge amount of value was created that previously did not exist. The value emerged from a systemic change at all levels. Can blockchain networks support new growth, like digitalization already does? It is undoubtedly a possibility. Bitcoin has a series of unique and very interesting properties to become a future global value reserve, with properties similar to gold, but better:

- To start with, cryptocurrency offers an alternative based on the digital economy, where the value is created and transferred directly, without intermediaries or restrictions.

- Bitcoin is also divisible, portable and fungible, making it an efficient and universal means of exchange.

- Finally, and probably most importantly, the global bitcoin reserve will always have a token limit (21 million units).