Market news

Weekly Keys: What is happening this week?

Pre-election week in the US with many states still undecided but with a clear lead in the polls for Joe Biden.

Megatrends of the 21st Century: global water market

The term megatrend is becoming commonplace within society and even more so within the investment world. The speed with which technology has changed our lives over the last few years has been extraordinary, we can also assume that this will not stop here and will continue in the future.

Market outlook: October 2020

Main milestones this month: The second wave of Covid-19 will slow down to a greater or lesser extent an economic recovery which will nevertheless continue, supported by fiscal and monetary stimuli and the foreseeable arrival of vaccines in the spring of 2021. And much more.

Market outlook: September 2020

Main milestones this month: The economic recovery should follow the expected path thanks to the fiscal and monetary stimulus measures, and the foreseeable arrival of vaccines. The authorities will avoid general lock-downs as much as possible, unless there the health systems are once again overwhelmed. The US is expected to take two years and Europe slightly longer to recover their 2019 GDP levels, while Latam and the European periphery could take at least three years. And much more.

The role of central banks

Since the onset of the economic crisis triggered by the Covid-19 pandemic, the leading central banks have taken an important role: they have taken the decision to drastically increase their balance sheets by pumping liquidity into the system, so restoring the confidence of most analysts and investors.

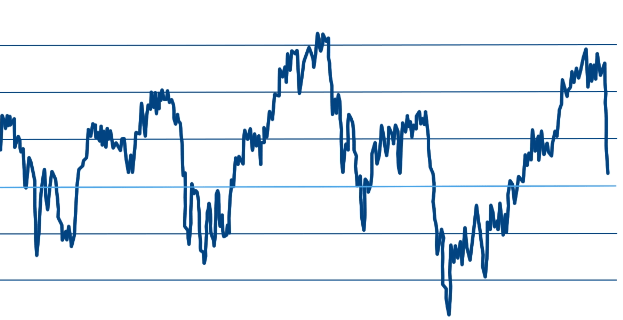

The disparity of the financial markets

Since the economic crisis triggered by the coronavirus began, with the sharp falls in the financial markets in March, we have witnessed a very significant recovery in the most efficient and flexible geographies, as is the case of the United States, Britain and Switzerland. The same has not occurred in weaker geographies, as is the case in many emerging economies or even some European ones. The reality is that this substantial improvement in the world's most important financial markets contrasts significantly with the economic reality of their economies. Economic expectations have improved substantially, but actual economic data remains very depressed.

Market outlook: August 2020

Main milestones this month: Uneven Covid-19 situation: more flare-ups in the summer than expected but good news on the immunisation front with some vaccines likely to be ready earlier than anticipated. Selective social distancing measures could be implemented to try and avoid lockdowns in the spring. It could take the US two years and Europe slightly longer to recover their 2019 GDP levels, while Latam and the European periphery could take at least three years. And more

Follow up with the market news online

The new Markets section is accessible from the homepage of www.bbva.ch. With a single click, you can access a complete panel of shares, stock indices, currencies and major market movements.

Market fluctuations in August

Historically, the month of August has been associated with volatility. Some attribute this to the low levels of trading on the market, which accentuate the fluctuations in asset prices. The truth is, though, that a record number of events with an impact on the markets have occurred in this month.

Commodities performance during 2020 second quarter

The second quarter has seen a strong performance by commodities. Since the market shock in February and March triggered by two black swan events - the Covid-19 and oil crises - the asset has rebounded vigorously. Below we compare the performance of the main commodities, the reasons for the price increases and their possible future behaviour.

Professional management of your investments

What is discretional mandate? Discretional mandate is an investment service characteristic of Private Banking, by which the clients delegate all or part of their assets to a team of professionals. This team then manages their assets within a certain framework of action and with a specific of risk and investment objective.

Market outlook: July 2020

COVID-19 outbreaks in Europe and the difficult situation in the US and Latin America may slow down economic recovery. The implementation of selective measures of social distancing could predominate, to try and avoid the confinements of spring. The strength and speed of the announced economic measures (monetary and fiscal) could protect markets from the worst-case scenario. This is a cyclical recession, with a sharp drop in supply and demand, but it will be different in nature from the 2008/09 crisis. The European Union could approve the recovery fund in mid-July, with positive economic and political repercussions.

