Often ignored by Western media and investment funds, the Association of Southeast Asian Nations (ASEAN) is emerging as the world’s fifth largest economy. With ten countries and 663 million inhabitants, the region is ripe with investment opportunities.

The ASEAN Asia Pacific region has passed under the radar for a long time. In fact, investment funds have recently started to invest in these countries, but they do not yet have a very long track record. It can't be ignored that ASEAN is the world's fifth biggest economy. And according to the forecasts of the International Monetary Fund (IMF), this region is expected to contribute 70% to global growth this year, experiencing an increase in its economic expansion from 3.58% to 4.6%.

But what is ASEAN?

The Association of Southeast Asian Nations is made up of ten countries: Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Vietnam and Thailand. They have 663 million inhabitants in total, with a combined GDP of 3.9 billion dollars and covering 4.5 million square kilometers. But perhaps the most striking thing is the average age of its population, which is incredibly young: 30, compared to an average age of 42 in Europe.

2020 was undoubtedly a key year for ASEAN, as it managed to sign an economic agreement to establish the Regional Comprehensive Economic Partnership (RCEP). A free trade agreement with Australia, China, Japan, South Korea and New Zealand, which has become the largest in the world by representing 30% of the world's GDP.

Amazing forecasts

The Asian share of global GDP will rise from around 45% to 57% in 2030, according to World Economics forecasts. This growth would place the region as the fourth largest in the world at the end of this decade, just behind the United States, China and India. According to the Association's general secretary, Cambodian Kao Kim Hourn, this growth will be particularly boosted by the young population. And around 60% of ASEAN's total population is under 35 years old. Of these, half of the population will join the middle class before the end of the decade.

The future, our best investment

Capitalize on opportunities in a way that is positive, conscientious and committed, with solutions designed for you by our investment experts in your bank in Switzerland.

Investment opportunities

In this scenario, it is logical to think about investment opportunities. The first thing to stress is that the countries do not all fit the same profile: some focus on industry, others on tourism. The same applies to income, digitalization and levels of education. So you should keep this information in mind before looking for opportunities in which to invest.

For J. P. Morgan, there are mainly four major opportunities in which to invest in this region. The first one is related to the low level of banking penetration; the second, the limited presence of e-commerce; the third, the strong presence of foreign investors and entrepreneurs; and the fourth, the process to reduce carbon emissions, which has not caught on in the region to a considerable extent.

In the case of one of the star funds that invests in the region, the Fidelity ASEAN Fund, the main opportunities are in the financial sector, as it represents more than 40% of the portfolio. For Bill Maldonado, CIO of Eastspring Investments, the main opportunities are in Vietnam and in the general transformation of the economy across this region. “Manufacturing capacity is being built, infrastructure, know-how and technology are being developed. And this is not something that will change overnight", he says.

The financial system

Two areas of particular growth in the region seem to be the financial sector and tourism. In the first case, the McKinsey Institute estimates that almost 59% of the population in East and South Asia does not use formal or semi-formal financial services. This figure, combined with the average age of the population and its entry into the middle class, makes it an interesting opportunity for investors. In addition, smartphone penetration exceeds or nears 90% in the region, so the role of online banking and fintechs can be critical.

In view of the young population with rising income, e-commerce is worth considering. ASEAN e-commerce sales rose to $38 billion in 2019 - in 2015, they were $5.5 billion - and calculations take this figure up to $150 billion in 2025. In Thailand, the 4.0 initiative has been launched, a 20-year strategy to move towards a digital economy; and in the Philippines, the central bank has launched its Digital Payments Transformation Road Map.

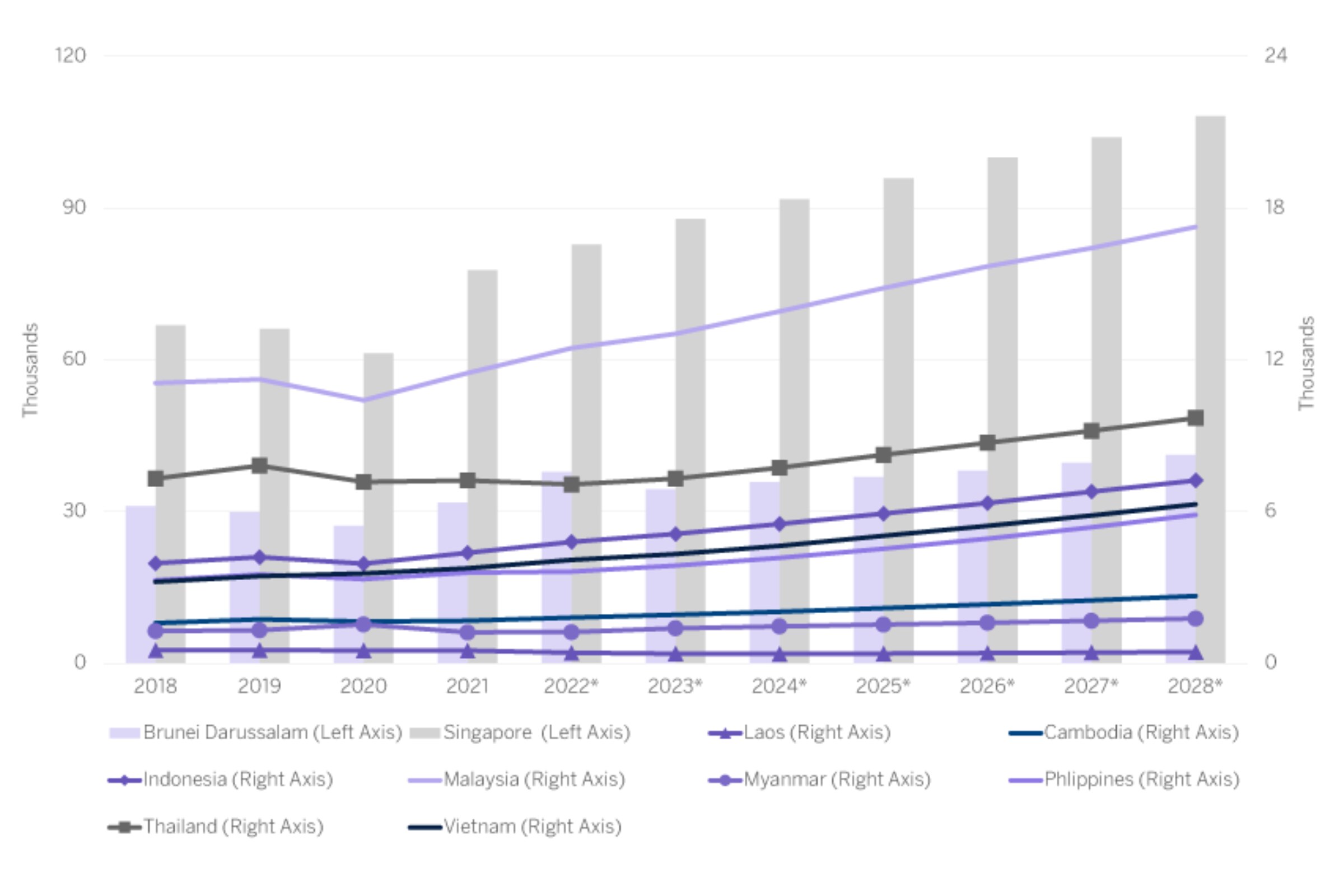

ASEAN countries: GDP per capita at current values from 2018 to 2028 (in US dollars)