Actively managed ETFs (exchange-traded funds) have begun to gain popularity in recent years and now hold over $974 billion in assets under management. But what is an actively managed ETF? And how does it differ from passive management?

For investors, the term “actively managed ETF” is likely to arouse feelings of disbelief and surprise. An actively managed exchange-traded fund (ETF)? How is that even possible? Many may ask that very question, and with good reason. The truth is that since the first ETF ever was launched in 1993, called SPDR SPY, all those that came after it were passively managed products. That was until 2006, when the first actively managed ETF was created. However, their popularity and demand among investors did not start to grow until the last three years, when their market cap managed to exceed $628 billion.

What is an actively managed ETF and how does it work?

A good definition of what an ETF (Exchanger-Traded Fund) is has been given by Ben Johnson, Director of ETF Research for Europe at Morningstar. “ETFs are simply a package in which asset managers wrap up and distribute investment strategies, whether active, passive or somewhere in the middle, to investors,” explains the expert.

So what happens in an actively managed ETF? In this case, the manager could decide what companies it excludes or includes. This means that the stocks that make up the product are no longer predetermined by the index, but rather by the subjective vision of the manager. The management team will be responsible for deciding what companies to buy, when, in what percentage, and even the possibility of including other types of assets, like bonds or commodities. In short, an actively managed ETF is more like a conventional investment fund; what changes is the packaging in which it is traded in order to reach a larger number of investors.

50 years growing at your side

Our team of high-net-worth experts offers its extensive experience in advising and designing sophisticated strategies tailored to your needs and values.

Exponential growth in recent years

At the end of July of this year, the global ETF industry—including both actively and passively managed funds—had exceeded $10.86 trillion. This is over double the $4.8 trillion in assets under management recorded five years ago. Of these 10.86 trillion, 628 billion are actively managed ETFs, according to data from the specialist consulting firm ETFGI. Although they only account for 5.7% of the total market, since December 2022, they have recorded a growth of 28.8%.

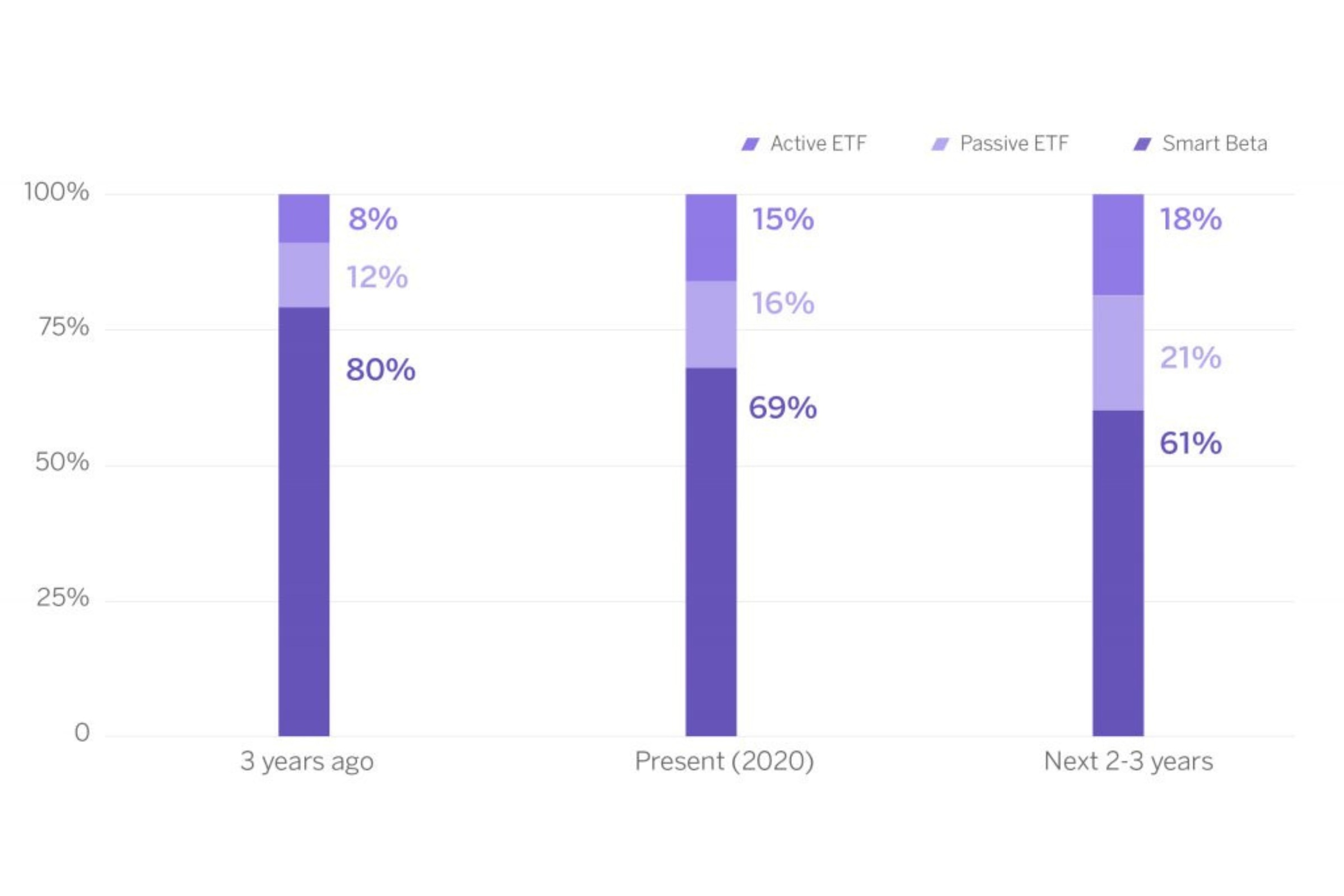

The capital flow into these products reflects the growth of the supply. Just ten years ago, there were only 153 actively managed ETFs worldwide, compared to the nearly 2,100 that can be found today. The bulk of the growth has occurred since 2020, with the volume under management rising from $288 billion to $628 billion and the number of ETFs listed from 1,053 to 2,072.

Advantages and disadvantages

It is clear that actively and passively managed ETFs are only similar in how they are marketed and in how investors can include them in their portfolio. However, the content is very different. For example, in the case of one of the most popular passive ETFs, the Vanguard S&P 500 ETF (VOO), the product replicates, almost exactly, the composition and performance of the S&P 500. This formula gives the investor greater clarity and transparency with regard to the composition of the portfolio, both now and in the future. What’s more, in terms of costs, the expense ratio is 0.03%. However, this ETF does not allow the manager to make any changes to the portfolio, even in a bearish market.

However, in the case of the SPDR SSGA Global Allocation ETF (GAL), one of the most closely monitored active ETFs, it invests in stocks, indexes and bonds. This gives the investor a great deal of diversification with a single product. However, its composition will depend on the manager’s discretion and the investor cannot know what the manager may do over time. Furthermore, in terms of expense ratio, due to the fact that they are actively managed and require a greater effort on the part of the management team, the cost rises to 0.35%.

Global distribution of active vs passive ETFs