Economy

Medium-term value of US investment-grade corporate bonds

As a consequence of the global economic slowdown deriving from the COVID-19 outbreak, the main central banks have set their rates back to 0% or negative; and they are promising to leave them at this level in the coming years to support the sustainable recovery of economic growth.

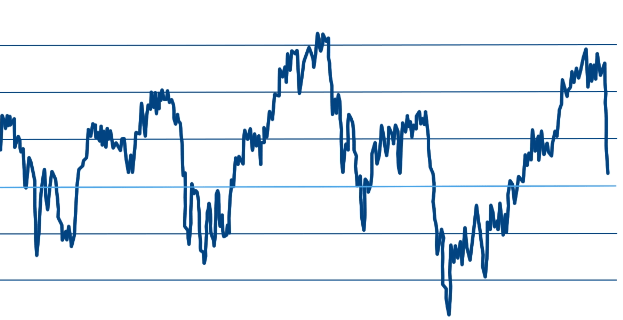

Consumer confidence index shows the US consumer sentiment of the general economic situation

Consumer confidence, measured in the Conference Board Consumer Confidence (CCI), is defined as the degree of optimism about the state of the economy in general. This index shows the results of a survey of 5,000 households.

Market outlook: May 2020

The trend in the coronavirus contagion curve and the improvement in the Chinese economy acting as a leading indicator are positive signs. It increases the probability that we will be in the central scenario in which recovery and economic growth return in Q3. The strength and speed of the announced economic measures (monetary and fiscal) could protect markets from the worst-case scenario. It is a cyclical recession, with a sharp drop in supply and demand, but shorter and different in nature from the 2008/09 crisis. Headline inflation could fall in the coming months due to the drop in oil prices, to gradually rise again in 2021.

Differences between inflation and deflation

Due to the current crisis situation we are living, we are often seeing in the media the terms "inflation" and "deflation". Both terms can be confusing on occasions, so here we provide a brief and simple overview to give you a basic idea of the two concepts.

Opening an account in a bank abroad: frequently asked questions

Given the growing number of people who are interested in opening an account in Switzerland, we have decided to present answers to some of the most frequently asked questions we receive on this matter.

The evolution of financial markets

Several weeks have passed since the market crisis associated with the global spread of COVID-19: weeks during which we have witnessed extreme financial market developments.

Emerging-market currencies beaten down by COVID-19

The surge to the U.S. dollar given its perceived safe-haven status has driven several EM currencies to record lows against the greenback in recent weeks, such as the Turkish lira, Mexican peso and Brazilian real.

Long-term economic risks associated to Coronavirus crisis

The substantial fiscal and monetary stimuli being implemented around the world are from our point of view essential to counter the strong negative effects of the paralysis we are currently suffering from in many segments of the economy.

Analysis of the fall in the price of oil

The price of West Texas Intermediate crude, closed last 19th April 2020 at - $ 37.63, something that seemed impossible. It has never closed negative at maturity before. The Price on the spot contract was also negative, due to the lack of storage

The importance of liquidity in fixed income vehicles

One of the most important decisions we must make when implementing our vision in an investment portfolio is to choose between traditional mutual funds or exchange-traded funds, better known as ETFs.

Market outlook: April 2020

The increase in economic uncertainty due to the spread of the coronavirus outside China may last a few weeks. The expansionary cycle should continue negative impact concentrated in Q1 and recovery from Q2, with an impact of -0.2% of global GDP. The alternative high-risk scenario is that the virus becomes a pandemic, with a negative impact on Q1 and Q2 and -0.5% on global GDP. This uncertainty has occurred at a time of improvement in global cyclical indicators, which will help rebuild confidence. In China, there has already been an upturn in production levels and they are also currently implementing tax incentives, a pattern that can be repeated in other regions.

Risks of investing in gold in times of crisis

Gold is considered by many investors to be the perfect safe-haven asset during an economic recession or crises

What's the minimum amount to open an account in a private bank in Switzerland?

Opening a bank account in Switzerland is a simple procedure. Not only complies with every international legislation but also offers excellent advantages by diversifying your savings in a neutral and stable country with a triple-A (AAA) rating.

Investment in fixed income against Coronavirus

The worldwide spread of the COVID-19 virus (coronavirus) in recent weeks has led to strong movements in the fixed-income markets. The possible impact of the new virus on the world economy (its precise dimensions are still unknown) and a marked drop in oil prices (caused by the announced increase in production by Saudi Arabia) have pushed investors to take refuge in developed government bonds instead of high-yield corporate bonds; the latter are more sensitive to the economic cycle and registered price drops of around 10% in the last two weeks.

Coronavirus: Economic situation analysis

At this stage, it is challenging to predict the consequences of the real economy and the business sector. The reason is that there are no historical situations with which to compare the current context reliably. We believe, in any case, that the global economy is weakened due to the high level of debt, so we are cautious about how the economic activity will be affected.

We consolidate our position in the market against Coronavirus

During the last two weeks, we have witnessed a worsening of the effects of the coronavirus on a global scale; showing that the problem is far from being under control and that it is reasonable to assume that several months of

Commodities as an investment alternative

The commodities market is probably one the least known and most unpredictable for the majority of investors.

Is there an opportunity with equities?

Only last summer did we mention, with a hint of irony, the "imminent collapse of equities" based on a deluge of headlines and news that pointed to an impending market correction.

Which is the strongest currency in the world?

The most important, considering that it is the international reference currency and the most used, is the US dollar, but which is the strongest?erte?

Investment strategy against the uncertainty surrounding coronavirus

During the last days, we have witnessed an increase in the uncertainty surrounding coronavirus and its possible effects on the population and the world economy.

Economic situation after the first months of 2020

The markets ended January with corrections affecting risk assets, despite optimism over the signing of an initial trade agreement between USA and China, improved growth prospects and central banks committing to accommodative monetary policy.

Impact of the coronavirus on the economy and markets

The coronavirus is generating economic and financial uncertainty. It is still too soon to have a clear understanding of what economic impact the outbreak will have in China.

Consequences for investors of monetary policies

After the Great Recession (2008-2009) until now, the main central banks have established ultra-expansionary monetary policies to combat the extreme de-inflationary pressures resulting from excessive economic indebtedness , the fall in labor force growth (demography) and technological progress.

The value of assets and the important role of professional investors

The main assets offer far less value over the next 10 years in terms of anticipated yield than was the case over the last decade.

The fiscal solution: attracting new residents to southern Europe

Some countries in southern Europe have set up special fiscal solutions for new residents in an attempt to lure wealthy and talented individuals to their shores.

The positive balance and challenges for 2020

The financial markets, supported by the actions of the world's central banks, have performed very well during 2019, which has allowed us to offer our customers very significant returns in an environment of low-interest rates and moderate economic growth.

United States consumer confidence as a leading indicator of recessions

In the last 50 years, the United States economy has suffered a total of seven recessions. Each of them was preceded by a drop in consumer confidence in the world's largest economy, specifically of the indicator's one-year moving average.

Do I include my descendants in my investment account?

When opening an investment account in a Bank to manage funds, many investors ask us if it is convenient to include a spouse or their descendants as co-owners to simplify inheritance procedures in the event of the death of the principal holder in the future.

The Federal Reserve lowers the reference rates and applies new stimuli

The Central Bank of the United States (Fed) has again lowered the reference rates for the third consecutive time during 2019. Far are the forecasts of rate hikes at the end of 2018 when our forecast was, and continues to be, that the Federal Reserve won't be able to upload them for a long time (years) and there is still a long way down.