About BBVA

Is it as important to have cash as profitable investments?

Having cash available can, at certain times, be as important as making secure and profitable investments. The need for cash can be key to the future of the family's wealth.

24 million people have benefited from BBVA’s social programs over the past three years

BBVA has invested more than €300 million over the past three years as part of its Community Investment Plan

Carlos Torres Vila: “BBVA works to help build a more inclusive and sustainable society"

Carlos Torres Vila delivered his first speech as Group executive chairman at BBVA’s Annual General Meeting.

BBVA approves new structure and completes succession plan

In a meeting conducted today, the Board of Directors of BBVA named Carlos Torres Vila Group executive chairman, replacing Francisco González, and Onur Genç as CEO.

BBVA Results 4Q18

In 2018, the BBVA Group earned €5.32 billion, 51.3 percent more than in the previous year. Recurring revenues, cost containment efforts, and capital gains on the sale of BBVA Chile drove these results. BBVA’s diversified model and the transformation strategy are behind this positive evolution and of the improvements in efficiency.

White Turf 2019: A date with horses and snow in Switzerland

For the fifth consecutive year, BBVA in Switzerland – the BBVA Group’s International Private Banking unit based in Switzerland – is organising a special Alpine event with horses and snow during the Swiss winter.

Onur Genç will be the next CEO of BBVA

The Board of Directors of BBVA approved the succession plan for the company’s Chief Executive Officer (CEO). Onur Genç, who is currently the CEO of BBVA Compass and U.S. country manager for BBVA, will replace Carlos Torres Vila as Group CEO. The succession is expected to take place on Dec. 31, 2018.

BBVA adheres to the United Nations Principles for Responsible Banking

BBVA joined in launching the Principles for Responsible Banking at the United Nations Environment Programme Finance Initiative (UNEP FI) global roundtable in Paris.

BBVA, the only major bank among the 100 digital pioneers in Europe

BBVA has been recognized by the Financial Times (FT), Google and a panel of leading European policy makers as one of the 100 digital pioneers in Europe. BBVA is the only major bank included in a special report from the Financial Times, ‘Europe’s Road to Growth,’ because of its innovative use of new technologies, as well as the cultural shift that the company has undertaken.

What are profitable and socially responsible bonds?

At BBVA Switzerland, we are conscious that our main mission is to safeguard our clients' wealth, but this objective is not incompatible with maintaining our commitment to a sustainable future. What are profitable and socially responsible bonds?

BBVA Open Talent awards entrepreneurs in Switzerland

The country's Open Talent Final at the Zurich Impact Hub in the trendy Zurich West district went as punctually as Swiss clockwork. Jointly organized with Seedstars and Open Innovation, Switzerland's first ever edition of the event was a success in terms of turnout and certainly lived up to all the hype. Entrepreneurship, enthusiasm and innovation pervaded throughout event, which was evident during the final project lunch, where attendees had a moment to share their impressions and ideas.

Welcome to the first swiss edition of BBVA Open Talks

Besides a themed keynote panel, five of Switzerland’s best fintech startups will feature the swiss round of BBVA Open Talent 2018, competing for all-inclusive trips to BBVA Open Summit Madrid, Mexico (roadshow with high executives from the bank) and the opportunity to do an innovation pilot with the spanish bank.

BBVA designates Carlos Torres Vila as its next chairman

The Board of Directors of BBVA approved the succession plan for the company’s chairman. The plan establishes that CEO Carlos Torres Vila is to replace Francisco González as group executive chairman when he leaves his post, which is expected to take place on Dec. 31st, 2018. The succession ensures the continuity of the transformation process which has placed BBVA at the forefront of the global financial industry.

Consequences of the monetary policy of the Federal Reserve

Only a few months ago we commented on the process of increases in reference rates by the Federal Reserve of the United States and how this process can affect the economy and the financial markets. It may be interesting to return to the subject given the situation of some countries and the dynamics of the global economy in recent weeks.

What is private banking in Switzerland?

Have you ever asked yourself what private banking is? Or why Swiss banking is so famous? BBVA's employees in Switzerland reveal the opportunities already enjoyed by our customers.

BBVA in Switzerland invites you to the Prado Museum

The Prado Museum is approaching its 200th anniversary. The Spanish gallery is home to a fascinating collection of masterpieces by seminal figures in the history of art. A tour of its collection will provide you with the opportunity to admire works by artists like Hieronymous Bosch, Titian, El Greco, Rubens, Velázquez and Goya.

