The importance of diversification in debt environments

The importance of diversification for investors

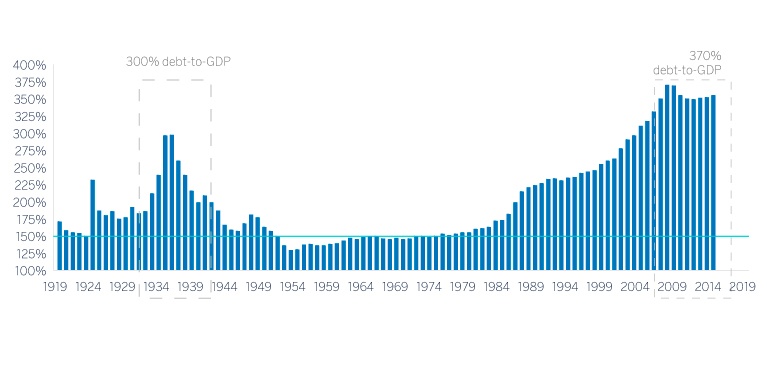

The debt levels of governments and companies with respect to GDP are at a record levels, something we should take into account when investing

On 23 September 2019, the world’s oldest travel agency, Thomas Cook, announced that it had ceased trading and the company went into liquidation. We’ve recently seen similar cases with Sears and Toys “R” Us. The high cost of financing in debt environments reminds us of the importance diversification has for investors.

There are usually many different reasons behind the demise of such large and well-established companies, but we’d like to focus on two in particular which they all tend to have in common.

- They were big players in the market and they failed to adapt to new business models and embrace innovation, either because management didn’t see the need to innovate or because they simply misread what their customers wanted. They tend to be old business models because in recent years new disruptive competitors have appeared on the market.

- They are over-leveraged and have high financing costs.

Currently, the size of the debt has increased exponentially in proportion to the size of the economy, both in the private sector (households plus the non-financial business sector) and the public sector.

In the past, these levels of debt caused major defaults in most sectors, which was the only way to deleverage.

When a company defaults on its debt, the position of each investor is different in terms of its expectations of being paid back. A pre-debt relationship establishes the payment priority for investors, and naturally, those with the least priority expect higher returns.

When a company announces a default on its debt, it enters an orderly process in which all operations cease and its assets are sold to repay the debt (as recently occurred when Thomas Cook’s planes were seized, leaving the tourists who had purchased its services stranded). The repayment rates depend on the company’s credit rating or origin. Statistics indicate that for senior unsecured investment-grade bonds the recovery rate is 43.15% in five years and 43.14% for the same period for high yield companies.

The current level of debt of both countries and companies suggests that we will see more bankruptcies in the near future. For protection from these events, we recommend a diversified portfolio with high credit quality.

Related news

-

The power of diversification

On 6 June last, the Spanish entity Banco Popular was sold for one euro. The increasing withdrawals of deposits had created an unbridgeable liquidity gap. The European authorities gave the go ahead to the sale of Banco Popular, which marked the disappearance of the entity with the highest efficiency ratio in Spain.

-

Switzerland, an international finance center ideal for portfolio diversification

Many people around the world choose to place part of their savings in investments outside their home country, in order to diversify their holdings. That’s why they put part of their capital in international financial centers. Switzerland is one of them.