The advantages of multi-currency accounts with BBVA in Switzerland

A Swiss bank account offers a wide range of advantages. One of them is to be able to hold deposits in different currencies.

The main advantages of the multi-currency account are as follows:

● Capitalizing currency movements: our investment department offers investment ideas related to pairs of currencies.

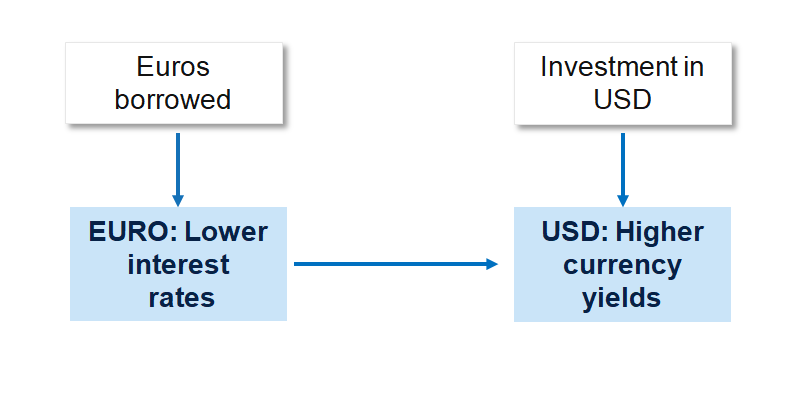

● The possibility of obtaining financing in a currency with lower interest rates than other currencies: an interest rate in euros is lower than in US dollars.

● The ability to make payments in different currencies.

● The possibility of hedging transactions that involve different currencies.

● Diversifying between different currencies.

At BBVA in Switzerland, we regularly offer our customers currency-based investment ideas. In 2018 we gambled on the revaluation of the dollar against the euro, which allowed our customers to obtain attractive returns by borrowing euros at low rates and investing in dollars.

BBVA in Switzerland is offering customers the possibility of choosing between different currencies to open deposits and make investments and transfers.

The range of currency deposits offered to customers of BBVA in Switzerland is very wide. At present, 70% of our customers hold two or more currencies in their portfolios, such as the US dollar, euro, Swiss franc and Mexican peso.

The ability to hold deposits in Swiss francs is a major advantage because this has been the most robust currency in recent times. Coinciding with the ‘end of the gold standard’, it has appreciated an annualised 3.20% against the dollar since 1970.