The power of diversification

On 6 June last, the Spanish entity Banco Popular was sold for one euro. The increasing withdrawals of deposits had created an unbridgeable liquidity gap. The European authorities gave the go ahead to the sale of Banco Popular, which marked the disappearance of the entity with the highest efficiency ratio in Spain. Reams and reams have and will be written over the next few months as to how the entity got into such a critical situation. Therefore, it may be more rewarding to talk about the problems a portfolio may incur by holding individual stocks.

Many investors thought that after falling 95% from its all-time high, passing the recent stress tests and with the economic recovery in Spain in full swing, this would be the perfect medium for the share to undergo a revaluation. But sometimes, the obvious is not so obvious and overnight our investment ends up worth nothing and our wealth has been significantly eroded. On this occasion it was Banco Popular, but tomorrow it could be any other company. Events that happen unexpectedly and have a great impact are known as “black swans”.

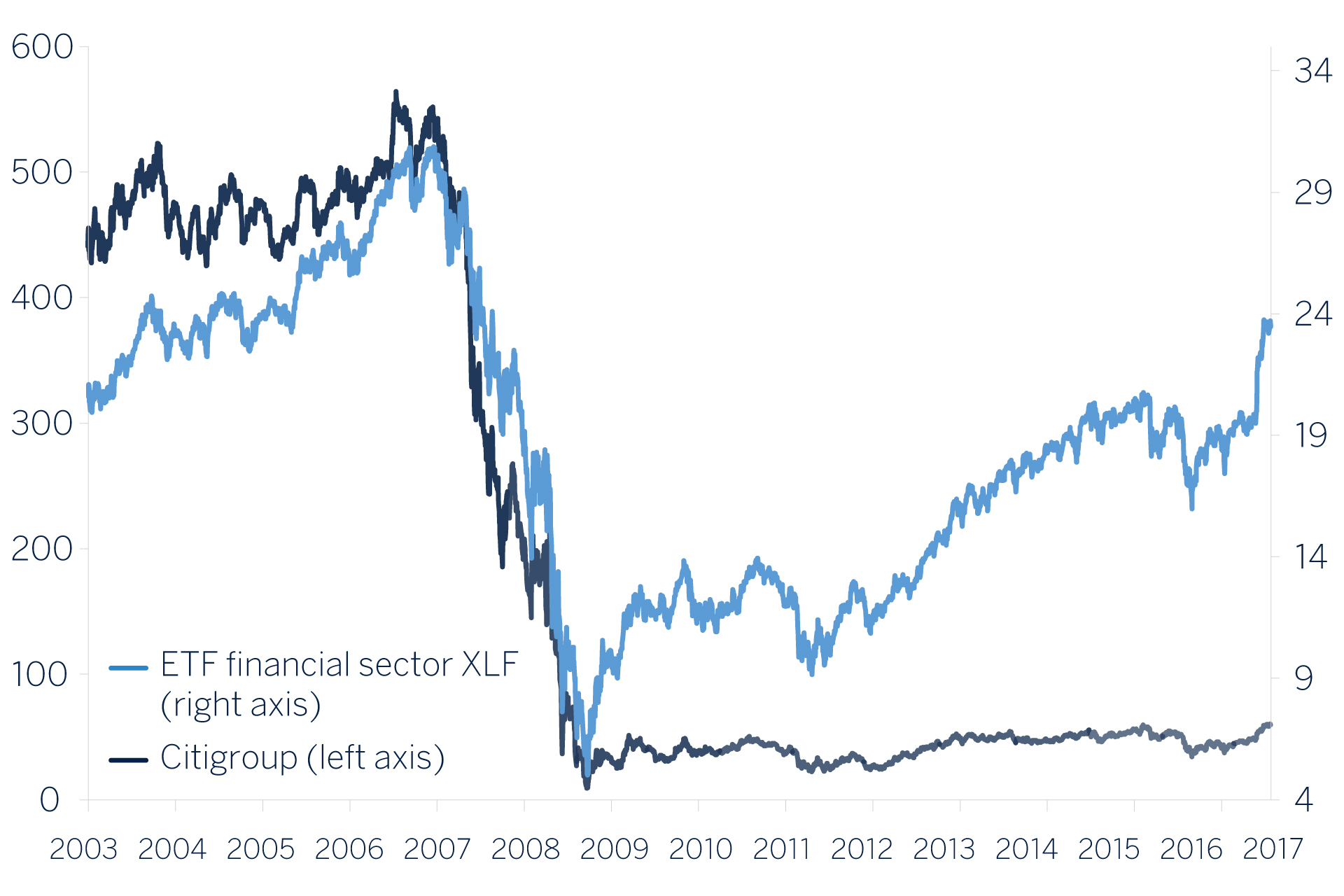

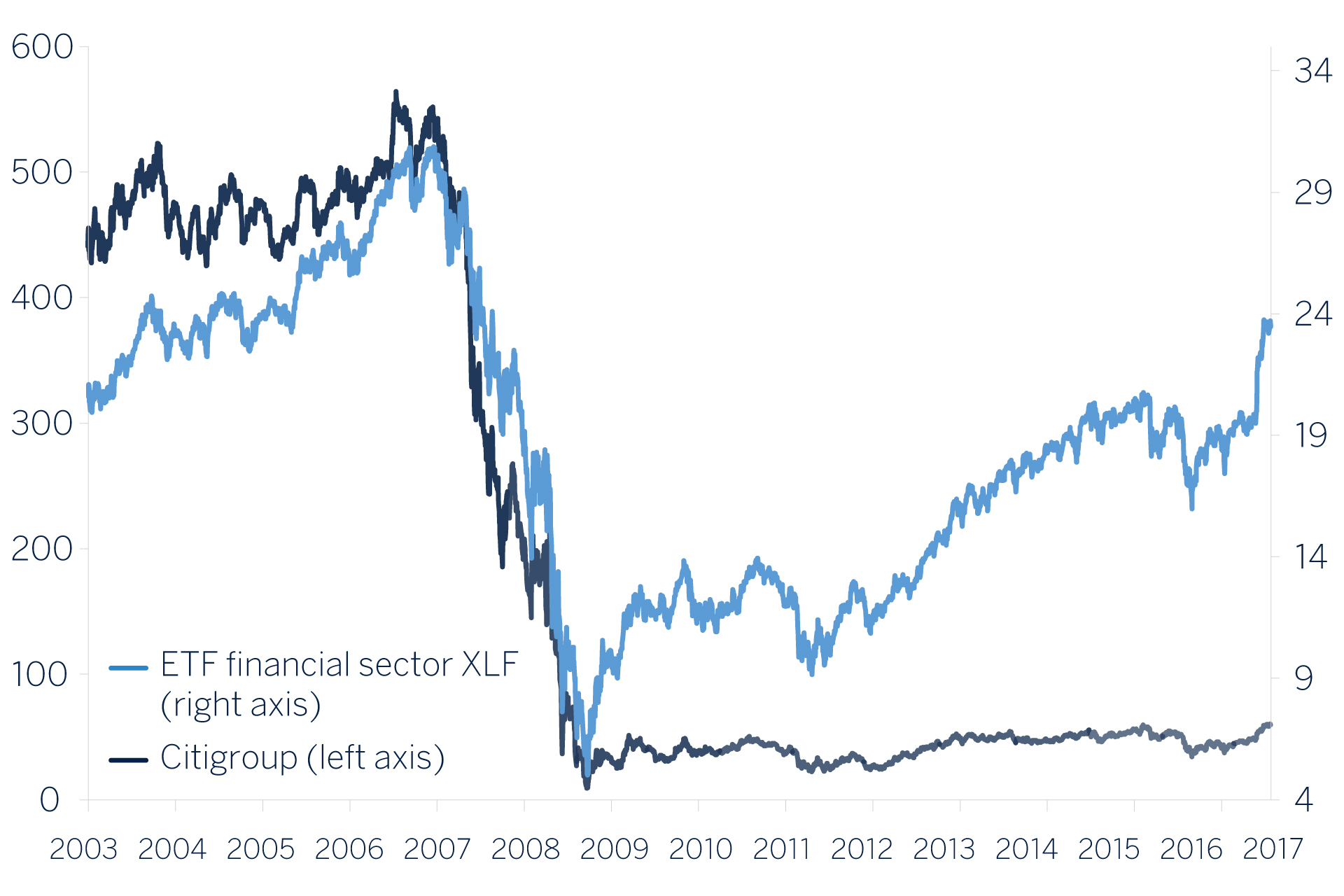

The USA offers us another example. Although it has not reached these extremes, it is more than interesting to analyse the trend in banks as a whole in the USA from 2007 (blue line) with one of those banks, Citigroup (black line). We can see how until 2008 both the financials ETF, XLF (the ETF comprising all the companies in the US financial sector) and Citigroup bear a perfect correlation, but whilst the ETF has today recovered most of the value it lost, Citigroup remains virtually flat.

The USA offers us another example. Although it has not reached these extremes, it is more than interesting to analyse the trend in banks as a whole in the USA from 2007 (blue line) with one of those banks, Citigroup (black line). We can see how until 2008 both the financials ETF, XLF (the ETF comprising all the companies in the US financial sector) and Citigroup bear a perfect correlation, but whilst the ETF has today recovered most of the value it lost, Citigroup remains virtually flat.

To handle portfolios correctly and responsibly, it is important to control risks and detect opportunities wherever they may lie.

Write to us here if you are interested in learning more about this topic.

