Dots, points that plot our destiny

Despite janet Yellen, the chair of the US Federal Reserve, is the most influential component in said organisation, we should never forget that she is not alone and there are other members whose vote, and often whose opinion, are equally important.

The FED is a much bigger body than most people believe. Indeed, when the majority talk about the Fed, in actual fact they should really refer to the FOMC (Federal Open Market Committee).

The FOMC is the body belonging to the Federal Reserve that implements its monetary policy measures. It has 12 voting members and in the event of a tie, the opinion given by its chair prevails.

The trend in the dot plots in each meeting will depend, or at least so the theory says, on how close the economy is to reaching full employment and price stability -the Fed’s two major mandates-.

The trend in the dot plots in each meeting will depend, or at least so the theory says, on how close the economy is to reaching full employment and price stability -the Fed’s two major mandates-.

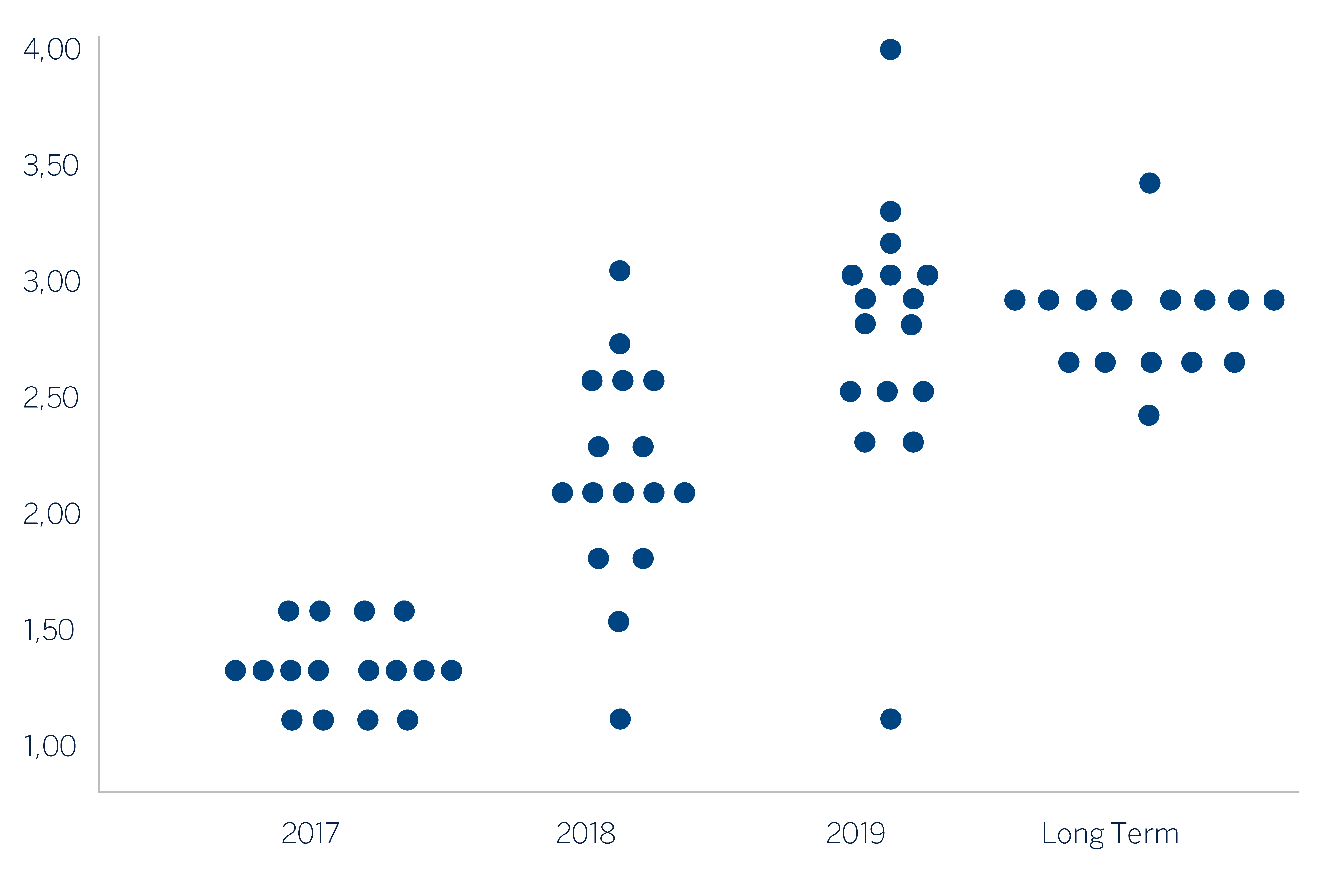

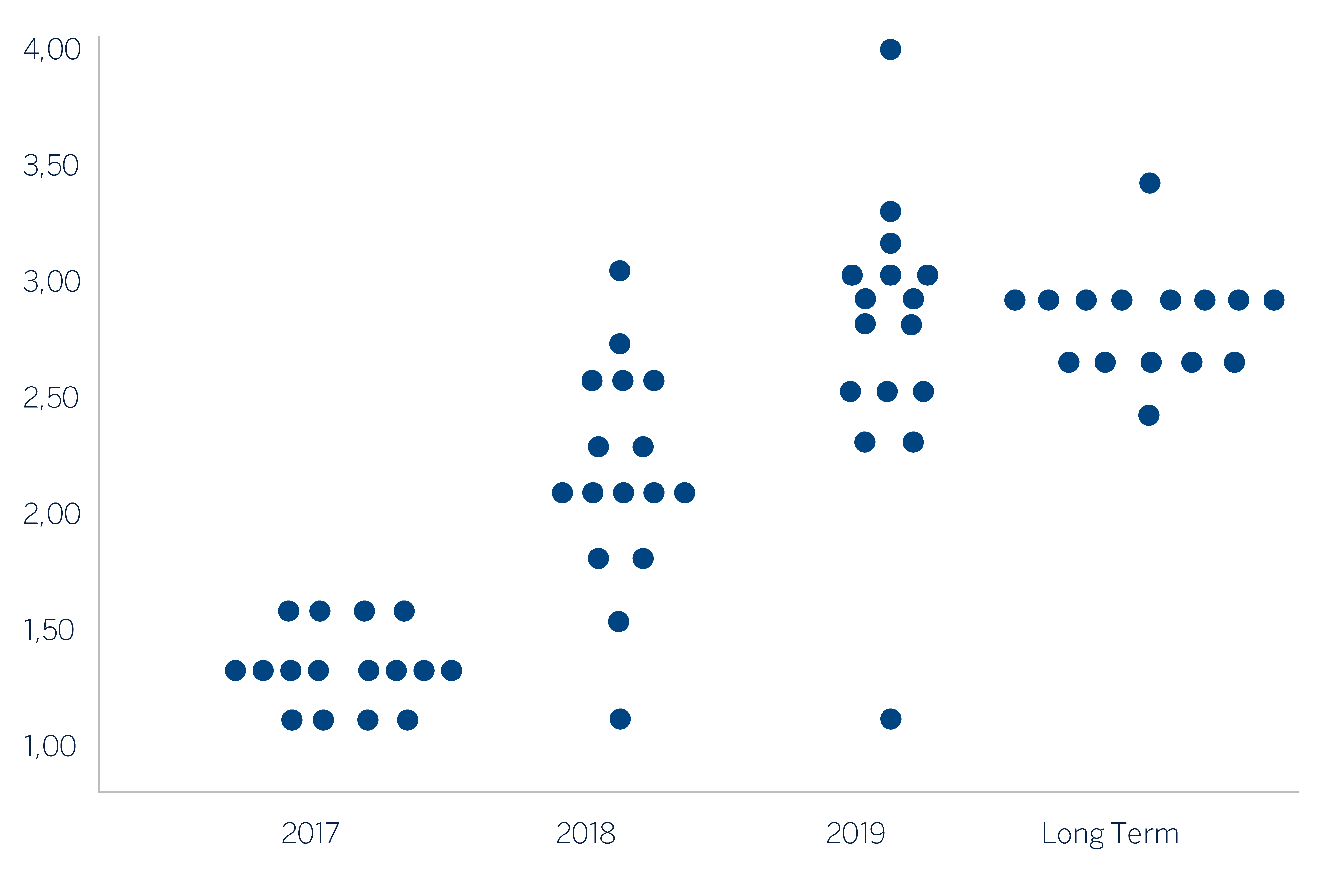

Hence, despite the undoubted influence that Janet Yellen may have on the final decision, it is risky at the very least to think that hers is the only opinion to bear in mind.It comes as no surprise that the markets move when highly influential members like Dudley or Fisher appear in public; which reveals their importance. However it is more instructive to see how these remarks materialise or are quantified in rate hike - cuts or how their opinions are set forth in each meeting in the so-called “Dot Plot”. As its name indicates, dot plots are dots that represents each individual from the committee. These dots tell us what the future pace in official rate hike - cuts will be in the opinion of each individual FOMC member. As we can observe at below graph, the median tells us that the majority of members believe that rates will remain at 1.5% until the end of 2017, at 2.00-2.25% at the end of 2018 and close to 3.00% for 2019 and thereafter.

The trend in the dot plots in each meeting will depend, or at least so the theory says, on how close the economy is to reaching full employment and price stability -the Fed’s two major mandates-.

The trend in the dot plots in each meeting will depend, or at least so the theory says, on how close the economy is to reaching full employment and price stability -the Fed’s two major mandates-.