BBVA Microfinance promotes the development of Latin American women

In its Social Performance Report, which it has just presented, the BBVA Microfinance Foundation (BBVAMF) describes its contribution to the United Nations' Sustainable Development Goals, which recognise the importance of financial inclusion and microfinances for their achievement. The Foundation provides financial products and services to at-risk communities in Latin America, in particular to women, to promote their development. According to the World Bank, nearly one in every two does not have a bank account.

Bonds and loans to finance green technologies

Green technologies, such as renewable energies, energy efficiency and electric vehicles, can help to reduce the impact of human action on climate change. In 2007, the European Investment Bank issued the world's first green bonds aimed at financing and developing these technologies. In Spain, BBVA signed its first green loan in 2017, worth 500 million euros.

BBVA Switzerland, never logging to mobile banking was safer

All BBVA Switzerland customers will be able to use the new BBVA Switzerland Access Key, a modern and secure means of logging on to e-banking and mobile banking services.

Creating Opportunities with the BBVA Microfinance Foundation

For over ten years the BBVA Microfinance Foundation (BBVAMF) has been committed to the sustainable and inclusive economic and social development of low-income entrepreneurs. Its activities are focused on Colombia, Peru, Chile, Panama and the Dominican Republic. Through its mission, this foundation is aligned with the Sustainable Development Goals (SDG) included in the 2030 United Nations Agenda, and its activity has a particular impact on eight of them.

How to invest in capital protected structured products?

Structured products are interesting investment solutions that help us build an investment vehicle that exactly matches our needs from combinations of different financial assets (fixed income, equities, derivatives, etc.) Its flexibility allows us to choose the term of the investment, the underlying assets, the currency, and of course, the level of risk that we want to assume, even delimiting the capital guarantee. Learn with the financial formation of BBVA in Switzerland, how to invest in funds protecting capital.

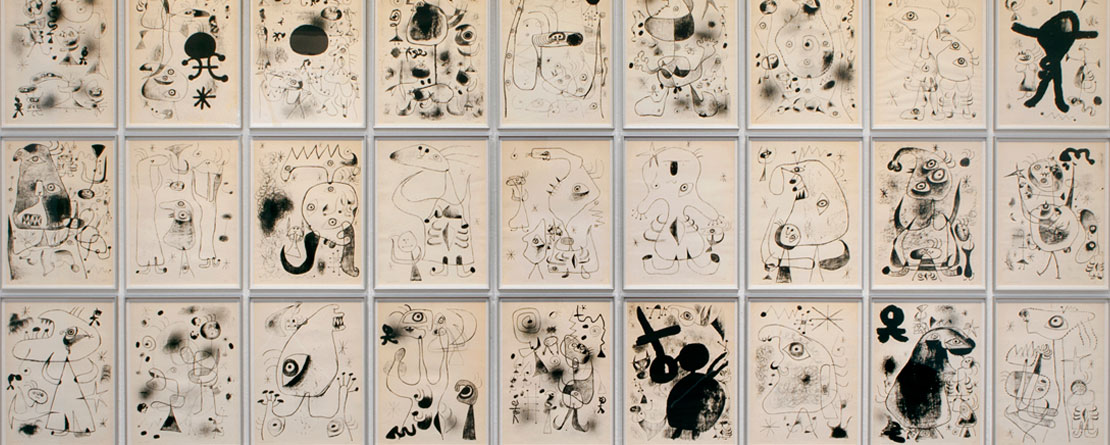

Tour around Joan Miró Foundation at the hands of BBVA in Switzerland

In the tree-lined streets of Barcelona's Montjuïc district, the Joan Miró Foundation does not go unnoticed. It houses more than 14,000 items of the surrealist artist's work, including sculptures, paintings and ceramics. Guided tours of the Foundation are included in the Unique Experiences offered by BBVA in Switzerland.

The best financial advice at the click of a finger

Nowadays, customers decide when and how they want to receive the best financial advice. That’s why we’ve developed two tools to enable them to take control of their decisions, comfortably from their own homes and at the click of a finger.

We're a team. Meet the BBVA Switzerland professionals

The BBVA Switzerland team comprises 125 professionals. We're a young, dynamic team with an average age of 37 and boast a multicultural profile. We employ 18 different nationalities.

How do I protect my family against contingencies?

Potential family and business risks can be detected with good wealth planning, in order to protect our family against contingencies. However, without planning, structuring and organizing, we will not achieve such protection.

Let's learn together ... for a better life

Let's Learn together is an educational project developed by BBVA and the editorial group El País Ediciones S.L, to make our brand promise happen: 'Creating opportunities'.