To handle portfolios correctly and responsibly, it is important to control risks and detect opportunities wherever they may lie.

Write to us here if you are interested in learning more about this topic.

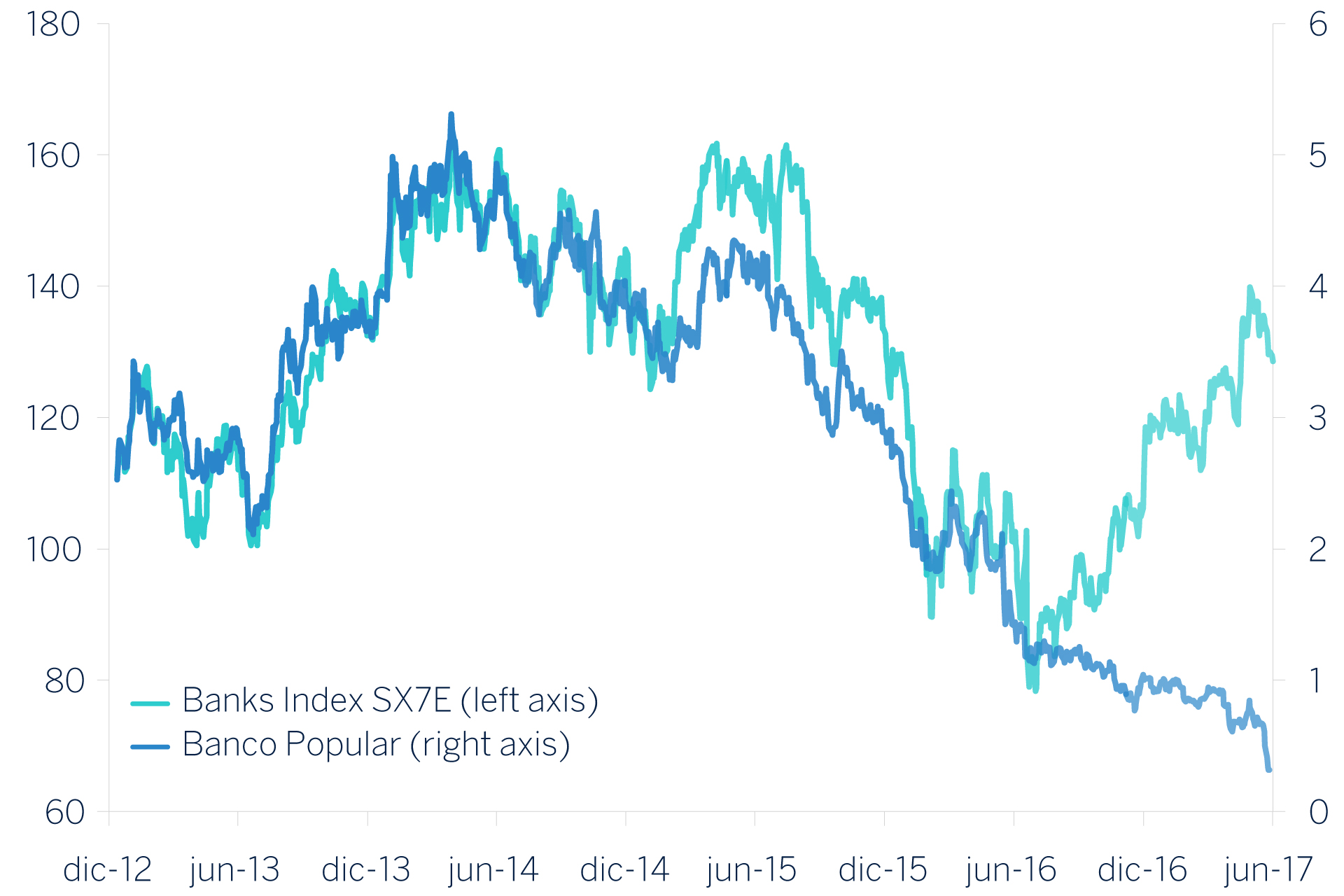

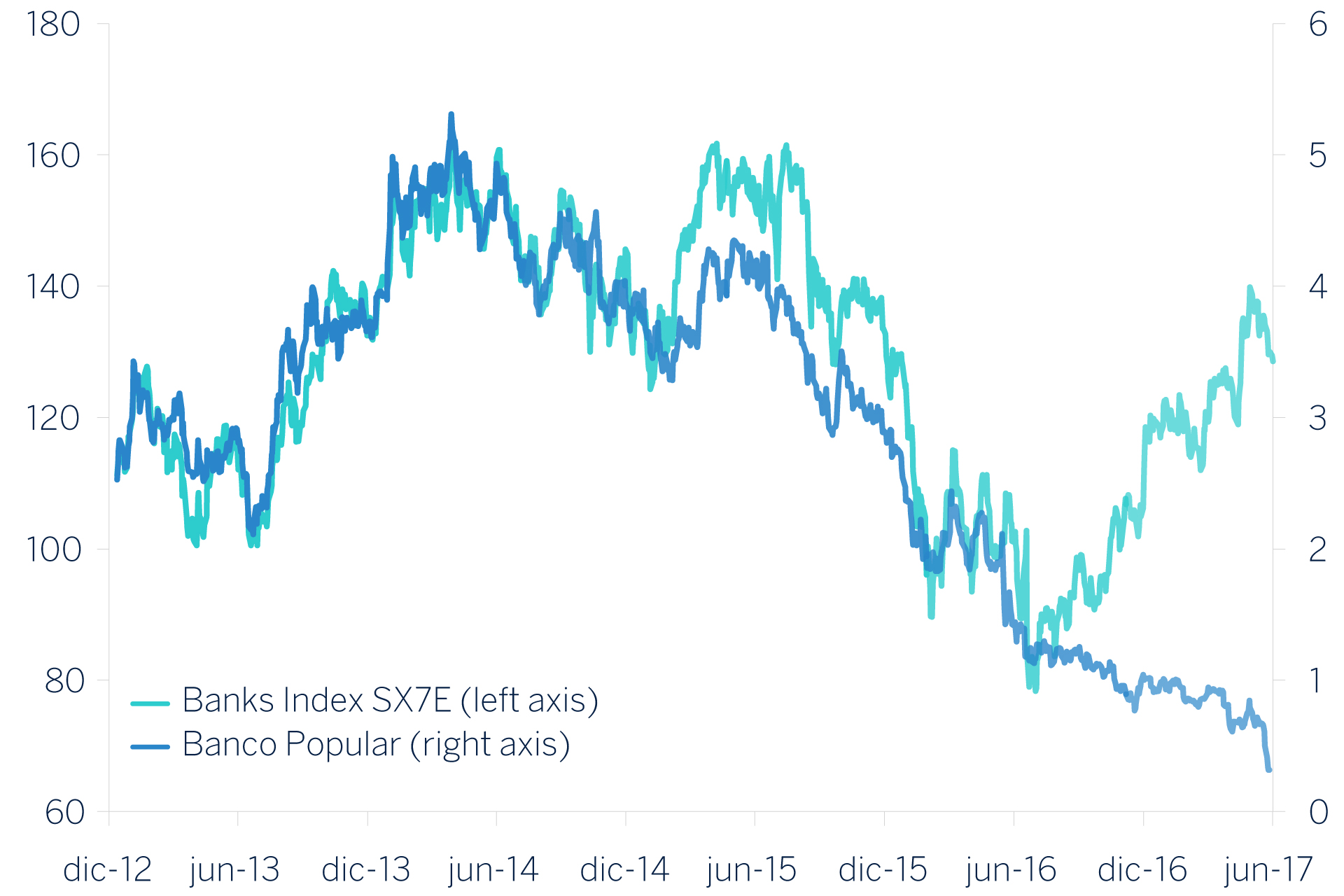

Given how difficult it is to predict these events and the importance of capital conservation, one aspect becomes vitally important: Diversification.It never does any harm to look back and, with the undoubted advantage of analysis, draw conclusions as to what the best alternative would have been to broach this situation. The graph below compares the trend in Banco Popular (blue) with the European banks index (green). We see that they bear a perfect correlation from 2013 to 2016, whereby for a positive view in Europe, focusing on the banking sector, the most prudent approach is always going to be to invest in an ETF that replicates this index (we would be buying a set of banks making up the ETF) and spares us troubles with individual stocks.

The USA offers us another example. Although it has not reached these extremes, it is more than interesting to analyse the trend in banks as a whole in the USA from 2007 (blue line) with one of those banks, Citigroup (black line). We can see how until 2008 both the financials ETF, XLF (the ETF comprising all the companies in the US financial sector) and Citigroup bear a perfect correlation, but whilst the ETF has today recovered most of the value it lost, Citigroup remains virtually flat.

The USA offers us another example. Although it has not reached these extremes, it is more than interesting to analyse the trend in banks as a whole in the USA from 2007 (blue line) with one of those banks, Citigroup (black line). We can see how until 2008 both the financials ETF, XLF (the ETF comprising all the companies in the US financial sector) and Citigroup bear a perfect correlation, but whilst the ETF has today recovered most of the value it lost, Citigroup remains virtually flat.

To handle portfolios correctly and responsibly, it is important to control risks and detect opportunities wherever they may lie.

Write to us here if you are interested in learning more about this topic.

To handle portfolios correctly and responsibly, it is important to control risks and detect opportunities wherever they may lie.

Write to us here if you are interested in learning more about this topic.