It is not known when interest rates will fall, and by how many points. Investors are waiting for something to change compared to 2023. We explain how rate changes can affect you, and what to do in the event of increases and decreases.

Citizens and experts have been waiting for months for a change in the monetary policy of the main central banks that has not yet arrived. This circumstance is affecting market performance following 2023, which was characterized by a maintained economy, decreasing inflation and high interest rates, both in the eurozone and in the US. U.S.

This scenario brought attractive returns in public debt and private fixed-income, significant rises in the main stock market indexes and also unusual situations. In Switzerland, for example, Swiss bonds outperformed Swiss equities, a fact that has only occurred in six of the 98 years studied in Pictet’s Historical Equity and Bond Returns in Switzerland (1926-2023) report.

In order to prepare your portfolios for the next few months, if there is a question that most investors are asking now, it is when interest rates will drop - and by how many points. The question - for which there is no clear answer at the moment - is essential for anyone who wants to make a profit from their money, whether they are invested in fixed-income or stocks, real estate, raw materials, etc.

But how can interest rate changes affect investments, and what should we do in the event of increases or decreases? This is a situation where we should learn from the past. These experiences tell us that the performance of investments is very different depending on whether the period has an expansionary or contractionary monetary policy.

The future, our best investment

If we focus on the expansionary policy, the one applied by central banks when an economy is stagnant, as is happening now, and it is decided to lower interest rates to encourage investment and growth, historically stocks achieve good returns. The explanation is that both companies and investors have easier access to borrowed money to put it into circulation.

The opposite happens to fixed-income investors, who receive smaller returns for their money the lower the interest rates. The situation of almost zero interest rates was experienced in Europe for almost a decade, until they began to rally in 2022. This forced companies and governments to issue debt at unusually low rates. This led investors in bonds having no choice but to raise their risk profiles to gain somewhat better returns.

Low rates, however, are interesting for investors in real estate assets, since by lowering the price of mortgages, more families can afford to buy a home and, therefore, the price of the assets tends to rise. As for raw materials, they also tend to behave well in an expansionary monetary policy environment.

What is the economic theory's perspective on contractionary policies and the increase in interest rates? This type of measure, implemented by the European Central Bank (ECB) and the Federal Reserve of the United States U.S. in the last two years due to economic growth and the significant rise in inflation, has the main consequence of making finance more expensive.

In this scenario, investment in equities tends to generate less favorable returns, given that the general risk profile adopts a more conservative stance as attractive returns are easily available through investments in fixed-income instruments. The rise in rates does not benefit real estate assets, since mortgages get more expensive, thus decreasing the demand for housing.

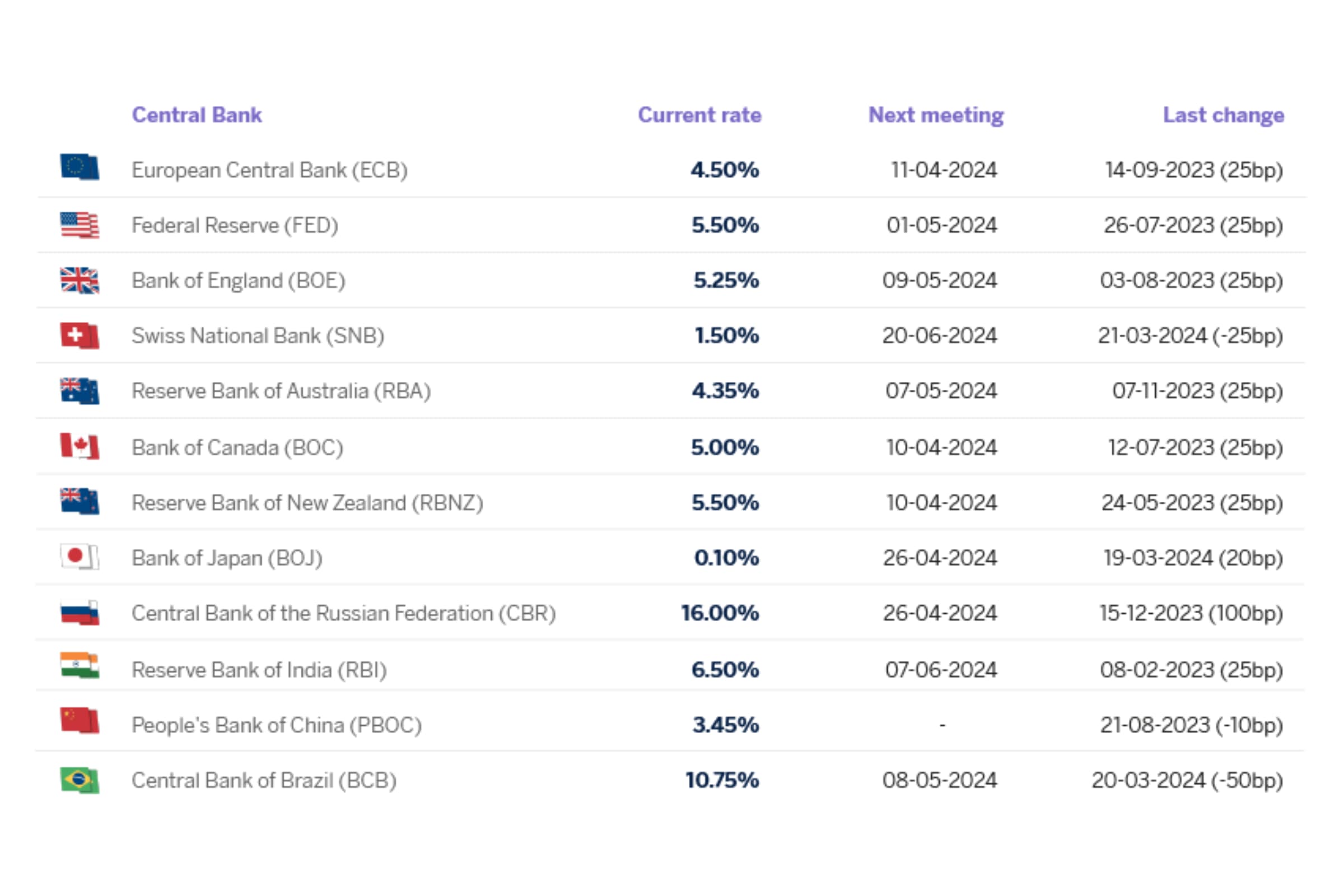

Economic calendar of the world's central banks