Valuation of the stock market against the economic situation

Due to the economic situation that we are confronting these days, it seems relevant to discuss issues of utmost importance to investors and that, for some reason, continue to cause confusion and puzzlement, even among professional investors and analysts.

Market outlook: June 2020

The developed economies are gradually reopening but the downward revision of economic growth in 2020 continues for now. There is an increasing likelihood of recovery and economic growth returning in the third quarter. The strength and speed of the announced economic measures (monetary and fiscal) could protect markets from the worst-case scenario. This is a cyclical recession, with a sharp drop in supply and demand, but it will be shorter and different in nature from the 2008/09 crisis. The European Union is negotiating a recovery fund with positive political repercussions in terms of cohesion and the European project.

2020 Outlook: A winning strategy

After 10 years of bull markets and one of the longest economic cycles in history, many investors refuse to think that the situation has changed; and that the most appropriate equity investment model has therefore also changed.

Consumer confidence index shows the US consumer sentiment of the general economic situation

Consumer confidence, measured in the Conference Board Consumer Confidence (CCI), is defined as the degree of optimism about the state of the economy in general. This index shows the results of a survey of 5,000 households.

Market outlook: May 2020

The trend in the coronavirus contagion curve and the improvement in the Chinese economy acting as a leading indicator are positive signs. It increases the probability that we will be in the central scenario in which recovery and economic growth return in Q3. The strength and speed of the announced economic measures (monetary and fiscal) could protect markets from the worst-case scenario. It is a cyclical recession, with a sharp drop in supply and demand, but shorter and different in nature from the 2008/09 crisis. Headline inflation could fall in the coming months due to the drop in oil prices, to gradually rise again in 2021.

The evolution of financial markets

Several weeks have passed since the market crisis associated with the global spread of COVID-19: weeks during which we have witnessed extreme financial market developments.

Emerging-market currencies beaten down by COVID-19

The surge to the U.S. dollar given its perceived safe-haven status has driven several EM currencies to record lows against the greenback in recent weeks, such as the Turkish lira, Mexican peso and Brazilian real.

Long-term economic risks associated to Coronavirus crisis

The substantial fiscal and monetary stimuli being implemented around the world are from our point of view essential to counter the strong negative effects of the paralysis we are currently suffering from in many segments of the economy.

Analysis of the fall in the price of oil

The price of West Texas Intermediate crude, closed last 19th April 2020 at - $ 37.63, something that seemed impossible. It has never closed negative at maturity before. The Price on the spot contract was also negative, due to the lack of storage

Market outlook: April 2020

The increase in economic uncertainty due to the spread of the coronavirus outside China may last a few weeks. The expansionary cycle should continue negative impact concentrated in Q1 and recovery from Q2, with an impact of -0.2% of global GDP. The alternative high-risk scenario is that the virus becomes a pandemic, with a negative impact on Q1 and Q2 and -0.5% on global GDP. This uncertainty has occurred at a time of improvement in global cyclical indicators, which will help rebuild confidence. In China, there has already been an upturn in production levels and they are also currently implementing tax incentives, a pattern that can be repeated in other regions.

Coronavirus: Economic situation analysis

At this stage, it is challenging to predict the consequences of the real economy and the business sector. The reason is that there are no historical situations with which to compare the current context reliably. We believe, in any case, that the global economy is weakened due to the high level of debt, so we are cautious about how the economic activity will be affected.

We consolidate our position in the market against Coronavirus

During the last two weeks, we have witnessed a worsening of the effects of the coronavirus on a global scale; showing that the problem is far from being under control and that it is reasonable to assume that several months of

Is there an opportunity with equities?

Only last summer did we mention, with a hint of irony, the "imminent collapse of equities" based on a deluge of headlines and news that pointed to an impending market correction.

Investment strategy against the uncertainty surrounding coronavirus

During the last days, we have witnessed an increase in the uncertainty surrounding coronavirus and its possible effects on the population and the world economy.

Economic situation after the first months of 2020

The markets ended January with corrections affecting risk assets, despite optimism over the signing of an initial trade agreement between USA and China, improved growth prospects and central banks committing to accommodative monetary policy.

Impact of the coronavirus on the economy and markets

The coronavirus is generating economic and financial uncertainty. It is still too soon to have a clear understanding of what economic impact the outbreak will have in China.

The value of assets and the important role of professional investors

The main assets offer far less value over the next 10 years in terms of anticipated yield than was the case over the last decade.